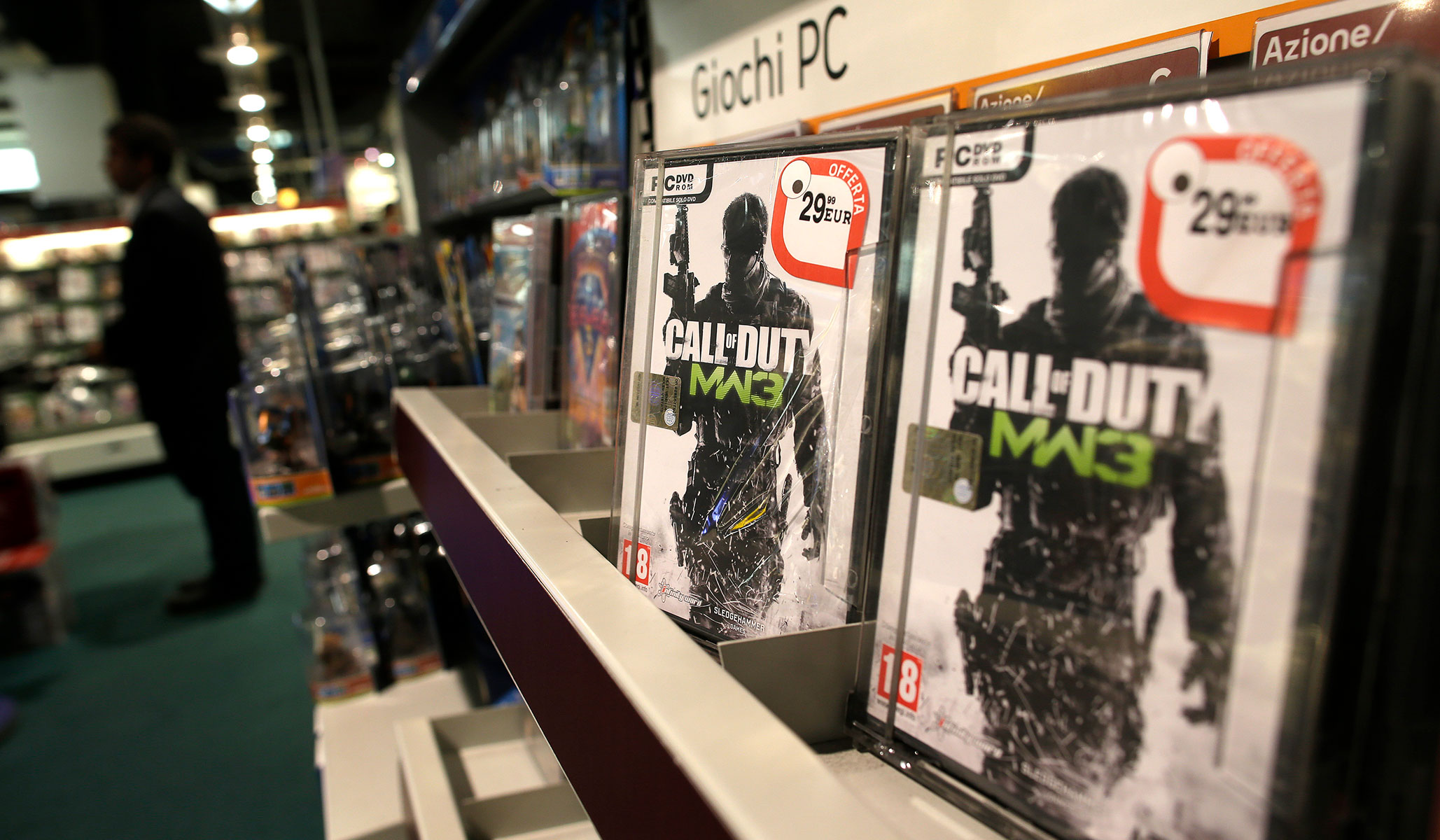

NRPLUS MEMBER ARTICLE T he gaming industry is booming, so it should come as no surprise that tech giants are vying for a larger share of the pie. In January 2023, Microsoft announced its proposed acquisition of Activision Blizzard, the gaming behemoth (its 2022 sales were over $7.5 billion) behind popular franchises such as Call of Duty and World of Warcraft. However, the Federal Trade Commission (FTC) has since sought to block the deal, claiming that it would stifle competition and harm consumers in the relevant gaming markets. If the FTC’s view prevails, it could set a dangerous precedent for future mergers and acquisitions in the industry.

