NRPLUS MEMBER ARTICLE ‘I built and grew my business in Wisconsin, a state my family and I love with all our hearts,” said Bill Mansfield, President of On Track Technology Solutions. “But eventually we chose to relocate to Texas because of Wisconsin’s taxes. This is a sad reality that too many Wisconsin businesses and families ultimately come to face.”

This statement to us from a business owner and former Wisconsin resident says it all. Wisconsin needs tax relief. For years, lawmakers and thought leaders have collectively looked at tax relief as a “want” and not a “need.” Now, the conversation has changed. Why? Other states have enacted bold tax reforms, leaving Wisconsin behind. In short, our state is quickly becoming uncompetitive with our neighbors.

In 2020, Wisconsin’s high individual income-tax brackets placed the state 37th on the Tax Foundation’s State Business Tax Climate Index. In 2023, the state slid down to 38th. Our neighbors in Michigan, Illinois, and Indiana rank 12th, 13th, and 15th respectively. Iowa, which currently ranks 40th, just passed legislation that will bring a 3.9 percent flat tax by 2026, vastly improving its tax climate. Although Wisconsin has actually cut taxes in recent years, policy-makers have not been able or willing to cut taxes by enough.

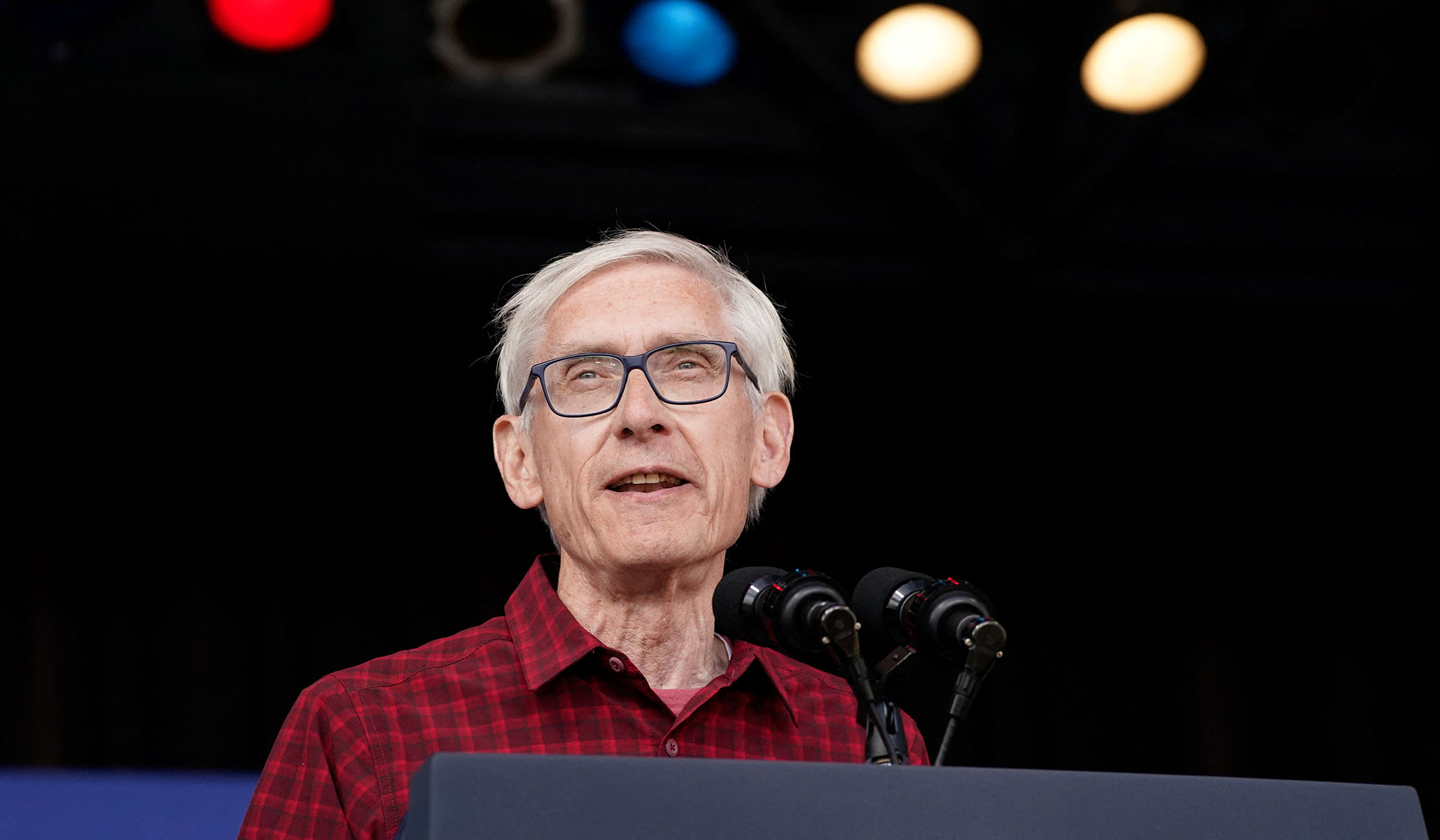

However, any hope for a middle-class tax cut this year was dashed by Wisconsin governor Tony Evers on Wednesday when he vetoed what would have been the largest tax cut in the state’s history.

That tax cut, which was approved by Wisconsin’s legislature last week, was part of a $4.4 billion tax-cut package, with $3.5 billion dedicated solely for income-tax relief. After Governor Evers’s actions, only $175 million for the lowest tax brackets remains. Ninety-five percent of the middle-class tax cut was vetoed. The plan was simple: Of Wisconsin’s four income brackets, it collapsed the two middle rates of 4.65 percent and 5.3 percent into one lower rate of 4.4 percent, dropped the top marginal rate of 7.65 percent to 6.5 percent, and reduced the lowest rate from 3.54 percent to 3.5. All that remains is the reduction of the lowest two rates, or 5 percent of the overall cut. Instead of a $573 average annual cut per taxpayer, the amount is now only $37.

