Berkshire Hathaway said on Monday that its subsidiary National Indemnity Company is raising its stake in five Japanese trading firms.

National Indemnity plans to inform the Kanto Local Finance Bureau that it has expanded its ownership in Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo, the only publicly traded investments that CEO Warren Buffett has in Japan.

Averaging 8.5% of control per company and excluding treasury stock, Berkshire’s aggregate Japanese investment exceeds any other investments outside the U.S.

Berkshire said it will hold its Japanese investments for the long term, and depending on price, may increase its holdings up to a maximum of 9.9% in any of the five investments.

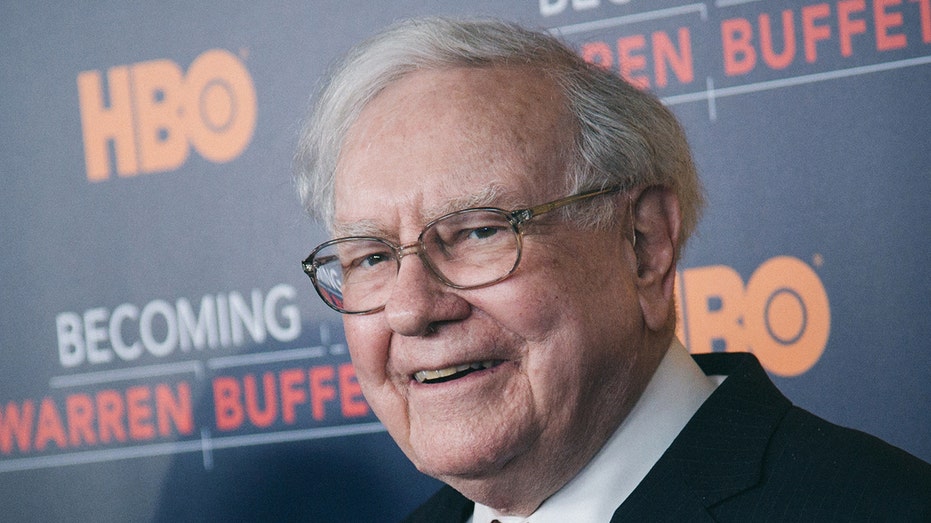

Warren Buffett attends the "Becoming Warren Buffett" World Premiere at The Museum of Modern Art on January 19, 2017 in New York City. (Getty Images / Getty Images)

However, Buffett has pledged that the company’s ownership will not surpass the 9.9% maximum without specific approval by the investee’s board of directors.

Buffett and other members of the Berkshire team traveled to Japan in April and met with chief executives from all five companies.