Democratic Minnesota Gov. Tim Walz blasted the federal government’s decision to tax Minnesotans who receive rebate checks this year as "bullsh--" on Wednesday.

Walz was speaking during a news conference about the state’s budget surplus forecast for 2024 when he responded to the IRS's decision to tax its rebate while pandemic-era relief payments in other states were tax-free.

"Bullsh--," said Walz. "I don't know. It's the IRS. I will tell you this: I have been on the phone, not much more judicious than that slip there, to let them know."

The federal tax on the rebate check could cost some Minnesota residents between $26 and $286, depending on household income and the total amount of the rebate, MPR News reported. The initial rebates were $260 per person, though qualifying households could see up to $1,300 if a couple claims at least three dependents.

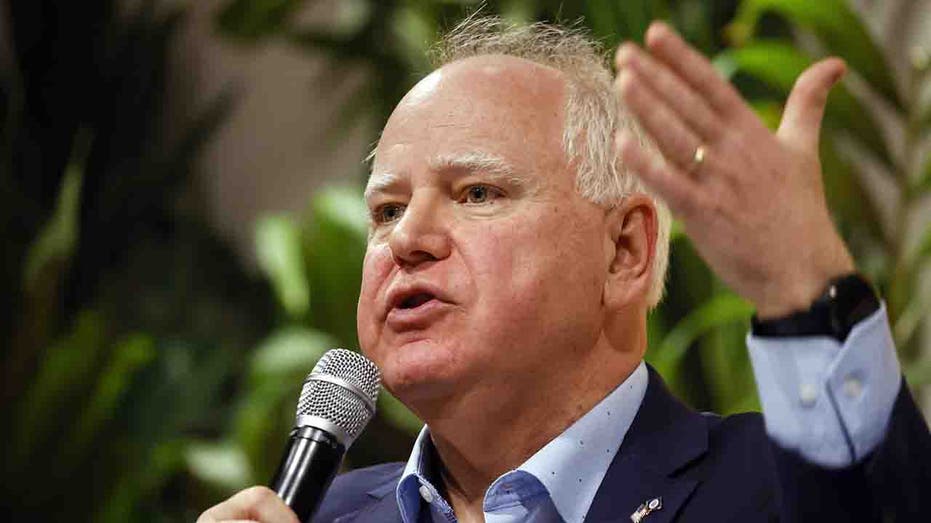

Minnesota Gov. Tim Walz said he's spoken to Biden administration officials about the issue, though no progress has been made. (Eva Marie Uzcategui/Bloomberg via Getty Images, File / Getty Images)

Walz said that he told White House Chief of Staff Jeff Zients that Minnesotans were "being treated unfairly" because the state missed a cutoff by 15 days to qualify for the tax-free status.

Other states were able to qualify, since their rebates were authorized before the federal government ended the COVID-19 health emergency on May 11.

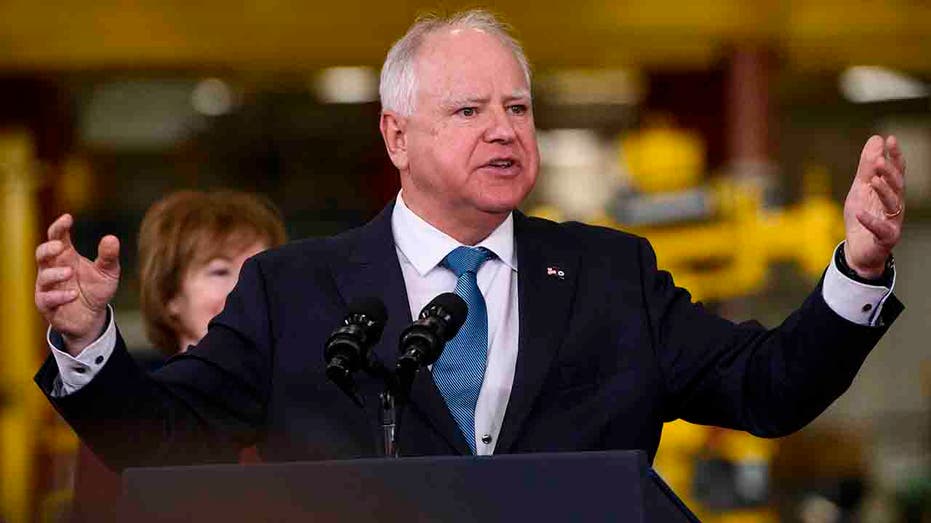

Walz said the state missed the authorization cutoff for the rebate by 15 days. (Stephen Maturen/Getty Images, File / Getty Images)

The Minnesota Department of Revenue said that 1099-MISC forms will be sent to rebate recipients when filing for their federal tax returns, FOX9 Minneapolis reported.

Meanwhile, the Minnesota budget will remain stable with a surplus of $2.4 billion through June 2025, Minnesota Management and Budget projected.