The Federal Trade Commission (FTC) on Monday ordered life sciences company Illumina to unwind its $7.1 billion acquisition of cancer detection test developer Grail Inc., citing antitrust concerns.

The commission voted unanimously in a 4-0 decision to force Illumina to divest from Grail, reversing a decision from the FTC's own chief administrative law judge from Sept. 2022, which had dismissed the antitrust charges.

The Federal Trade Commission has ordered Illumina to divest from Grail, reversing the decision of the agency's chief administrative law judge. (Reuters / Andrew Kelly / File / Reuters Photos)

In its order, the commission raised concerns that Illumina's acquisition of Grail, which makes a multi-cancer early detection (MCED) test using liquid biopsies, "would stifle competition and innovation in the U.S. market for life-saving cancer tests."

But the battle over the multi-billion dollar deal closed in August 2021 is not over.

Illumina said in a statement it plans to appeal the FTC's decision in federal court, saying the order will be automatically stayed upon filing a petition for review, pending appeal.

Illumina is fighting on multiple fronts against orders to divest from cancer test developer Grail. (Reuters / Mike Blake / File)

The company is fighting on multiple fronts and multiple continents to keep the deal alive.

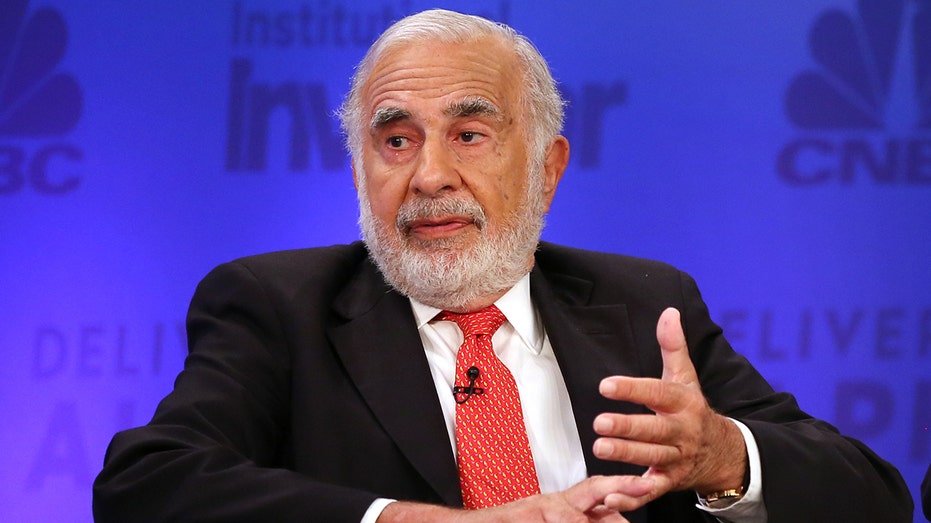

Last month, activist billionaire investor Carl Icahn launched a proxy fight that sought to quash Illumina's takeover of Grail, arguing that the deal had already cost shareholders some $50 billion.

Carl Icahn launched a proxy fight last month seeking to force Illumina to divest from Grail. (Adam Jeffery / CNBC / NBCU Photo Bank / File / Getty Images)

Illumina is also currently appealing a decision by the EU's European Court of Justice, which previously ordered the company to divest from Grail over concerns that it would hurt competition and stifle innovation.

"Winning both appeals would maximize value for shareholders," Illumina said in a statement in reaction to the FTC's decision.

"It enables Illumina to expand the availability, affordability and profitability of the groundbreaking Galleri test in the $44-plus billion multi-cancer screening market," the statement continues. "It also protects Illumina's ability to optimize a future divesture should that be in the best interest of shareholders."

The company said that if it is not successful in its appeals, it will move quickly to divest from Grail.

Reuters contributed to this report.