President Donald Trump moved to calm fears of an escalating trade war with Beijing on Sunday after he threatened to impose 100% tariffs on China’s imports in response to the nation's export curbs on rare earth minerals.

Trump's new tariffs on China would amount to a big increase over the current average 55% levy.

In a post on Truth Social, Trump said that China’s economic troubles would "all be fine" and insisted that the U.S. "wants to help China, not hurt it."

"Don’t worry about China, it will all be fine!" Trump wrote. "Highly respected President Xi just had a bad moment. He doesn’t want depression for his country, and neither do I. The U.S.A. wants to help China, not hurt it!!!"

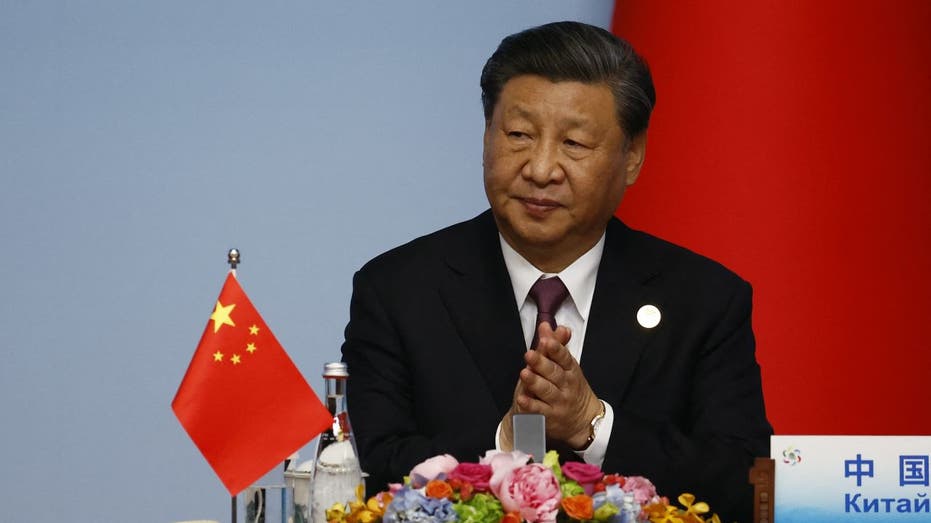

Chinese President Xi Jinping speaks during an international business meeting at The Great Hall Of The People on March 28, 2025, in Beijing, China; Right: President Donald Trump talks to reporters after signing an executive order, "Unleashing prosperi (Left: Ken Ishii - Pool/Getty Images; Right: Chip Somodevilla/Getty Images / Getty Images)

The post came hours after China issued an official response to Trump’s threat to impose a 100% tariff on Chinese imports by Nov. 1, warning Washington not to resort to "threats" and pledging to "resolutely take corresponding measures" if the U.S. proceeds.

"China’s stance is consistent," the Commerce Ministry said in a statement Sunday.

"We do not want a tariff war, but we are not afraid of one." The ministry urged the U.S. to address differences "through dialogue," calling repeated tariff threats "not the correct way to get along with China."

Chinese President Xi Jinping applauds during the joint press conference of the China-Central Asia Summit in Xian, in China's northern Shaanxi province on May 19, 2023. (FLORENCE LO/POOL/AFP via Getty Images / Getty Images)

Beijing suggested it would retaliate against any new levies the U.S. may impose on Chinese imports.

Sunday’s exchanges pointed to a turn in a trade truce between the world’s two largest economies.

Trump’s threat was initially triggered by new Chinese restrictions on the export of rare earths, or minerals that are crucial to advanced manufacturing and military technology.

China controls about 70% of global rare earths mining and nearly 90% of processing capacity.

Vice President J.D. Vance speaks to Fox Business' Maria Bartiromo in an interview that appears on "Sunday Morning Futures" tomorrow. (Fox Business / FOXBusiness)

Vice President JD Vance also defended Trump’s stance in an appearance on Fox News, where he called Beijing’s dominance in key supply chains "the definition of a national emergency."

"It’s going to be a delicate dance and a lot of it is going to depend on how the Chinese respond. If they respond in a highly aggressive manner, I guarantee you the President of the United States has far more cards than the People’s Republic of China," Vance said on "Sunday Morning Futures."

Trump’s tariff threat and China’s response have also cast doubt on a meeting happening with Xi later this year.

China’s Commerce Ministry said it would continue to grant export licenses for legitimate civilian uses of rare earths but warned that "if the U.S. side obstinately insists on its practice," Beijing would act to protect its interests.

Fox News Digital reached out to the White House for comment.