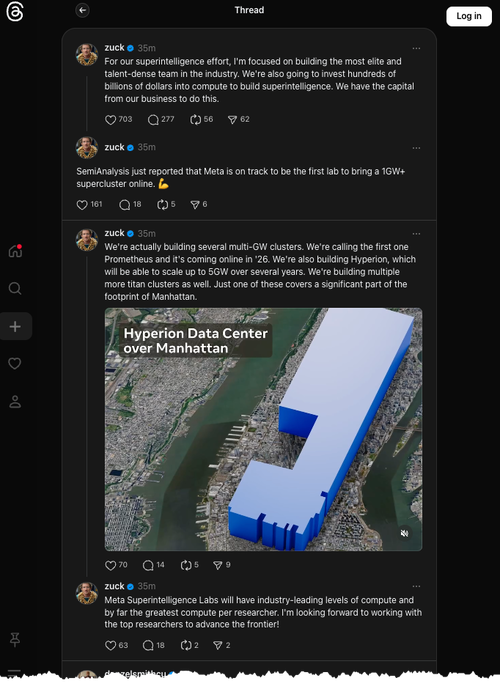

Meta shares rose during the U.S. morning cash session after CEO Mark Zuckerberg announced on Threads that the company is building several massive data centers to support its superintelligence ambitions.

"For our superintelligence effort, I'm focused on building the most elite and talent-dense team in the industry. We're also going to invest hundreds of billions of dollars into compute to build superintelligence. We have the capital from our business to do this," Zuckerberg wrote in a post.

He continued, "We're actually building several multi-GW clusters. We're calling the first one Prometheus and it's coming online in '26. We're also building Hyperion, which will be able to scale up to 5GW over several years. We're building multiple more titan clusters as well. Just one of these covers a significant part of the footprint of Manhattan."

Zuckerberg cited a recent report from tech blog SemiAnalysis that noted Meta was aggressively advancing toward superintelligence amid a series of setbacks in model performance, such as losing its lead in open-weight models to competitors like China's DeepSeek.

Here's more from SemiAnalysis...

Meta's shocking purchase of 49% of Scale AI at a ~$30B valuation shows that money is of no concern for the $100B annual cashflow ad machine. Despite seemingly unlimited resources, Meta has been falling behind foundation labs in model performance.

The real wake-up call came when Meta lost its lead in open-weight models to DeepSeek. That stirred the sleeping giant. Now in full Founder Mode, Mark Zuckerberg is personally leading Meta's charge, identifying Meta's two core shortcomings: Talent and Compute. As one of the last founders still running a tech behemoth, Mark doesn't need SemiAnalysis to tell him to slow down stock buybacks to fund the future!

Meta's race for compute:

And the race for talent and strategy

In markets, Meta's shares rose just over $1 to $725.50 on the news. The stock is up 24% year-to-date, trading in record-high territory amid the broader trend of the race for AI compute and talent.

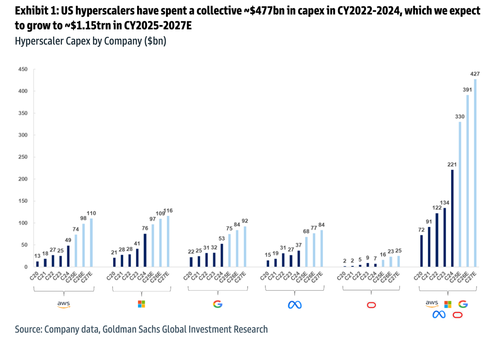

All of this capital expenditure (capex) by Big Tech firms...

...has many on Wall Street increasingly asking whether this unprecedented AI spending surge will translate into sustainable new revenue streams.