An ugly night of data from China tonight suggests the 're-opening' is not gathering pace:

And finally, and perhaps most problematically, the jobless rate for 16-to-24 year olds hits 20.8% in May, another all-time high that is four times the national rate which stands at 5.2%...

As Goldman noted, both cyclical and structural factors have contributed to the elevated youth unemployment rate in China.

Ken Wong, Asia equity portfolio specialist at Eastspring Investments, said youth unemployment seems to be the big one:

"It impacts the consumption story and youth unemployment will probably continue to go up a bit more with fresh grads entering the workforce."

The National Bureau of Statistics desperately tried to put some lipstick on this pig:

“The global environment is complex and grim, the domestic economy faces grave pressure of structural adjustment, and the economic recovery’s foundation is not yet solid.”

There is one silver- lining - the apparent oil demand rose 17.11% from a year ago in May

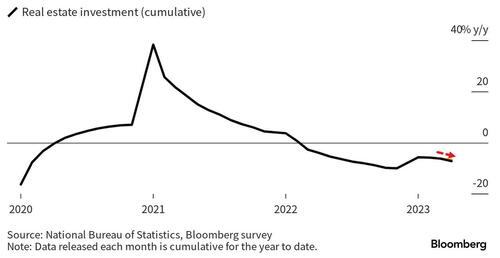

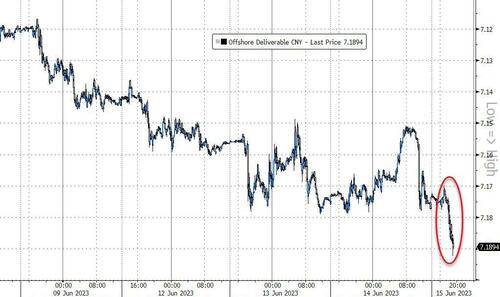

Critically, all of this puts more pressure on Beijing to unleash more stimulus (broader stimulus) and is sending the yuan lower...

Steven Leung, UOB Kay Hian executive director, says the data suggests more support will be needed from Beijing: "China has to announce more policies to aid the economy. Among the speculated supportive policies, markets are betting Beijing will roll out more policies to help the consumption sector given the big miss in retail sales. Those policies should be effective given Chinese citizens’ huge savings."

Incidentally, China cuts it MLF rate by10bps earlier this evening, same as all the other secondary rate-cuts.

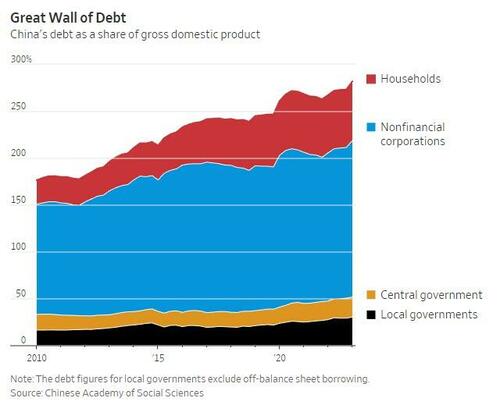

However, as The Wall Street Journal recently noted, the urgency to throw money at the problem could have reached its efficacy limits since after years of heavy borrowing, many in China are focused on paying down their debts this year—and the result could be weaker growth for a long time to come.

The issue isn’t the central government, whose debts are relatively low as a percentage of gross domestic product, but households, the private sector and local governments. Total debt as a share of GDP hit 295% in China last September, surpassing 257% in the U.S. and an average of 258% in the eurozone, BIS data show.

Consumers are hoarding cash, with many refusing to take out loans.

Other countries - most notably Japan - have been through similar processes, almost always painful.

As WSJ goes on to note, economists at Société Générale in a recent report said Chinese policy makers need to learn lessons from Japan and prevent a deleveraging mind-set from becoming entrenched, by restructuring more debts or offering direct income support to households to boost consumption. If not, the economists warned, China could fall into a trap in which even zero interest rates wouldn’t stimulate growth.

“Such a danger seems increasingly relevant for China,” they wrote.

The bottom line is China's economy is struggling; Beijing knows it but the best they can do are small piece-meal stimulus measures because China (more specifically the Chinese and their corporations) are already at their limit (even greater debt loads than the US).