It's been a while since the market considered the possibility of a yuan devaluation: after the latest Chinese trade data it's time to start seriously thinking about it once again.

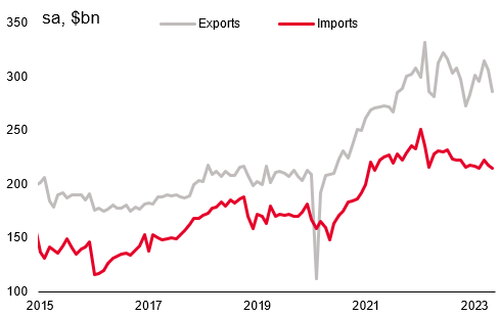

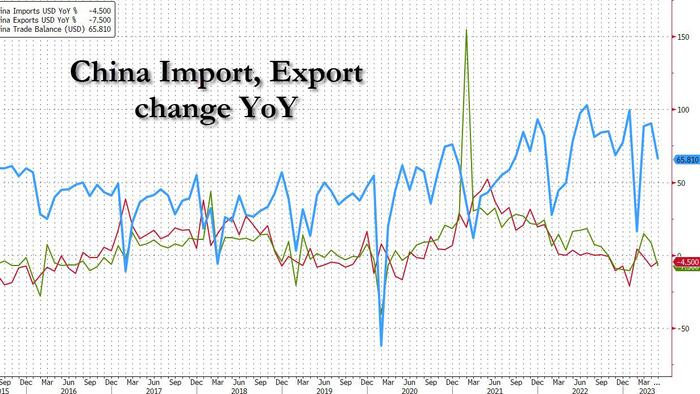

Overnight, China reported May trade data which revealed that exports again slowed sharply and missed market expectations, while imports also contracted but modestly beat expectations:

Although it was partly due to base effects, the underlying momentum has clearly slowed after a resilient 1Q. As SocGen notes, the disappointing export data helps explain the weakness in the manufacturing sector as the latest PMI data showed.

And despite the French bank's call for near-term growth resilience in DMs, exports remain a key headwind to China's manufacturing sector. More importantly, the data clearly reinforces expectation for more easing from the PBoC.

Some more details:

While China's economy has had a dreadful post-covid "recovery", at least trade was solid. Well, not anymore, which is why we asked yesterday if yuan devaluation was coming (China suddenly needs a far weaker yuan to boost its exports, which account for roughly 40% of China's GDP).

But wait, there's more, because while China's exports are clearly slowing, the real picture could be far worse. Why? Because as everyone has known for years, China has been rigging its trade data to make its economy appears stronger than it is, similar to what the Biden admin is doing with labor data.

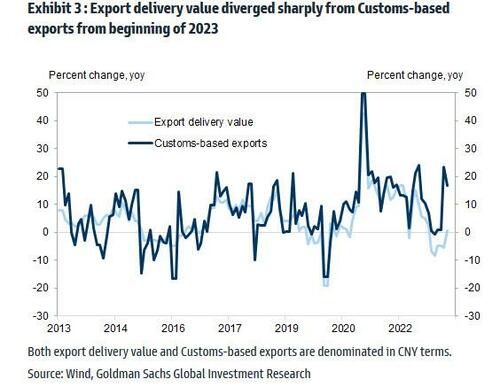

In a recent piece from Goldman "Analyzing recent puzzles on China trade data" (available to pro subs in the usual place), the bank wrote in late May that despite weakening external demand, "China’s exports have beaten consensus expectations for four consecutive months now" (but not five months as the latest trade data showed).

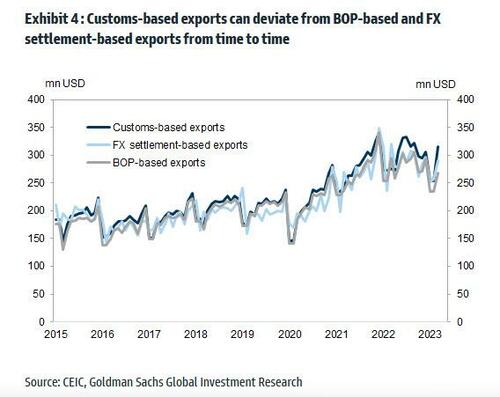

But, as we have observed frequently in the past, Goldman cautions that different trade-related data seem to send conflicting signals and some trading partners’ reported imports from China appear inconsistent with China’s exports to these countries. This has prompted "many client questions on the reliability of Chinese trade data" according to the bank's strategists. Here is Goldman's punchline:

Our "outside-in” measure does not show systematic divergences between China’s import data and trading partners’ exports to China in Q1. However, trading partners’ data released so far suggest significantly lower year-over-year growth than China’s export data in March.

A chart showing just how glaring the trade discrepancy has become:

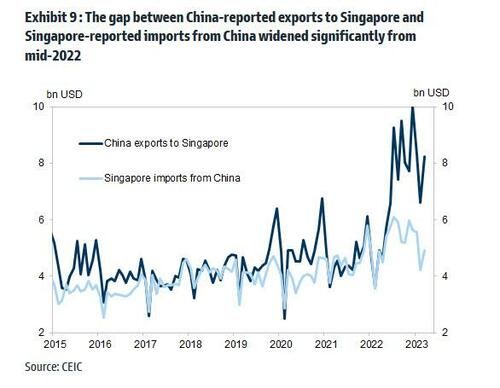

Nowhere is the trade discrepancy more obvious than in bilateral "trade" with Singapore: here, the gap between China-reported exports to Singapore and Singapore-reported imports from China has become laughable.

Goldman then writes that "some of the discrepancies may be related to re-exports and transshipment, but disguised capital outflows are also a potential explanation."

But whatever the reason for the staggering divergence between China's export data and everyone else's, the conclusion is that China's true exports are far, far weaker than the officially reported. And while China's fake export "data" was stronger than expected for 4 months in a row, now that even Goldman pointed out just how fake the Chinese data is, reality may be coming home to roost. Which is also why the market is now starting to frontrun what comes next: a powerful impulse to weaken the currency, because while Beijing may not feel the heat to stimulate as long as (fake) exports are growing and are coming stronger than expected, once China's mercantilist engine begins to sputter, even Xi has to pay attention. And sure enough:

And one China aggressively pursues quasi (or full) devaluation, the race to the currency bottom will restart with a vengeance.