Oil prices slipped lower after weak China macro data overnight dominated US core retail sales data and a stronger dollar didn't help.

“In China, where there were great expectations for demand growth, there is a lot of failure,” Ed Morse, global head of commodity research at Citigroup Inc., said in a Bloomberg Television interview on Monday.

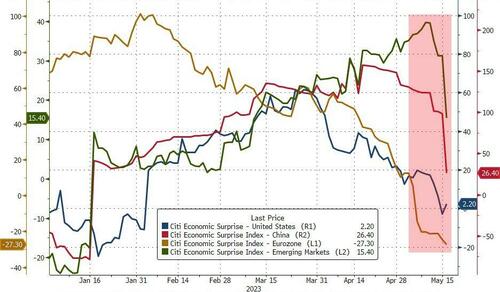

A quick glance at the China macro surprise index tells you all you need to know...

After last week's surprise crude build (and now the Biden administration actually talking about a possible SPR refill - although it's de minimus), expectations are for a modest draw this week...

API

For a second week in a row, crude inventories rose (significantly) with stocks at the Cushing hub soaring. Gasoline stocks drew down notably for a second straight week...

Source: Bloomberg

WTI was hovering around $70.50 ahead of the API data and held the losses after the unexpected build.

Oil has declined 12% since this year as China’s recovery disappointed some bulls and the potential for a US recession weighs on the global demand outlook. Meanwhile, the US government has solicited bids for as much as 3 million barrels of sour crude for its Strategic Petroleum Reserve, with deliveries planned for August. The agency released more than 200 million barrels last year, in part to curb higher prices.