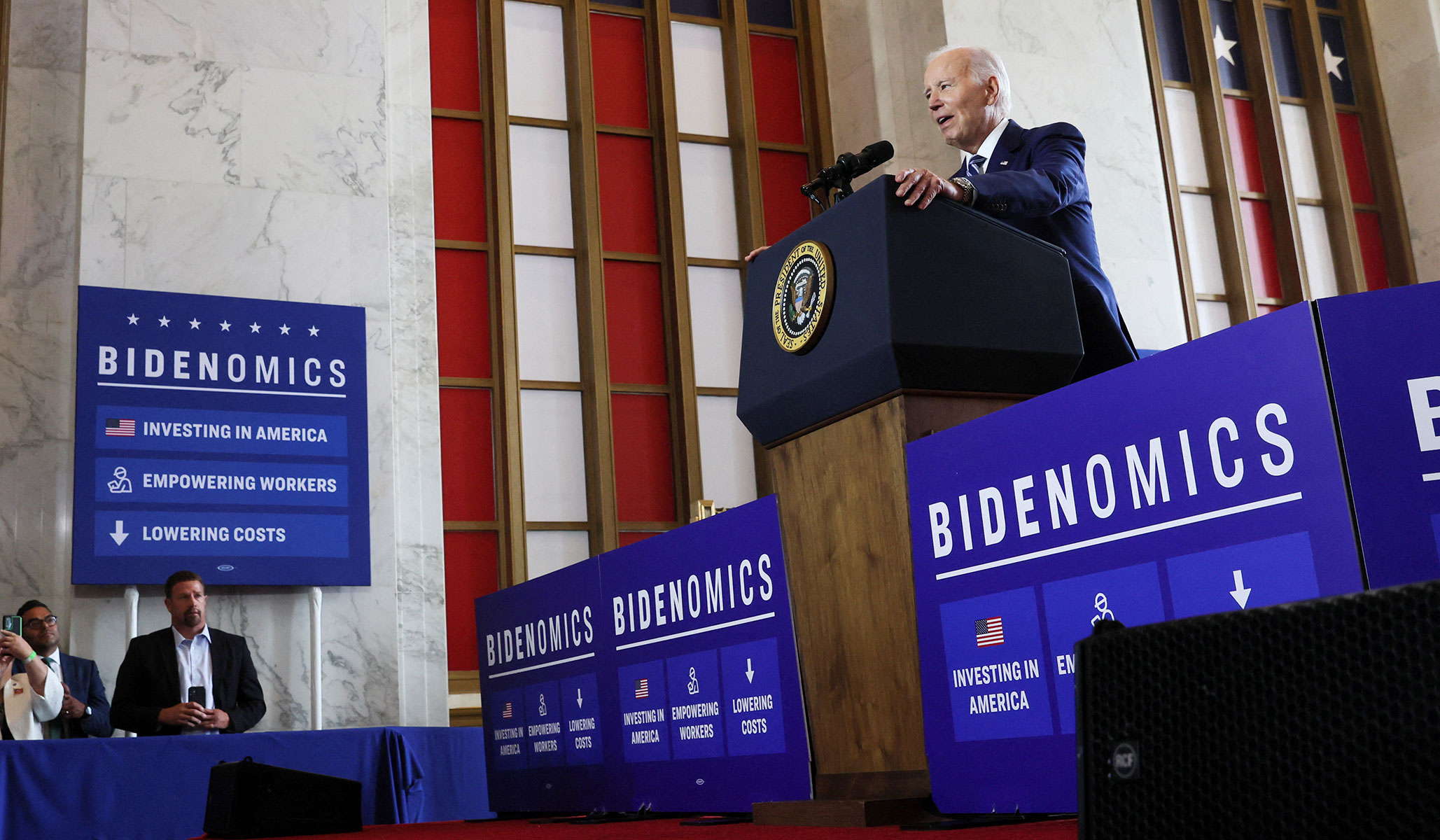

As President Joe Biden laid out his economic plan in Chicago, which he too is now dubbing “Bidenomics,” the nonpartisan Congressional Budget Office (CBO) released a report noting that if the current laws remain unchanged, “the United States faces a challenging fiscal outlook.”

According to the agency, the nation’s public debt is set to skyrocket in the next 30 years. At the end of fiscal year 2022, debt held by the public equaled 97 percent of the country’s gross domestic product (GDP). By 2029, federal debt will expand to 107 percent of GDP and will ultimately reach 181 percent of GDP by 2053.

“Such high and rising debt would slow economic growth, push up interest payments to foreign holders of U.S. debt, and pose significant risks to the fiscal and economic outlook; it could also cause lawmakers to feel more constrained in their policy choices,” explained the agency.

Budget deficits are also set to rise significantly after an initial decrease owing to the debt-ceiling deal. “Rising interest rates and persistently large primary deficits cause interest costs to almost triple in relation to GDP between 2023 and 2053,” explained the agency.

The CBO said that spending on the major healthcare programs and Social Security, driven by the aging of the population and growing healthcare costs, boosts federal outlays significantly. Significant portions of both parties see entitlement cuts as a losing political issue and have evaded addressing them.

Federal spending on Medicare will increase from 3.1 percent of GDP in 2023 to 5.5 percent by 2053; spending for Social Security will climb from 5.1 percent of GDP to 6.2 percent over that period.

Driving the ballooning debt is a mismatch between spending and revenues. While the recent debt-ceiling deal capped expenditures in the 2024 and 2025 budgets, many House Republicans thought it did not go far enough. As the chamber turns to a series of appropriations bills, a fight is looming on whether the House ought to spend even less than the agreed-upon caps.

“In 2023, outlays fall to 24.2 percent of GDP as federal spending in response to the pandemic diminishes. Outlays continue to decline through 2026 but increase thereafter, reaching 29.1 percent of GDP in 2053,” explained the agency.

Revenues are not set to keep pace with spending, though they will increase after 2025 once several provisions in 2017’s Tax Cuts and Jobs Act expire.