While we previously shared a detailed FOMC preview, below we excerpt from the Fed preview by Bloomberg Markets Live reporter and strategist Ven Ram, who breaks down his analysis in three parts: i) what traders are watching from the Fed today, ii) what the FOMC statement may look like, and iii) the Fed's dot plot options.

Starting at the top, here is...

What Traders Are Watching From The Fed Today

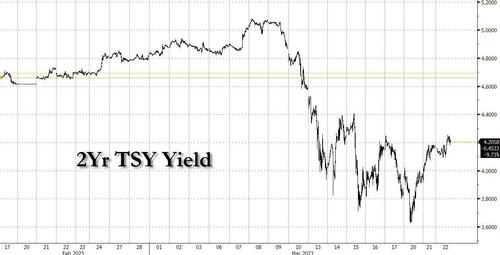

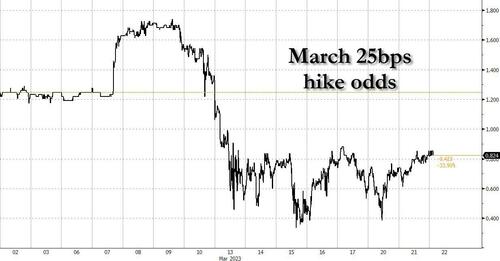

Treasury two-year yields have bobbed almost 150 basis points in their range since the Federal Reserve met last month, enough to give any roller-coaster ride a run for its money. They are still looking for a definitive direction, and today’s Fed decision holds the key.

Decision & dissent:

Dot plot:

Summary of Economic Projections:

Powell’s Pyrotechnics:

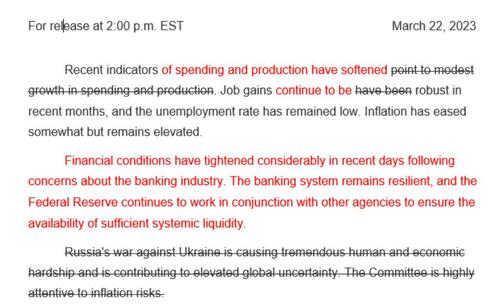

Here’s What the Fed Statement May Look

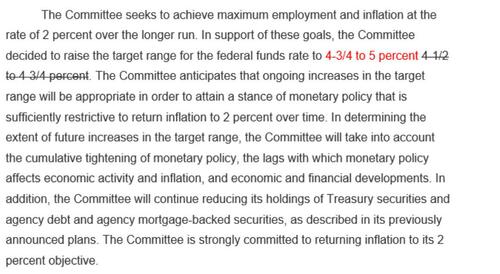

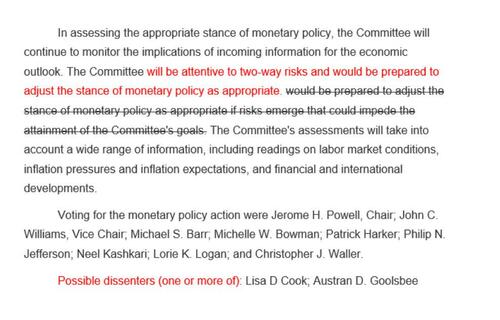

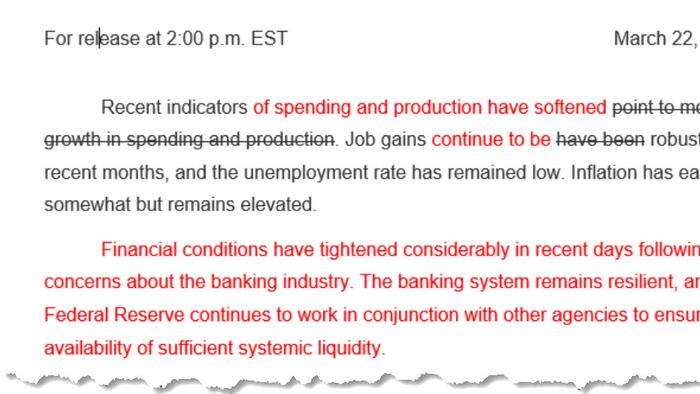

The Fed faces the unenviable prospect of having to craft a policy statement at a time when it is still coming to grips with a banking crisis and its fallout on the wider economy. In light of the recent market tumult, revisions to the statement will be the most extensive in a long while.

The top:

Rate increase:

Dissent:

What About The Dot Plot

The Fed’s dot plot could broadly go one of three ways today:

Option I: Cop-out

Option II: The Dovish Choice

Option III: Dovish & Hawkish Simultaneously