Oil prices were slightly higher on Friday as Israeli strikes against Yemen's Houthi rebels triggered what Tom Essaye, founder and president of Sevens Report Research described as a "fear bid" for the commodity.

"This is a geopolitics-driven market," Melek said.

"We're a little worried about events around the Red Sea and potentially getting shipments interrupted in the broader region," he added.

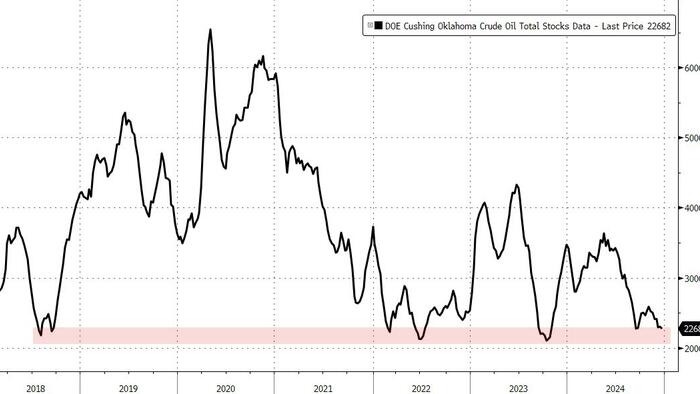

U.S. crude oil inventories fell by more than expected last week and product stocks were mixed as refineries raised their capacity use, according to official data released (on a delay due to the holiday) from DOE.

This is the 5th straight week of crude stock drawdowns and sixth straight week of gasoline builds...

Source: Bloomberg

Cushing stocks fell back near 'tank bottoms' once again (lowest since Oct 2023)...

Source: Bloomberg

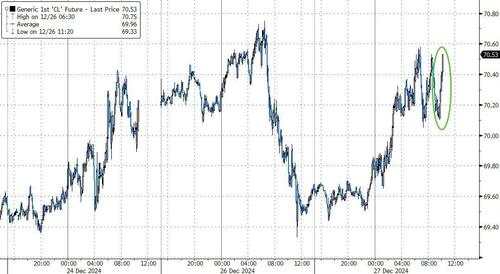

WTI extended the day's gains on the crude draw, holding solidly above $70...

Source: Bloomberg

Crude is on track for a modest annual loss, with trading confined in a narrow band since mid-October.

There are widespread concerns the market may be oversupplied next year as China’s demand slows and global production expands, although traders remain cautious about potentially tighter US sanctions against flows from Iran under Donald Trump.

The prompt spread on WTI futs - with the nearby contract trading at a premium of more than 40 cents a barrel to the next in line - points to near-term supply tightness.