Over at the Washington Post, Jeff Stein reports:

On a recent private phone call with a longtime colleague after McCarthy was elected speaker, Meyer marveled at the seeming absurdity of his position. As Meyer told his friend, McCarthy is in a nearly impossible bind, having vowed to advance a budget proposal that eradicates the deficit in a decade without touching Medicare and Social Security or increasing taxes.

Well, yes. Marc Goldwein of the CFBR sums it up like this over at the New York Times:

“It’s incredibly difficult to balance the budget within 10 years,” said Marc Goldwein, a senior policy director at the Committee for a Responsible Federal Budget, a group that backs deficit reduction. “It goes from being incredibly difficult to practically impossible if you start taking things off the table.”

In addition, by refusing to touch Medicare and Social Security, Republicans are allowing Democrats to set the tone for future reforms. Indeed, in an interesting turn of events, many Democrats and their allies are finally acknowledging that cuts to Medicare and Social Security are coming if Congress doesn’t change the law.

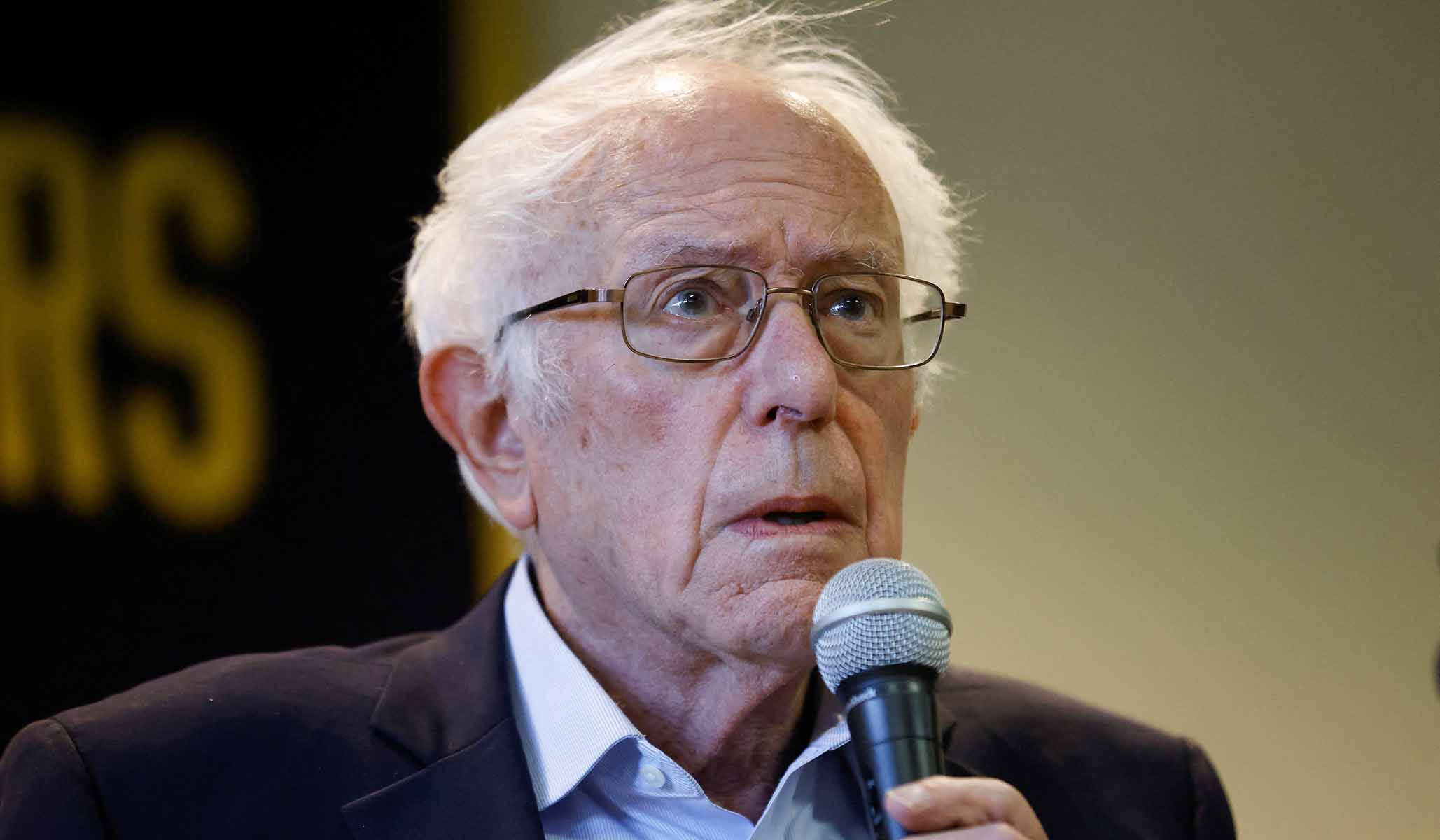

Here’s Senator Bernie Sanders (I., Vt.), for instance:

“The truth is that Social Security does have a solvency problem, and we have got to address that.”

You don’t say! He doesn’t just recognize there is a problem but he also has some ideas about how to solve it: raise taxes, raise taxes, raise taxes.

Sanders pushed the president to fully fund Social Security for more than seven decades by expanding payroll taxes on affluent Americans, rather than just on workers’ first $160,000 in earnings, as is the case under current law. Sanders also asked the president to back his proposal — highly unlikely to pass Congress — to not only defend existing benefits but also increase them. He wants to provide another $2,400 per year for every Social Security beneficiary. . . .

Meanwhile, President Biden has a proposal to reform Medicare:

The White House on Tuesday proposed raising taxes on Americans earning more than $400,000 and reducing what Medicare pays for prescription drugs in an attempt to ensure that the health-care program for seniors is funded for the next two decades, challenging Republicans over an imminent funding crisis….

The White House’s proposal would raise the net investment income tax, created by the Affordable Care Act, from 3.8 percent to 5 percent for all Americans earning more than $400,000 per year, in line with Biden’s pledge not to raise taxes for anyone under that threshold. The tax applies to capital gains and investment income. The plan also would expand this tax by applying it to more kinds of income from pass-through firms — businesses in which the owners pay taxes on their personal income taxes. Currently, these kinds of business owners do not pay this tax.

He also wants some prescription-drug-price control. Democrats had floated a similar tax proposal to “fix” Medicare last year:

Under the latest proposal, people earning more than $400,000 a year and couples making more than $500,000 would have to pay a 3.8% tax on their earnings from tax-advantaged businesses called pass throughs. Until now, many of them have been using a loophole to avoid paying that levy.

Of course, President Biden’s policy to not reform Social Security is an implicit endorsement of a 20 percent cut in benefits when 2032 rolls around.

One thing is clear now: Some Democrats have started to acknowledge that Social Security and Medicare will be cut if Congress doesn’t act. If Republicans continue to stubbornly insist that Social Security and Medicare shouldn’t be touched, the inevitable result will be not only that Democrats win the political debate, but that all such reforms will mostly mean higher taxes.