Oil prices are dropping this morning after the weak ISM Services print, erasing the overnight gains following API's report of inventory draws across all cohorts. However, prices remain up notably on the week, holding the post-OPEC+ production-cut surprise gains.

Additionally, a weaker dollar has helped to boost the allure of commodities priced in the US currency.

API

DOE

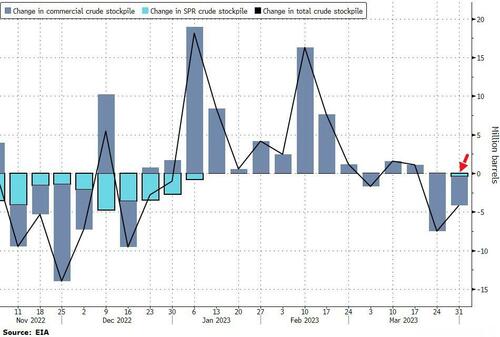

The official EIA data confirmed API's overnight with draws across the board. Distillates saw biggest drop in stocks since Oct '22.

Source: Bloomberg

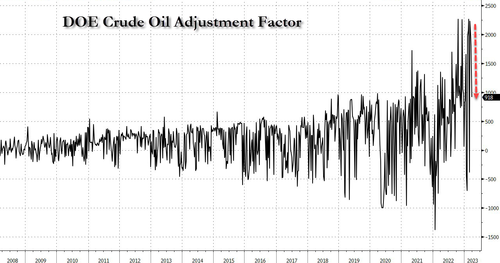

Interesting that as soon as the so-called "adjustment factor" collapses, we get draws galore?!

Source: Bloomberg

Even more interesting, at a time when the Biden admin is supposed to be refilling the SPR, they actually drained it (admittedly by a little) for the first time since Jan 6th. No wonder the Saudis were pissed...

Source: Bloomberg

Cushing saw stocks decline for the 5th straight month...

Source: Bloomberg

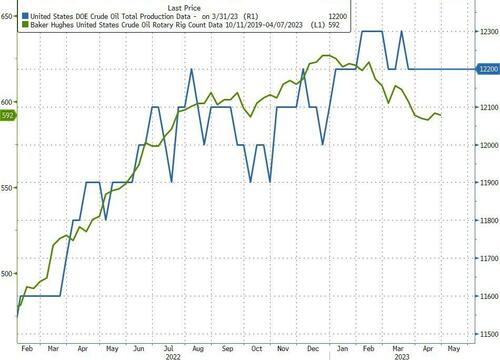

US crude production was flat at 12.2mm b/d, even as rig counts continues to trend lower...

Source: Bloomberg

WTI is holding around the $80 level after slumping yesterday (ISM Manufacturing, JOLTS) and this morning (ISM Services)

For now, the oil market remains "flush" with inventories, said Manish Raj, managing director at Velandera Energy Partners. However, the announced output cuts will "turn the market to a deficit in the second half."