Ahead of President Trump's "Liberation Day" tariff rollout on Wednesday afternoon—particularly the 25% tariff on vehicles and auto parts imported into the U.S.—reports surfaced last week of consumers rushing to dealerships to purchase vehicles already on the lot, as those would be exempt from the new levies. We suspect that if consumers are willing to flock to auto dealerships, they're probably just as willing to stock up on their favorite Chinese-made products before the next round of tariffs takes effect this weekend and next Wednesday.

Tariffs on Chinese goods are set to increase by 34% next Wednesday, on top of the existing 20%, bringing the effective rate to 54%. This will significantly impact companies heavily reliant on Chinese manufacturing (and other Asian countries), forcing them to absorb the cost or pass it on to consumers—setting the stage for sticker shock.

Goldman analysts Brooke Roach, Kate McShane, and others earlier today provided clients with a breakdown of Trump's reciprocal tariffs:

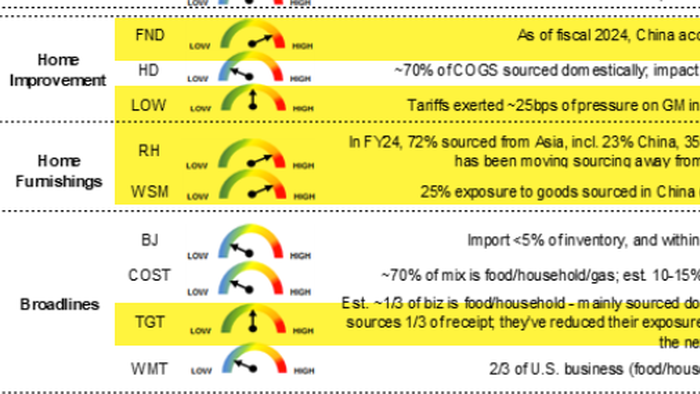

Given the tariff breakdown and timeline, Roach and McShane provided clients with a "China Tariff-O-Meter," highlighting companies in their retail coverage whose supply chains are heavily exposed to China, Vietnam, Indonesia, Bangladesh, and Cambodia.

From their Softlines coverage, companies such as Warby Parker, Torrid Holdings, Groupe Dynamite, Nike, Yeti Coolers, and SharkNinja have high exposure to China and other Asian countries targeted by Trump's upcoming round of tariffs. In other words, the products from these companies entering U.S. ports in the coming days will be subjected to sizeable tariffs.

In their Hardline coverage, companies such as Floor & Decor, Lowe's, RH, Williams-Sonoma, Target, Dick's Sporting Goods, Dollar Tree, and Five Below have elevated or high supply chain exposure to China or other Asian countries.

Take note of the Softline and Hardline retailers listed above. If there's a product you've been eyeing—whether it's a new couch from RH or some Chinese junk from Five Below—now might be the time to buy.

To avoid paying higher prices for foreign goods, just buy American.

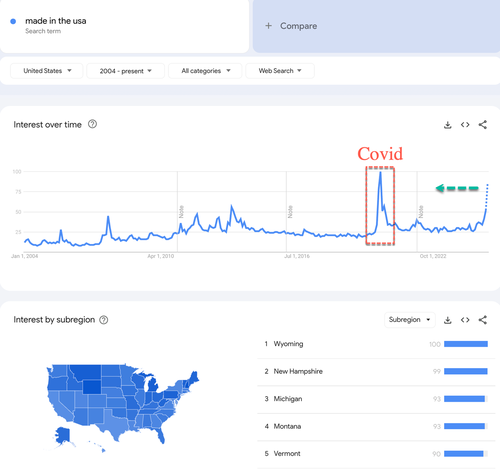

We also suspect searches for "American Made" will begin to rise.