Oil prices extended recent gains overnight (but have trodden water for the last couple of hours) after a surprise crude draw reported by API last night and the ongoing dispute over Iragi crude exports via Turkey (disrupting supply).

“Supply concerns continue to support oil prices,” said Warren Patterson, the Singapore-based head of commodities strategy at ING Groep NV.

One of the biggest oil producers in Iraqi Kurdistan, Norway’s DNO ASA, has started to lower production as the dispute drags on.

However, despite the support for oil prices coming from supply concerns, oil prices are likely to remain volatile in the near term, led by the financial market turmoil, according to UBS strategist Giovanni Staunovo.

And if official inventory, supply, and demand data matches API's that upside vol may continue as positioning is very short.

API

DOE

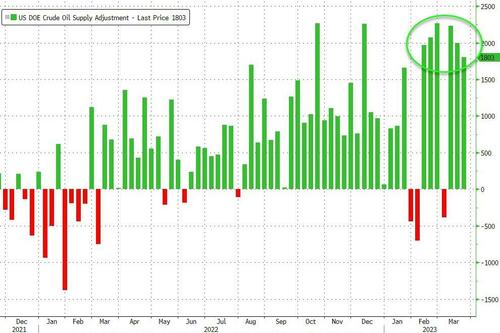

The official DOE data shows an even bigger crude draw than API reported along with a draw in gasoline stocks (6th week in a row). Cushing stocks fell for the 4th straight week while Distillates saw a small build...

Source: Bloomberg

The infamous "adjustment factor" dropped last week but remains extremely high historically speaking...

Source: Bloomberg

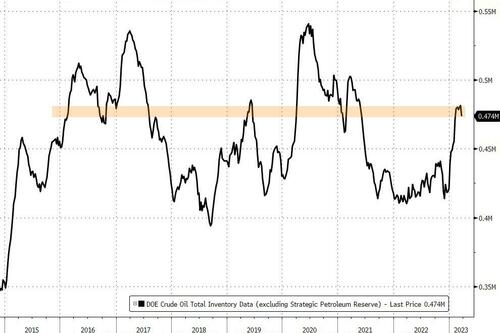

US Crude stocks overall remain relatively elevated...

Source: Bloomberg

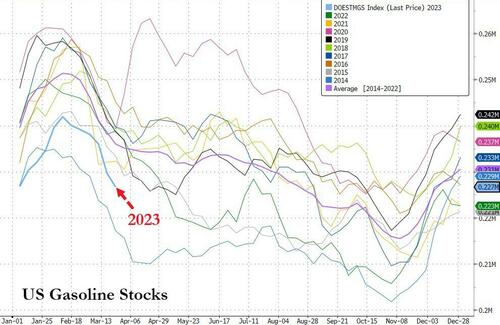

Overall US gasoline stocks are at their lowest for this time of year since 2014...

Source: Bloomberg

US Crude production was flat week-over-week, as rig counts continue to decline..

Source: Bloomberg

WTI has been chopping around in a narrow range around $74 for the last few hours ahead of the official data and extended gains after the draws...

Finally, as Bloomberg notes, while oil has rallied from recent lows as the banking sector stabilizes, it remains on track for a fifth monthly decline amid concerns over a potential US recession and resilient Russian energy flows. Most market watchers are still betting that China’s recovery will accelerate and boost prices later this year as demand rebounds.

Meanwhile, OPEC+ is showing no signs of adjusting oil production when it meets next week, staying the course amid turbulence in financial markets, delegates said.

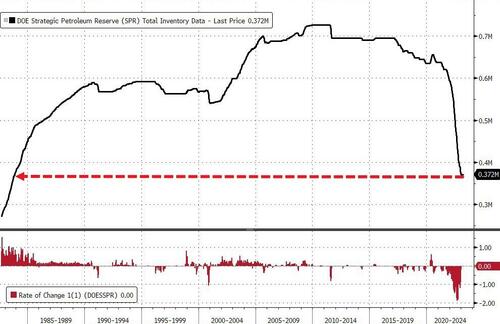

We also note that there is the 'Biden Call' sitting under the market as at some point he will have to start refilling the SPR.