Crude prices are higher this morning on signs of progress in trade talks between the US and EU and the API report of a major drawdown in American crude inventories (despite product builds).

Geopolitical tensions continue to drive prices more aggressively as the possibility of a Putin-Zelensky meeting came and went and Iranian peace deal talks stumble.

The big question for traders is - will the official data confirm API's drawdown?

API

DOE

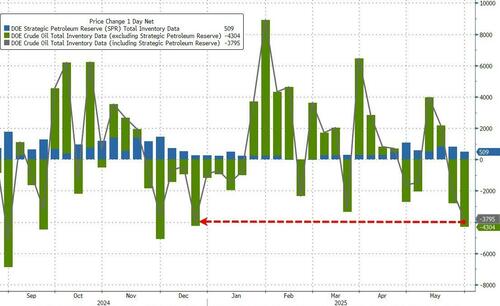

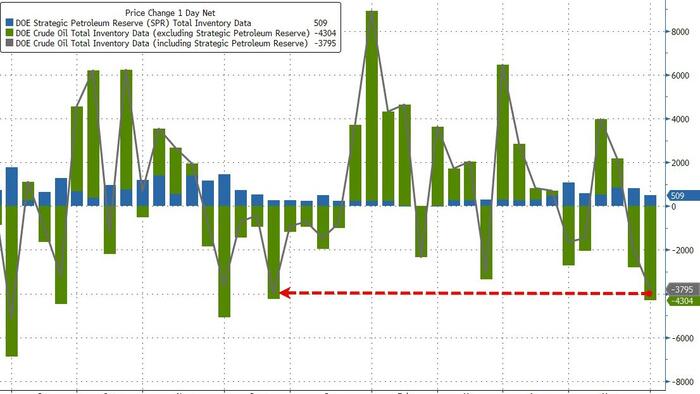

The official data confirmed API's report with a large crude draw offset by big draws in products...

Source: Bloomberg

Even including the 509k barrel addition to the SPR, total crude stocks fell by the most since December...

Source: Bloomberg

The rig count continues to slide (now at its lowest since Dec 2021), and despite Trump's 'Drill, Baby, Drill' push, US crude production remains well of its highs...

Source: Bloomberg

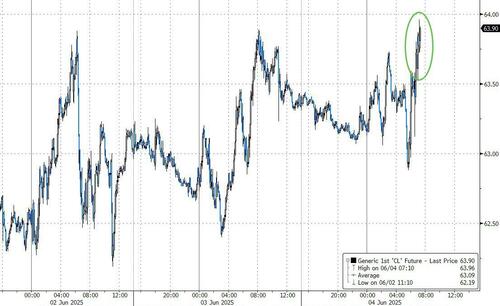

WTI extended gains after the official data confirmed API's...

Source: Bloomberg

Oil rose at the start of the week after a decision by OPEC+ to increase production in July was in line with expectations, easing concerns over a bigger hike.

However, prices are still down about 11% this year on fears around a looming supply glut, while traders continue to monitor US trade tariffs as President Donald Trump said his Chinese counterpart is “extremely hard” to make a deal with.

Saudi Arabia led increases in OPEC oil production last month as the group began its series of accelerated supply additions, according to a Bloomberg survey.

Nevertheless, the hike fell short of the full amount the kingdom could have added under the agreements.