Rupert Hoogewerf has a passion for billionaires. A former consultant with Arthur Andersen, this 53-year-old Luxembourgish man settled in Shanghai in 1999 to found the company bearing his Chinese name: Hu Run. Over 20 years, his ranking of the world's billionaires has become an authoritative reference.

The Chinese immigrant's adventure alone illustrates the story of the upheavals at the last turn of the century, which he has been illustrating with figures – those of the ultra-rich. His 2023 ranking, the "Global Rich List" – which is based on calculations of billionaires' wealth as of January 15, 2024 – further demonstrates the power of his adopted country, as China boasts the highest number of billionaires in the world (814), ahead of the United States (800). A world of wealth that continues to grow: the Hurun List has recorded 3,279 billionaires around the globe (+5% over the last year), and their total wealth, valued at $15 trillion (around €13,855 billion), has increased by 9% over the same period.

Hoogewerf, however, may have to move countries to keep up with his billions: For example, to Mumbai, the Indian business capital. Nevertheless, the big news is not China's rise, but its decline. It has lost 155 billionaires and, over two years, 40% of its "Rich List" members of its list have dropped off it, even though new arrivals (120 over the past year) have partially offset the fall.

The rise of artificial intelligence

Even more symbolic, despite being behind New York and London, Mumbai has become the Asian city with the most billionaires (92), beating Beijing. The slump in the Chinese real estate market, the difficulties of its solar panel producers, and the doldrums of its stock market contrast with India's thundering growth (+7.5% in 2023) and its exuberant financial markets.

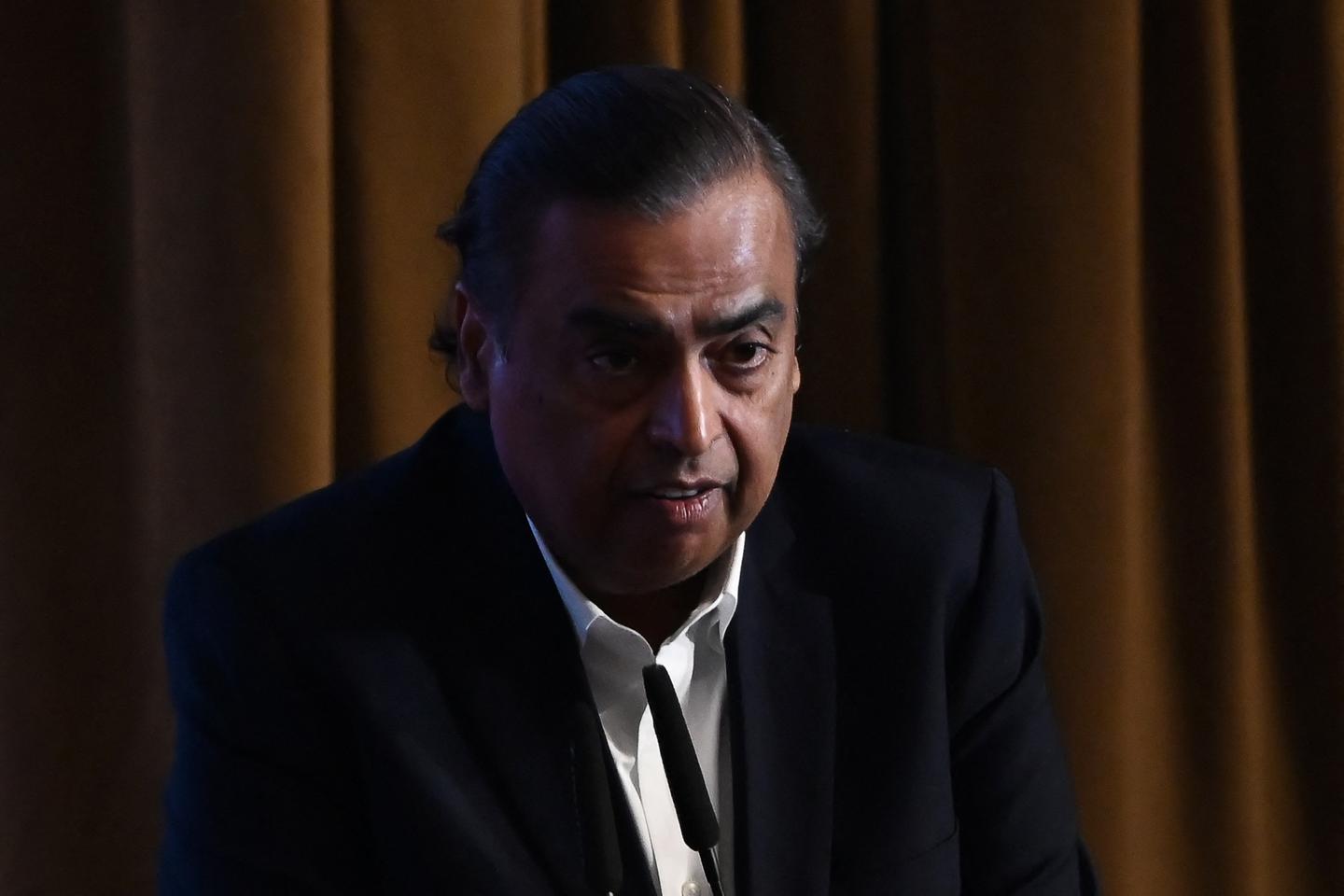

At $115 billion, India's Mukesh Ambani is the "Richest Person in Asia," although he is only the 10th in the world – far behind Elon Musk ($231 billion) and Bernard Arnault ($175 billion). American billionaires have been propelled by the rise of artificial intelligence and a return to form by the shining stars of the internet industry.

The wheel of fortune has therefore always been turning, but there is one constant: The concentration of dollars at the top barely trickles down to those who strive below. In China, affluent households have seen their wealth shaken by the real estate crisis, and in India, the wealthiest 1% now make up 40% of total national wealth – the highest level of inequality ever recorded in the country since record-keeping began. The Indian miracle is highly selective.