Oil prices are extending losses once again as weak durable goods (under the hood) and growing banking crisis fears prompted WTI to erase all of the post-OPEC+ production-cut gains.

“Concerns about the outlook for demand seem to be the main culprit” for lower prices in recent days, and are countering the effects of lower OPEC+ output, said Jens Pedersen, director of oil and commodities research at Danske Bank.

“For the market in general, including the oil market, it’s now wait-and-see before next week’s Fed and European Central Bank meetings which will set the tone.”

For now, confirmation of API's large crude draw could trigger a rebound off this key support level...

API

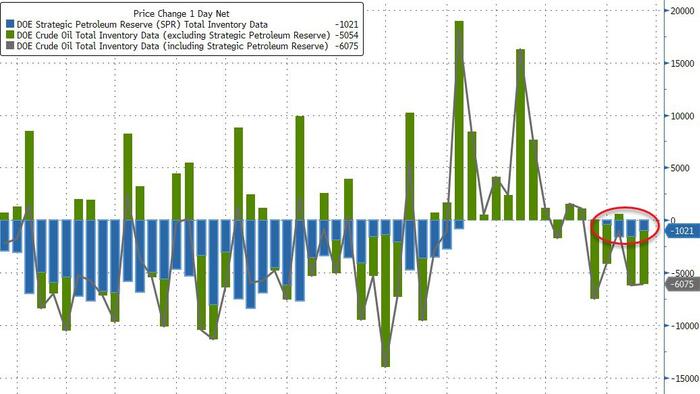

DOE

The official data confirmed API's report of a large crude draw last week (and we also saw product inventories drawdown once again). Stocks at the Cushing hub rose for the first time in 8 weeks...

Source: Bloomberg

The Biden admin drew down from the SPR for the 4th straight week...

Source: Bloomberg

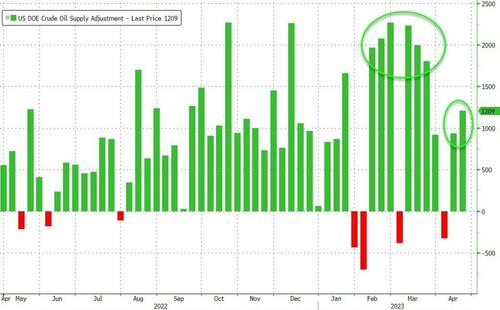

The so-called "adjustment factor" on crude stocks jumped again...why is the adjustment 'always' to the upside?

Source: Bloomberg

US crude production was flat at 12.2mm b/d despite the trend lower in rig counts...

Source: Bloomberg

WTI was trading around $76 ahead of the official print, having erased all of the post-OPEC+ production-cut gains...

And bounced higher after the official data reported the draws...

The market has added back so much length over the past month and no one is left to buy it at the moment, said Jonathan Wagner, global head of crude options at Marex North America. There will be very little interest in buying crude until West Texas Intermediate falls to $75.72, filling the gap from OPEC+ production cuts, he added.