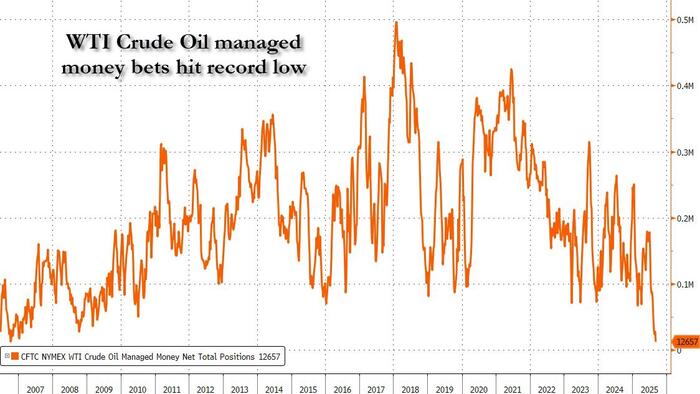

With oil trading just above multi-year lows - despite mounting speculation of peak shale - pessimism on oil prices has never been greater, and earlier this week sentiment hit rock bottom after WTI managed money spec positions hit a record low, the clearest sign yet of what speculators think of the future of oil.

And yet, this may prove to be one of the biggest conventional wisdom blunders yet because according to the International Energy Agency, the world needs to spend some $540 billion a year looking for oil and gas to maintain current output by 2050 as the pace of declines in existing fields increases.

Faster decline rates, in part because of an increased global dependency on US shale, mean that the global oil and gas industry “has to run much faster just to stand still,” the agency’s executive director Fatih Birol said.

This means that any low prices for oil are only temporary, because as more drillers pull the plug (as they can't break even on their investment) the less oil will be pumped out of the ground, resulting in a supply squeeze which in turn sends prices soaring. In this case, the old saying is true: the only cure for low oil prices is low oil prices.

The outlook also means that companies will need to tap reserves that haven’t yet been discovered, unless demand shifts away from fossil fuels, for production to remain where it is today in 25 years. It also marks a significant shift in tone for the IEA which, in recent years, has called on major producers to spend more on clean energy.

The outlook matters because there’s little sign of oil demand peaking soon, meaning that elevated output will be needed for years to come. While a global oil surplus is forecast for this year and next, BP Plc this year projected that supply growth outside of OPEC from early 2026 would remain largely flat for 12 to 18 months.

“In the case of oil, an absence of upstream investment would remove the equivalent of Brazil and Norway’s combined production each year from the global market balance,” the IEA’s Birol said in a statement, sounding uncharacteristically bullish.

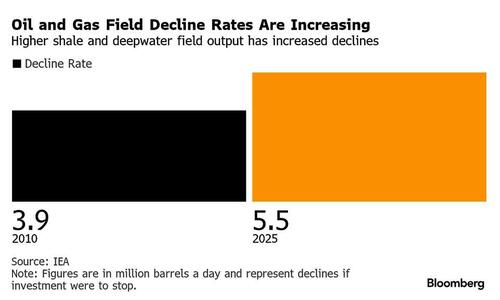

Its forecast is part of a report that analyzed more than 15,000 fields and how fast their output is declining. Without investment, global supply would fall by the combined production of Norway and Brazil - more than 5 million barrels a day - every year. That amount is around 40% higher than it was in 2010, partly because of more reliance on shale production, particularly from the US, which typically depletes faster than conventional reserves.

While global spending is likely to hit $570 billion this year — enough to keep production at current levels if sustained — the amount would be down slightly from 2024, Christophe McGlade, head of the IEA’s energy supply unit, said on a webinar.

What is notable here is that while oil has historically been a very capex-heavy industry, and offset such capex-light sectors as tech, in recent years the relationship had flipped with tech names now even more capex heavy than oil drillers. Which begs the question: with the world suddenly drowning in capex funding needs, just where will all this money come from, especially if and when the next global recession strikes?