The House Committee on Small Business will begin marking up two bills on Thursday aimed at recovering stolen pandemic funding for small businesses and holding those who stole Paycheck Protection Program funding accountable.

According to the office of House Committee on Small Business Chairman Rep. Roger Williams, R-Texas, the first bill would prohibit those convicted of defrauding any pandemic assistance program from ever taking out a loan from the Small Business Administration in the future.

The second bill, according to his office, requires the SBA to insert a link on their website that goes to the administration's Office of the Inspector General, where people can self-report potential fraud from PPP loans and Economic Injury Disaster Loans.

According to his office, the SBA has a backlog of over 100 years in casework because of the fraud that occurred during the pandemic. Roger's officer argues this gives the SBA the best chance at recuperating funds.

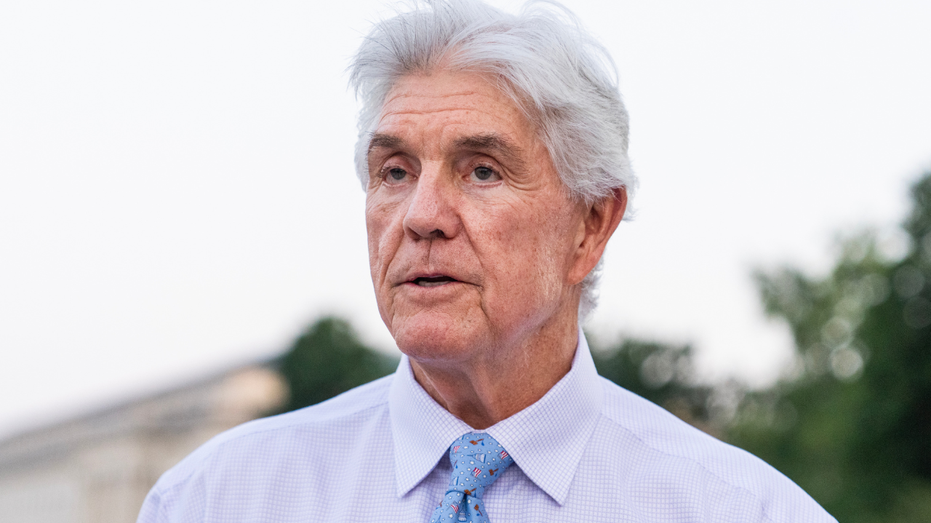

Rep. Roger Williams, R-Texas, arrives for the House vote on Fiscal Responsibility Act, which will raise the debt limit, outside the U.S. Capitol on Wednesday, May 31, 2023. (Tom Williams/CQ-Roll Call, Inc via Getty Images / Getty Images)

If passed, the link must be visible on the SBA's website within 30 days.

Rogers told Fox News Digital that the SBA allowed criminals to take advantage of the system by not implementing protections.

"When COVID-19 hit the United States, the SBA was tasked with taking on an oversized role to help save small businesses and our nation’s job creators. Unfortunately, the SBA failed to properly implement basic guardrails to protect these programs that allowed opportunistic criminals to take advantage of these emergency lending programs," said Chairman Williams. "One of the main goals of this Committee has been to find solutions to recoup the stolen pandemic funds for the taxpayers and hold these fraudsters accountable. These two bills we plan to mark-up on Thursday do exactly that. There’s still more work to be done, but this is a step in the right direction."

People walk through a shuttered business district in Brooklyn on May 12, 2020 in New York City. (Spencer Platt/Getty Images / Getty Images)

The inspector general of the SBA released a June report stating that over $200 billion in COVID-19 relief funds were stolen by fraudsters.

Officials in the report faulted the SBA for removing or weakening controls needed to prevent fraud.

A 'Help Wanted' sign is posted beside Coronavirus safety guidelines in front of a restaurant in Los Angeles, California on May 28, 2021. - Following over a year of restrictions due to the coronavirus pandemic, many jobs at restaurants, retail stores (Photo by FREDERIC J. BROWN/AFP via Getty Images / Getty Images)

"In the rush to swiftly disburse COVID-19 EIDL and PPP funds, SBA calibrated its internal controls. The agency weakened or removed the controls necessary to prevent fraudsters from easily gaining access to these programs and provide assurance that only eligible entities received funds," officials wrote. "However, the allure of ‘easy money’ in this pay and chase environment attracted an overwhelming number of fraudsters to the programs."

Fox News' Chris Pandolfo contributed to this report.