NRPLUS MEMBER ARTICLE E conomic growth suddenly disappeared last year, and the Federal Reserve is getting much of the blame. But new estimates point to another culprit: the revival of the regulatory state.

By the end of 2022, the Biden administration had imposed new regulatory costs on American households and businesses at least as heavy as the costs imposed by the Obama administration by the same point in Obama’s first term. The added costs from these Biden-era final rules, which include both their current and expected future costs, amount to more than $8,000 per household. If regulatory costs continue to accelerate as they did during the Obama administration, the total costs of Biden’s rulemaking over an eight-year period will exceed $50,000 per household.

Additional regulatory costs are created by statutes, such as the 2022 Inflation Recovery Act, and important sub-regulatory actions undertaken by federal agencies. President Biden also has pledged to find another pathway for his expensive student-debt-forgiveness rule, which is excluded from the totals above.

This isn’t about keeping air and water clean. Significantly more common and costly than environmental rules are business regulations: rules concerning employment contracts, telecommunications, consumer finance, the health-care industry, and more.

By all accounts the new rules coming out of federal agencies are numerous and go on for thousands of pages. But the agencies promulgating the rules insist that their costs are minimal, especially in comparison to our economy, the largest in the world.

They are wrong. With one or two exceptions, the most prolific rulemaking agencies routinely overlook opportunity and resource costs. Often no costs are quantified, or at best the agency estimates the hours required to do the paperwork necessary for compliance. The actual regulatory costs are likely ten or 20 times the clerical costs, due to lost opportunities to learn, trade, and innovate.

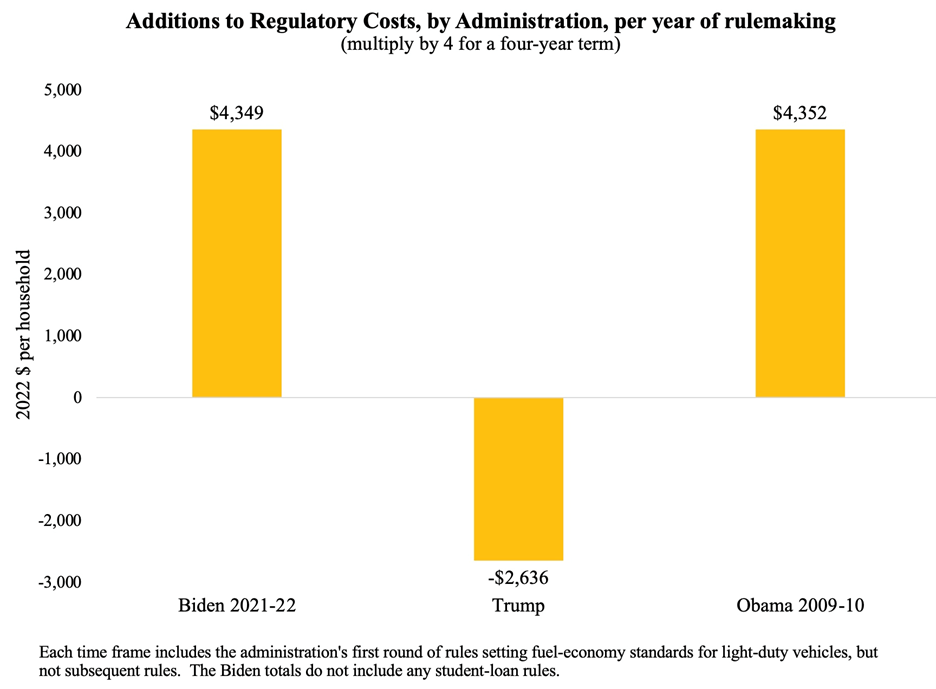

That’s why I conducted a study, drawing on work done between 2018 and 2020 by the White House Council of Economic Advisers, to better estimate the aggregate cost of regulations promulgated between 2009 and 2022. For comparability across administrations, the below chart shows the results expressed per year of rulemaking. As you can see, four years of President Trump’s rulemaking alone reduced regulatory costs by $10,500 per household:

The Biden administration’s executive orders and proposed rules indicate its intention to impose more rules, affecting all of us through higher prices, reduced incomes, wages, and job opportunities. Timothy Fitzgerald, Kevin Hassett, Cody Kallen, and I estimated that candidate Biden’s regulatory agenda by itself would reduce real wages by 2.5 percent relative to what they would have been under Trump’s lighter regulatory policy.

With fewer resources to devote to compliance, small businesses are especially burdened. Moreover, regulators often see the small-business sector as a supervision nightmare, introducing additional regulations to try to force more economic activity into big corporations that are easier for Washington to monitor and mold. Examples include the joint employer rules from the Department of Labor and National Labor Relations Board that “pose a direct threat to the franchise business model” that is ubiquitous in retail and other sectors.

New federal regulations disproportionately reduce the incomes of households whose incomes are already low, especially because a number of the rules “indulge[] the preferences of the wealthy.” The revival of the regulatory state will reduce the purchasing power of bottom-quintile households, by share of income, seven times as much as it would for top-quintile households.

It doesn’t have to be this way. President Trump’s approach to slowing the pace of regulation included regulatory budgeting, a first in U.S. history. Just like the chief executives of private companies don’t give their managers a blank check, President Trump limited the rulemaking authority of the cabinet members who ran rulemaking agencies. Agency heads had to eliminate old rules as needed to make room for worthy new ones. The regulatory budget coincided with a historical reversal in the trend of regulatory costs.

House Republicans have another proposal. The Regulations from the Executive in Need of Scrutiny (REINS) Act would require both houses of Congress to approve any major rule proposed by federal agencies. Congress could also keep its own regulatory budget, much like the Congressional Budget Office does for taxes and expenditures.

It’s no accident that the resurgence of regulatory costs coincides with a negative turn in productivity growth, and with the longest fall in real wages on record. Industries like oil and gas no longer produce like they did only four years ago. Regulatory reform would get us back on track by promoting economic growth and prosperity for all Americans.