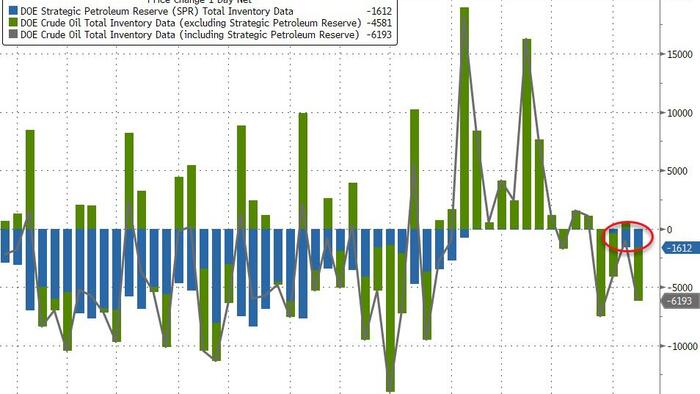

Update (1055ET): Oil prices rebounded after the initial downthrust on the gasoline inventory build. Flat production and a notable crude draw exacerbated the buy-the-dip as it became clear that the SPR saw its 3rd weekly drain in a row...

And WTI is testing back up towards $80...

...but we thought the Biden admin was supposed to be refilling the SPR?

* * *

Oil prices are sliding this morning after UK's shockingly high CPI set yields higher and reignited rate-hike-driven fears for demand growth.

As Bloomberg reports, the upshot is that oil traders are wrestling with a quandary that has troubled them for much of this year:

And today's official EIA data will give us the latest glimpse into that crystal ball.

API

DOE

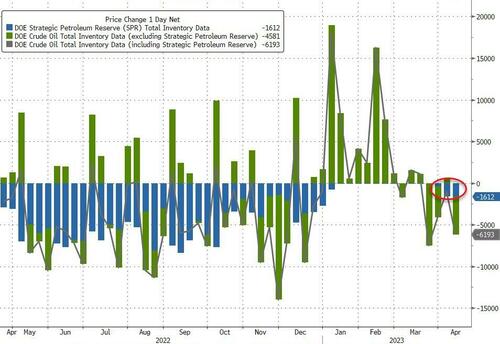

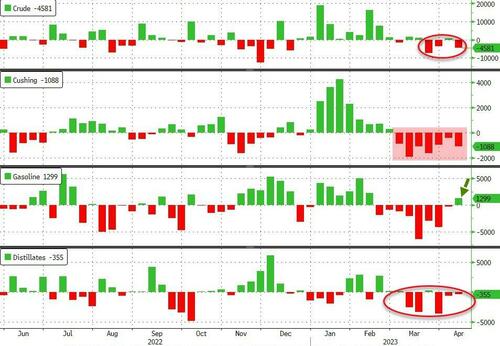

Official estimates show crude stocks fell 4.68mm barrels last week (more than API reported) and inventories at the Cushing Hub fell for the 7th straight week. Gasoline stocks unexpectedly rose, breaking an 8-week streak of draws, while Distillates fell...

Source: Bloomberg

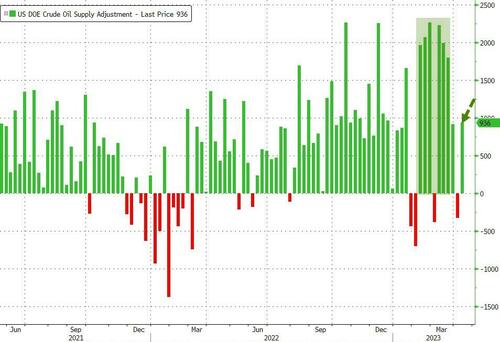

The so-called 'adjustment factor' was higher once again...

Source: Bloomberg

Stocks at the Cushing hub fell for the 7th straight week, back at the lowest levels since Jan...

Source: Bloomberg

US Crude production was flat at 12.3m b/d as rig counts continue to drift lower...

Source: Bloomberg

WTI is trading around $79.50, after bouncing back off the lower end of its post-OPEC-production-cut spike range...

But prices are extending losses here after the print...

"We wait for the expected, albeit reduced, pickup in demand during the second half as projected and reiterated by OPEC, IEA and the EIA in their latest oil market reports. A development that will likely boost prices and aggravate an emerging supply deficit in 2H23. The recovery in demand, however, is still very uneven with China and a pickup in international travel accounting for the bulk of the increase. Before then the market will continue to worry about the risk of recession and its impact on demand, a concern that is currently playing out in the diesel market, a fuel which powers heavy machinery such as truck and construction equipment," Ole Hansen, head of commodity strategy at Saxo Bank, wrote.