The Federal Reserve's decision on interest rates will dominate the coming week as investors also follow the ongoing UAW strike against Ford, GM and Stellantis, which is threatening to disrupt the economy.

Stocks ended the Friday session lower, capping off a mixed five days.

The Dow Jones Industrial Average was the only benchmark to post a slight gain for the week.

In IPO news, Instacart is expected to begin trading in the coming week.

Last week, the online grocery shopping company, which fulfills customer orders, disclosed its target valuation of up to $10 billion after Arm Holdings' strong market debut.

The stock will trade on the Nasdaq Marketsite under the symbol CART.

The Instacart logo on a laptop computer arranged in Hastings-on-Hudson, New York, on Jan. 4, 2021. (Tiffany Hagler-Geard/Bloomberg via Getty Images / Getty Images)

On Monday, Blackstone and Airbnb will replace Lincoln National and Newell Brands in the S&P 500, while Deere & Co will replace Walgreens Boots Alliance in the S&P 100.

Meanwhile, Israeli Prime Minister Benjamin Netanyahu will reportedly meet with Elon Musk, according to the Washington Post.

Tesla CEO Elon Musk (Chesnot / Getty Images)

The meeting comes amid Musk's criticism of the Anti-Defamation League (ADL).

AutoZone will report earnings after the bell and could provide details on the impact of the ongoing UAW strike against Detroit's Big Three automakers.

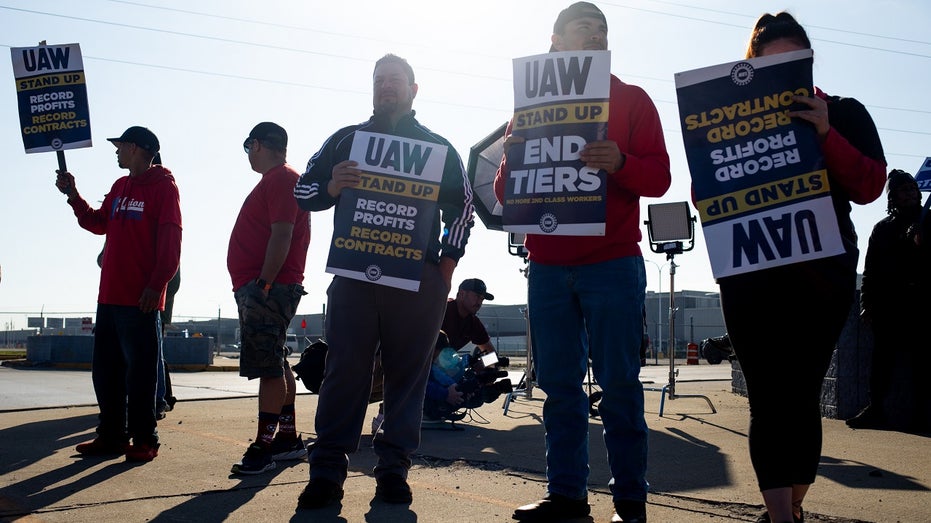

The strike, which began Friday, could cost the economy nearly $6 billion over just nine days.

United Auto Workers members on a picket line outside the Ford Motor Co. Michigan Assembly plant in Wayne, Michigan, on Friday, Sept. 15, 2023. The UAW began an unprecedented strike at all three of the legacy Detroit carmakers, kicking off a potential (Emily Elconin/Bloomberg via Getty Images / Getty Images)

In economic news, building permits and housing starts will be released.

The United Nations Headquarters in New York City (iStock / iStock)

Meanwhile, President Biden will travel to New York City to participate in the 78th session of the United Nations General Assembly.

The Federal Reserve will announce its decision on interest rates Wednesday after two reports on inflation last week ran hotter-than-expected. Consumer prices jumped 3.7% from the same time last year, faster than expected. While inflation at the wholesale level rose 1.6% annually.

According to the CME's FedWatch Tool, 98% of the market is expecting policymakers to hold rates steady.

Oracle will kick off CloudWorld in Las Vegas. CEO Larry Ellison hinted that the company will deliver significant updates at the event during last week's earnings call.

Oracle's Larry Ellison gestures while giving a demonstration during his keynote address at Oracle OpenWorld in San Francisco, Sept. 30, 2014. (Robert Galbraith / Reuters Photos)

Investors punished Oracle shares after the company's forecast fell shy of some estimates.

Economic reporting will include data on initial jobless claims and existing home sales.

Blue Apron will end its run on the New York Stock Exchange Friday and join the Nasdaq on Sept. 25.

On the economic front, data from the U.S. Manufacturing Purchasing Managers Index is slated for release.