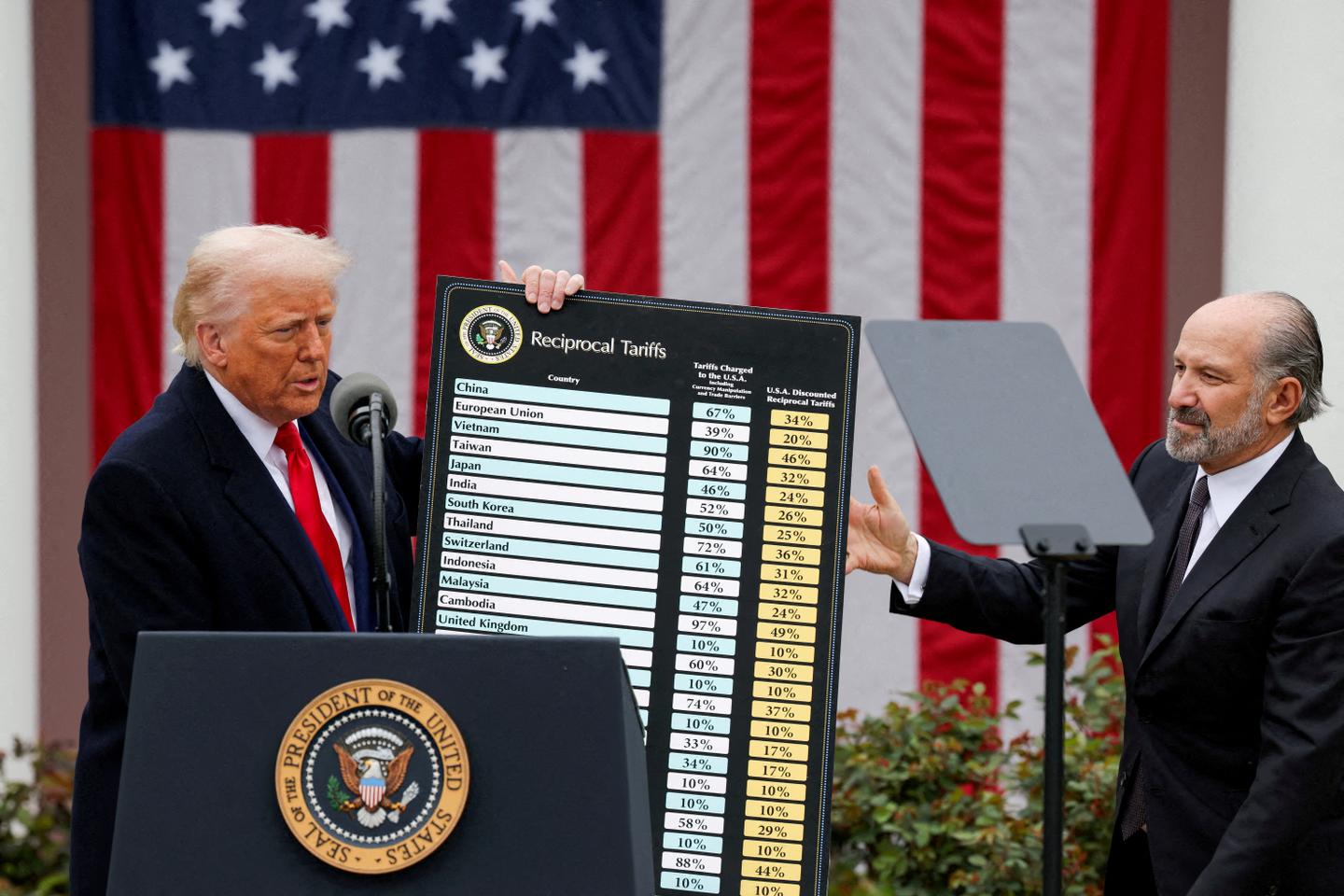

Donald Trump has declared a war (of trade) on the entire world with his "reciprocal tariffs" and announced a "Liberation Day" on April 2, 2025. These include increased tariffs of 20 percentage points for the European Union, 34% for China and 37% for Bangladesh.

The list goes on ad nauseam. These are in addition to early-term decisions: A universal additional tax of 25% on imports of steel, aluminum, derivative products and automobiles, as well as tariffs applied to Canada and Mexico, despite their membership with the US in the North American Free Trade Agreement.

Following "Liberation Day," China and the US engaged in an unprecedented tariff war: Retaliations, counter-retaliations... with, ultimately, tariffs on each side well above 100%. Canada and the European Union also announced retaliations against the US.

On April 9, the American president reversed course, announcing a 90-day pause in applying his reciprocal tariffs. Then, on April 12, electronic products were exempted from additional tariffs. Again, this decision was presented as temporary.

Decline in global GDP

Imagine there had been no withdrawal after "Liberation Day" and that the reciprocal tariffs and announced retaliations had been implemented. According to an initial estimate by the Center for Prospective Studies and International Information (Cepii), the US tariff rate would have risen from 2.6% at the start of Trump's first term to over 30% today.

This early 2025 trade war would ultimately lead to a decrease in global gross domestic product (GDP) of nearly 0.8% and global trade in goods by 4.2%. This loss in global GDP is the cost of decreased rationality in organizing global production. It does not take into account the current peak in uncertainty, which will inevitably impact investment and growth worldwide. In the short term, the loss of GDP and trade could be much higher.

You have 61.86% of this article left to read. The rest is for subscribers only.