How are you positioned for 2025?

Entering a new year and new era of ZeroHedge Debates, we’re hosting top strategists (institutional guys typically only accessible to accredited investors) for long-form discussions wherein market calls will be scrutinized and opposing view voiced so you can deploy capital armed with more than a 2-minute cnbc soundbite.

Piper Sandler’s Michael “Kantro” Kantrowitz was ranked 2024’s number 1 portfolio strategist by the widely followed Extel survey. Matt King was head of global strategy for Citibank for two decades and now runs Satori Insights.

Kantro and King will come face-to-face this Thursday evening at 6pm ET, only accessible on the ZeroHedge homepage and only visible to premium and professional subscribers so sign up now and save the date. The event will be moderated by Real Vision’s Ash Bennington.

Overview of their positions below.

In the debut episode of Kantro’s new podcast “What’s Next For Markets”, he calls for a reversal of the small/large cap bifurcation: “What the PMI suggests for profits is that we should begin to see the breadth of profits start to improve.”

Another key underpinning of his bullish outlook was counterintuitively kicked off by poor jobs data: “Ironically, that rise in the unemployment rate has actually been a good thing for stocks because it helped to get inflation down. It started to get the Fed pivoting.”

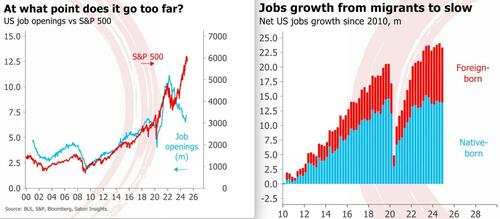

And jobs may be turning…

Kantro caveats his optimism with the concession that “if the 10 year goes above 4.5%, then markets are going to struggle.”

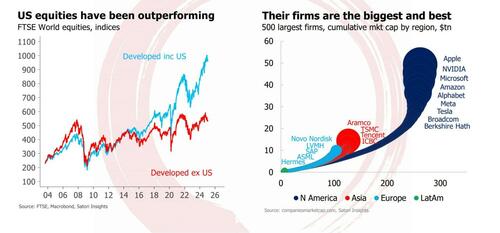

Too much “U.S. exceptionalism” is priced into valuations, says King, taking a more bearish view. King prefers charts to words and sees U.S. equities as ahead of their skis compared to the rest of the globe, an increasingly widening divide in recent years (pictured bottom left). And as King concedes, this is not unjustified as American firms are the “biggest and the best” (bottom right):

Yet money is beginning to flow out:

Lastly, foreign-born jobs have grown while native positions stagnate (bottom right). Meanwhile S&P has become unhinged from its previously tight correlation to job openings (bottom left). As King says, “Trump’s policies carry two-way risks” as eliminating foreign jobs will add more downward pressure to S&P”:

Both strategists agree: what Trump does on tariffs and immigration will be key to watch.

To see how they are both positioned in 1H ‘25, tune into the live debate: Thursday, Jan 23 at 6pm ET right at the top of the ZeroHedge homepage but only if you are logged in as a professional or premium user so sign up now. Professional users may email debates@zerohedge.com to submit questions for the debaters.