BlackRock said Monday that U.S. retail investors of its largest exchange-traded fund (ETF) will now have an opportunity to cast a proxy vote in 2024.

The asset manager’s move could reduce criticism over the firm’s environmental, social and governance (ESG) matters, with fund clients now able to choose among voting plans from proxy advisers Institutional Shareholder Services and Glass Lewis & Co, including one that prioritizes climate considerations and a new ISS offering aimed at conservatives favoring company managements.

div id="embed">.

A representative for New York-based BlackRock said investors in its iShares Core S&P 500 ETF will be able to select the range of policies to determine how the fund votes their shares at corporate annual meetings.

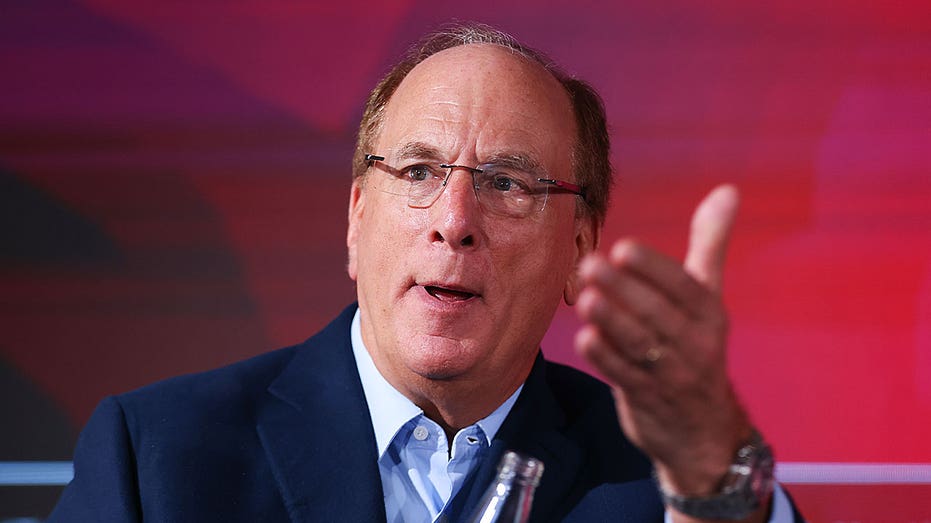

Larry Fink, chairman and CEO of BlackRock, speaks at the World Economic Forum in Davos, Switzerland, on Jan. 17, 2023. (Hollie Adams/Bloomberg via / Getty Images)

To date, retail investors hold about half of the fund’s $305 billion in assets. However, investors will not be able to specify votes in specific company elections.

While many clients will rely on the votes BlackRock will continue to cast, "consistent with our fiduciary duty as an investment manager, others want the choice to participate in proxy voting more directly," said Joud Abdel Majeid, global head of BlackRock Investment Stewardship, in a statement.

People visit the display stand of BlackRock during "Il Salone del Risparmio" on May 16, 2023, in Milan, Italy. (Emanuele Cremaschi/Getty Images)

Contemporaries like State Street and Vanguard also have programs to devolve proxy voting rights. With some $20 trillion in combined managed assets, the three companies have emerged as powerful voices in corporate boardrooms.

Despite the ESG push from each investment firm, all three have yet to install fossil-fuel divestment, while facing reproach from Republican politicians who say their industry participation in environmental matters may lead to collusion.

Reuters contributed to this report.