Oil prices are higher this morning as investors brushed off oversupply fears, having digested a decision earlier by OPEC+ to restrain production increases next month.

“The disconnect continues between paper pricing and the predicted glut in global balances,” said Keshav Lohiya, founder of consultant Oilytics.

“We are back to an oil trading world where flat price is firmly in the $65 to $70 world.”

Additionally, prices shrugged off the crude build reported by API overnight.

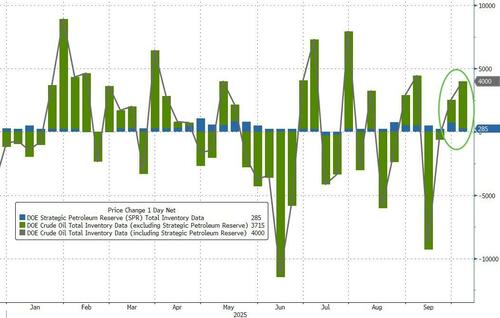

API

DOE

The official data confirmed API's sizable crude build (second week in a row) but products and stocks at Cushing saw inventory drawdowns...

Source: Bloomberg

With the addition of 285k barrels to the SPR, total crude stocks rose by the most in a month

Source: Bloomberg

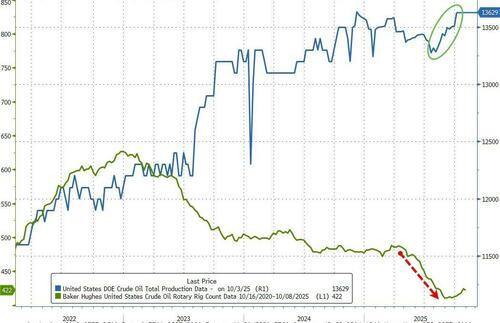

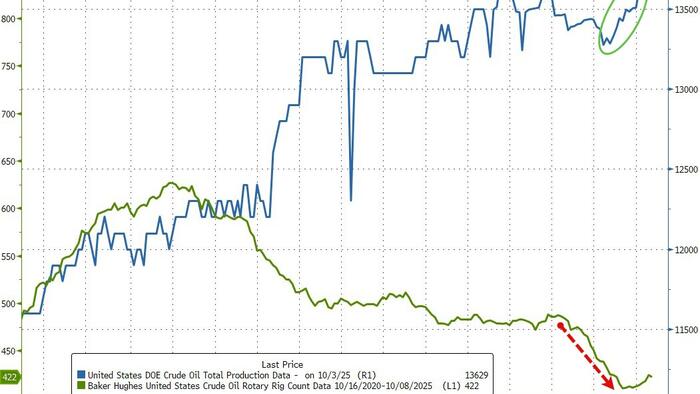

US crude production rose once again, back to record highs, despite the trend lower in rig counts...

Source: Bloomberg

WTI prices held gains after the official data

Goldman Sachs reaffirmed its bearish outlook on oil, saying the global market faces an average daily surplus of about 2 million barrels from this quarter through next year. That will drag prices lower, with Brent expected to average $56 a barrel in 2026, analysts including Yulia Grigsby said in a note.

"The market is in price limbo, with one side bent towards a possible supply glut and the other believing the ramp-up will not be as fast as anticipated," said Emril Jamil, a senior analyst at LSEG Oil Research.

Price gains are however capped as fears of Russian supply disruption eased, with crude oil shipments holding close to a 16-month high over the past four weeks, the ANZ analysts said.