Oil prices rallied for a second straight day, erasing some of last week's ugly losses, with prices supported by some upbeat prospects for Chinese demand and ongoing concerns that the Middle Eastern conflict will threaten crude flows from the region.

“We’re seeing a constant push-pull between expectations of a cease-fire — which would unwind the geopolitical risk premium — and concerns over potential escalation,” said Rebecca Babin, senior energy trader at CIBC Private Wealth Group.

“This environment remains highly volatile, with traders operating under low risk thresholds, contributing to significant price swings.”

While hurricane-related effects are likely still impacting the overall data, traders are looking for any signs of real demand picking up...

API

While crude stocks rose (more than expected), products saw sizable drawdowns and the Cushing hub saw a return to drawdowns...

Source: Bloomberg

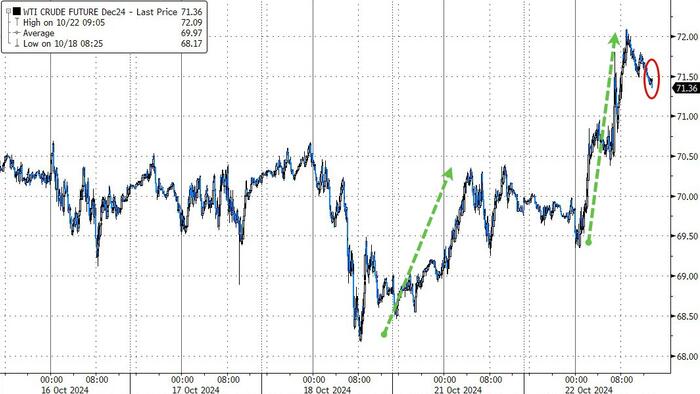

WTI was trading around $71.50 ahead of the API print and limped lower after...

Crude has been buffeted this month - with Brent fluctuating in a range of more than $11 - as the war in the Middle East raises the potential for disruptions to supplies.

“Assuming no supply disruptions in the Middle East, the oil balance looks increasingly comfortable through 2025,” ING analysts Ewa Manthey and Warren Patterson wrote in a note.

“With the market returning to a sizable surplus, we should at least see the front end of the curve moving into contango,” they said, referring to the market structure which indicates oversupply.

At the same time, top importer China has moved to support growth with stimulus, but investors remain wary that the global oil market may swing to a surplus in the coming quarters.