Oil prices are extending yesterday's gains this morning, after API reported a huge crude draw and the dollar weakness supportive. A military coup in OPEC-member Gabon added some risk premium to oil prices, however, as Keshav Lohiya, founder of consultant Oilytics, wrote in a note this morning, “oil markets are very quiet,” adding that crude has been supported by bullish inventory data.

Additional support for oil prices are headlines that Russia is discussing with its OPEC+ partners the possibility of extending oil-export cuts into October, but no decision has been made so far, Interfax reported, citing Deputy Prime Minister Alexander Novak in Moscow.

The big question is - will the official data confirm the API draw?

"Another sharp drop in oil inventories was reported by API. If the 11.5 mln barrel drop is confirmed, U.S. private oil stocks would be the lowest in a year," Marc Chandler, chief market strategist at Bannockburn Global Forex, said in a note.

API

DOE

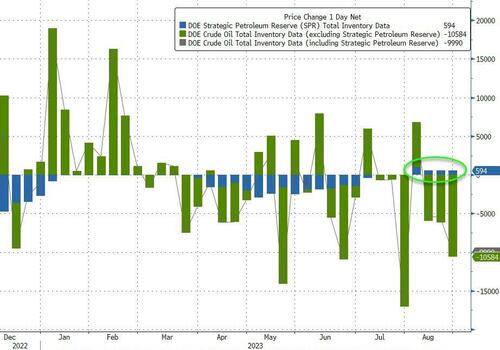

The official data confirmed API's reported large crude draw and also Cushing stocks continue to fall...

Source: Bloomberg

The Biden administration added to the SPR for the 4th straight week (+594k barrels)...

Source: Bloomberg

The recent huge commercial draws have dropped crude stocks to their lowest since Dec 2022...

Source: Bloomberg

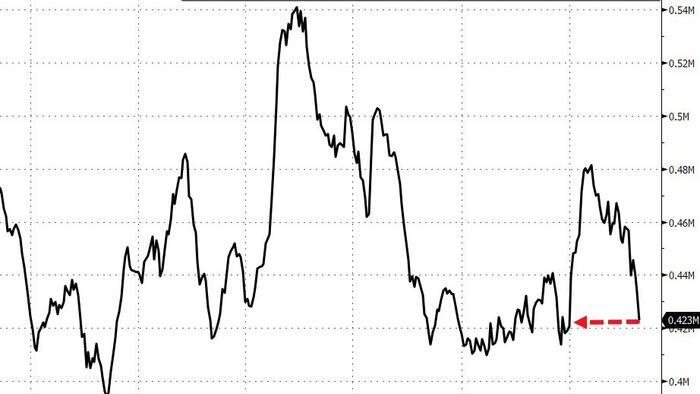

Stocks at the Cushing hub fell to their lowest since January

Source: Bloomberg

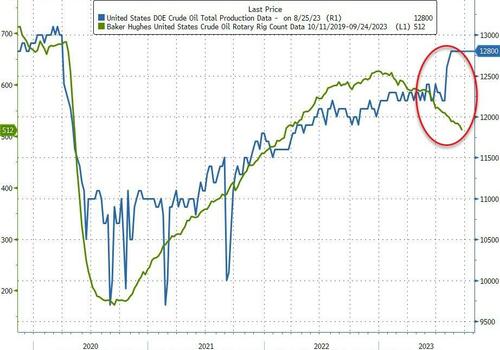

US Crude production remained at post-COVID highs, even as the rig count continues to plunge...

Source: Bloomberg

WTI was chopping around just below $82 ahead of the official data, and extending gains after...

Finally, we note that US demand could weaken as Hurricane Idalia hit the Florida coast early on Wednesday as a Category 4 storm before weakening to Category 3 with 120-mile per hour winds.

"While our primary concern goes out to FL residents, we also see the storm as a small headwind for the refining space. At this point, it doesn't look like any refineries are in the path of the storm, keeping supply intact. However, FL is a major demand center, with EIA 2021 data showing gasoline consumption of 584mbpd (6.6% of US total), distillate consumption of 149mbpd (3.9% of US), and jet consumption of 134mbpd (9.8% of US)," Tudor, Pickering, Holt analyst Matthew Blair noted.