The historic tax cut would have gone a long way toward making Wisconsin more competitive. Similar to options proposed by the Institute for Reforming Government (IRG), of which I am the CEO, it would have delivered relief for middle-class families suffering through economic uncertainty and lessened the burden on Wisconsin’s small-business owners.

In Wisconsin, 90 percent of small businesses, like coffee shops, restaurants, and small manufacturers, pay the individual income tax, and these businesses employ half of Wisconsin’s workers. In 2019, more than 55 percent of these businesses earned at least $500,000, subjecting them to Wisconsin’s top marginal rate of 7.65 percent. What’s more, when you layer on federal income taxes, these businesses could be paying as much as 48 percent of their income to the government. When small businesses benefit from tax relief, the whole state benefits. Because of the governor’s veto, those small businesses are largely left out of the tax savings.

The veto also means that Wisconsin will not stem the flow of people leaving for better tax treatment. A recent report from IRG showed that in 2021, almost 60 percent of those leaving Wisconsin went to states with a flat tax or no income tax at all. These middle-class Wisconsinites are moving to better tax climates. What’s worse, this migration out of the state took with them over $4 billion in income and $400 million in potential state and local tax revenues.

Wisconsinites know tax relief will make the state more competitive in the future. A recent poll showed that 59 percent of residents thought that taxes were too high, and another recent poll found that 86 percent of Republicans, 72 percent of Democrats, and 67 percent of independents were in favor of lowering the income tax to alleviate the worker shortage. The message is clear — there is broad bipartisan support for tax relief.

Governor Evers’s veto means Wisconsin is missing an opportunity to turn our fortunes around. We’ll continue working at IRG to show through data that tax reform works to grow economies, draw workers and families, and help small businesses. While the state is missing out right now, we can’t throw in the towel — and I’m confident that Wisconsin will one day join those states that are flattening and eliminating their income taxes. Wisconsin doesn’t have a choice anymore.