JPMorgan Chase boss Jamie Dimon will be deposed under oath in connection with the bank's relationship with Jeffrey Epstein, the late sex offender and a former client, a lawyer involved in the case said.

Reuters reports the interview is expected to happen in early May, according to Brad Edwards, a lawyer representing women who claim to have been sexually abused by Epstein.

The women are suing the largest U.S. bank for allegedly enabling the financier's sex trafficking.

FOX Business has reached out to JPMorgan Chase for comment.

JPMorgan CEO Jamie Dimon. (REUTERS/Jeenah Moon/File Photo / Reuters Photos / Reuters Photos)

Epstein was a client from 2000 to 2013, with the last five years coming after he had pleaded guilty to a Florida prostitution charge.

JPMorgan is defending in Manhattan federal court two lawsuits seeking damages over its dealings with Epstein.

One involves a proposed class action by Epstein's accusers and the other was brought by the U.S. Virgin Islands, where Epstein owned a home.

JPMorgan has tried to dismiss the lawsuit, noting the Virgin Islands government has already settled with Epstein's estate for more than $100 million.

The JP Morgan Chase & Co. headquarters on Park Avenue, Midtown, Manhattan, New York. (Tim Clayton/Corbis via Getty Images / Getty Images)

Earlier this month, a U.S. District Judge ordered JPMorgan to turn over documents from 2015 to 2019 – a period after which JPMorgan had dropped Epstein as a client.

The bank is also suing Jes Staley, a former private banking chief and later Barclays chief executive who had been friendly with Epstein.

JPMorgan wants Staley to reimburse it for eight years of compensation and damages it might incur in the other lawsuits.

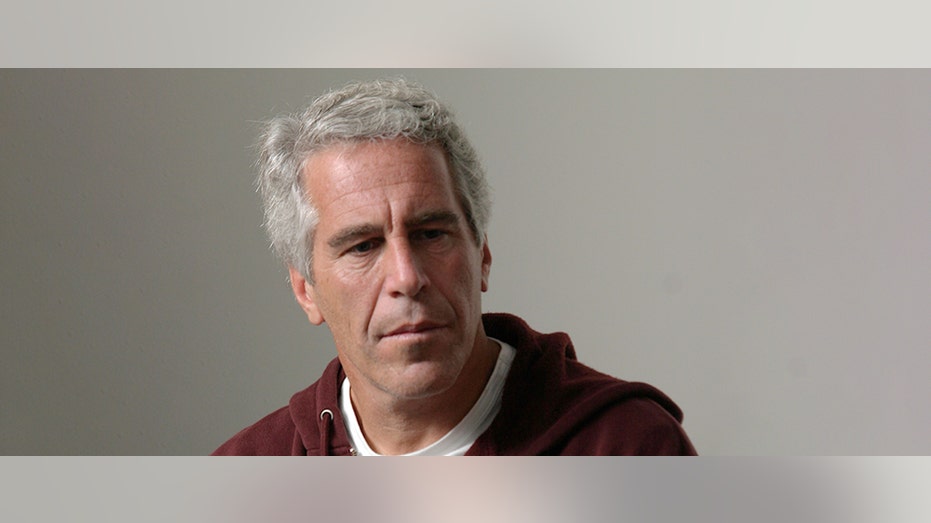

Jeffrey Epstein in Cambridge, Mass., Sept,8, 2004. ((Rick Friedman/Rick Friedman Photography/Corbis via Getty Images) / Getty Images)

Epstein killed himself in a Manhattan jail cell in August 2019 while awaiting trial for sex trafficking.

The Financial Times earlier reported Dimon's expected deposition.

Reuters contributed to this report.