Thankfully, Microsoft has successfully persuaded the U.K.’s Competition and Markets Authority (CMA) that its acquisition of Activision Blizzard would not hurt competition in the consoles market, thus taking a major step in closing the deal. This recent development has put the FTC in a tough spot. Sony, the leading firm in the console gaming industry, has strongly objected to the acquisition in multiple jurisdictions, alleging that Microsoft’s control over popular games like Call of Duty would stifle competition. However, upon learning Microsoft had offered Sony a global licensing deal to address concerns about exclusivity, the CMA rejected Sony’s allegation and found that the deal would not harm competition in gaming consoles. The governing body even noted that the Call of Duty franchise drove competition between consoles. Meanwhile, in response to complaints in the EU, Microsoft has offered to make changes to its cloud computing systems and the company is now close to settling the antitrust claims made against it by its rivals, which will pave the way for its acquisition deal with Activision. The EU is due to make a determination about cloud computing regulatory complaints by April 26.

If the FTC blocks the deal on anti-competitiveness grounds, it will have a difficult time making that argument in the light of recent clearances by CMA. Doing so would precipitate a lengthy administrative and appeals process that could ultimately lead to nothing. This would not only delay the potential benefits of the acquisition for the consumers and developers, but it would also suggest that the FTC is out of step with its international counterparts.

Moreover, blocking the acquisition would prevent Microsoft from competing more effectively with rivals such as Sony, which has dominated the gaming industry for two decades. Aside from providing Microsoft a toehold in mobile gaming — where most people game and where Microsoft’s Xbox currently has virtually no presence — acquiring Activision Blizzard would improve Xbox’s subscription service Game Pass, which offers a library of streaming content for a nominal monthly fee, just like Netflix and Hulu. Indeed, adding popular Activision games like Call of Duty and World of Warcraft to the game pass would make Xbox much more appealing to consumers, which in turn would prompt Sony and other gaming companies to turn up the heat and improve their own offerings.

This is precisely the kind of competition that drives a market forward to serve consumers through investments in innovation and creativity.

For example, Microsoft’s 2014 acquisition of Mojang, the developer of the popular game Minecraft, has been a great success. Since the acquisition, Minecraft has become one of the best-selling video games of all time, with over 200 million copies sold across all platforms. The merger enabled Mojang to access greater resources and reach a wider audience through Microsoft’s distribution channels. Consequently, Minecraft became available on more platforms and cross-platform play became possible, breaking down barriers and fostering greater innovation in the industry. Microsoft has continued to invest in the game, adding new features and expanding its reach to new platforms, including virtual reality. The acquisition has also helped Microsoft to expand its gaming portfolio by adding new games, giving it a foothold in the growing market for indie games.

Similarly, the merger between Electronic Arts and Bioware in 2007 led to the development of some of the most beloved and critically acclaimed games in recent memory, such as the Mass Effect series and Dragon Age: Origins. Indeed, the acquisition enabled Bioware to access greater resources and support, which then enabled the studio to take greater creative risks and push the boundaries of storytelling and player choice in gaming.

It’s the FTC’s job to investigate and block deals that would harm consumers. And it does its job best when it aims to protect competition, not individual competitors. Unfortunately, in this case, the FTC seems more interested in defending Sony’s dominant market position than in allowing a transaction that would enable Xbox to compete. Consumers that would gain access to new games from big and small developers, are getting hurt in the process.