It’s a September to remember courtesy of the Federal Reserve, which delivered a super-sized rate cut for investors on Wednesday.

The Dow Jones Industrial Average jumped over 500 points, closing above 42,000 for the first time. It took just 45 days since the last 1,000-point milestone, as tracked by Dow Jones Market Data Group.

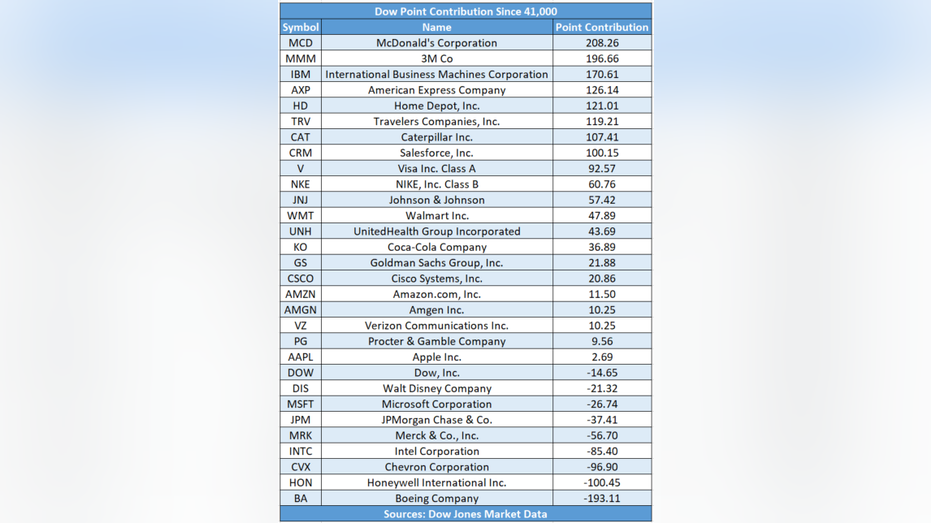

McDonald’s served up the most point gains at over 208, with 3M second behind, while embattled Boeing was the biggest drag, subtracting over 193, followed by Honeywell International.

IBM, American Express and Home Depot also helped lift the Dow to the fresh milestone.

Top & Bottom Dow Point Moves from 41,000 (Dow Jones Market Data Group )

The S&P 500 notched another fresh record led by technology, consumer discretionary and industrial names.

Apple, Salesforce.com and Meta helped lift the tech-heavy Nasdaq Composite.

The Fed, on Wednesday, announced its first-rate cut since March 2020, taking the target range to 4.75% to 5% with Chairman Powell signaling the significance of the fresh shift.

Jerome Powell, chairman of the US Federal Reserve, during a news conference following a Federal Open Market Committee (FOMC) meeting in Washington, DC, US, on Wednesday, July 31, 2024. Federal Reserve officials held interest rates at the highest leve (Photographer: Al Drago/Bloomberg via Getty Images / Getty Images)

"This recalibration of our policy stance will help maintain the strength of the economy and the labor market and will continue to enable further progress on inflation as we begin the process of moving toward a more neutral stance, we are not on any pre-set course. We will continue to make our decisions meeting by meeting" he said.

Policymakers, in their projections, outlined rates could fall to 4.4% by year-end, 3.4% by 2025 and 2.9% by 2026. Still, the team at Wells Fargo Investment Institute, says the outlook may be too optimistic.

"Our expectation of two more rate cuts in 2024 is in line with the Fed’s current view, but we find that the FOMC is still priced for a more optimistic outcome regarding future Fed rate cuts in 2025. As the economic recovery resumes in the second half of 2025, we think it will prove difficult for inflation to decline further towards the Fed’s 2.0% inflation target" they wrote.

New home construction is giving builders and realtors confidence. (Fox News)

Lower borrowing costs are favorable for corporations and consumers seeking mortgages, personal and auto loans, as well as other lending levers.

The rate for a 30-year fixed mortgage fell to 6.09% on Thursday. A year-ago it averaged 7.19%.