Update (1700ET): You cannot make this shit up. Minutes after the biggest weekly crude draw in history... and with crude prices at 2023 highs... and with wholesales gasoline prices exploding higher (implying retail pump pries are set to soar), the Biden administration has given up on its efforts to refill the Strategic Petroleum Reserve...

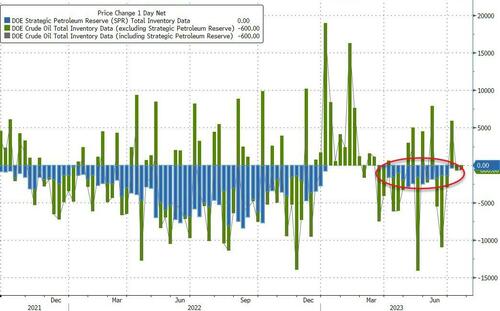

As a reminder, the Biden admin has been drawing down on the SPR for the last 14 weeks and - despite all the promises - has not refilled the "STRATEGIC" reserve one little bit...

The 3-2-1 crack spread is blowing out...

As a reminder, when one product spread is blowing out, the market is saying that there needs to be more output of said product.

When all spreads are blowing out simultaneously, that may be the market's way of signaling it needs more refining capacity to satisfy growing product demand.

We are seeing more of the latter (as Jet Fuel and Diesel cracks are also blowing out).

* * *

Oil prices gave back some of the recent solid gains today despite OPEC’s crude production tumbled by the most in three years as Saudi Arabia implemented a deeper cutback in a bid to shore up global markets, as dollar strength weighed on crude prices (and weak PMIs threatened demand outlooks).

"The OPEC+ Joint Ministerial Monitoring Committee will meet online on Friday, providing Saudi Arabia an excellent opportunity to roll its voluntary 1 million bpd production cut announced on June 3 for July production for another month to September. It would be the second time the Saudis have extended the voluntary 1 million bpd production cut. There is speculation that another 1 million roll forward could slow the global war on inflation, and kill the "golden goose," especially heading into the end of summer driving season, and the beginning of shoulder season," Robert Yawger, executive director of energy futures at Mizuho Securities USA, wrote in a Monday note.

Volumes also remain muted in light summer trading, while volatility is at the lowest since January 2020.

Expectations were for more inventory draws after last week's across-the-board drop...

API

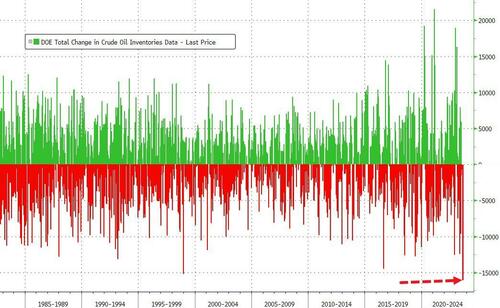

Umm... API reports that Crude stocks fell 15.4mm barrels last week (yes 15.4!!!) - over 10x expectations. Product inventories also fell as did stocks at the Cushing Hub.

Source: Bloomberg

If that holds for the official data released tomorrow that will be the biggest weekly draw in the data's history (back to 1982)

Source: Bloomberg

WTI was hovering around $81.60 ahead of the API report (well off the day's lows) and bounced on the massive draw into the green for the day, back above $82...

Back up to 2023 highs...

"Oil remains one of the most attractive trades and buyers will likely emerge on every dip," said Edward Moya, senior market analyst at Oanda,in a note.

Shit's about to get real for Mr. Biden...

Unleash the SPR again?