As we reported last night, president-elect Trump announced he intends to levy a 25% tariff on all imports from Mexico and Canada and an additional 10% tariff on imports from China. Tariffs on Mexico and Canada would remain in place until the flow of “drugs, in particular fentanyl, and all illegal aliens stop,” while tariffs on China would remain in place “until such time as [the drugs that are pouring into our country] stop”. He also stated that on January 20th he would “sign all necessary documents” to implement the tariffs on Mexico and Canada as one of his “many first Executive Orders”.

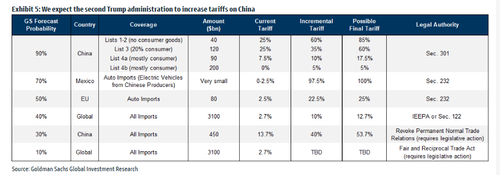

To be sure, Trump has proposed most of this before, in different forms:

Overall, the announcement is more reminiscent of the first Trump administration, when such tariffs were announced as a negotiating tactic, rather than the more systematic tariff policies (e.g., the 10-20% “universal baseline tariff”) Trump frequently discussed during the campaign.

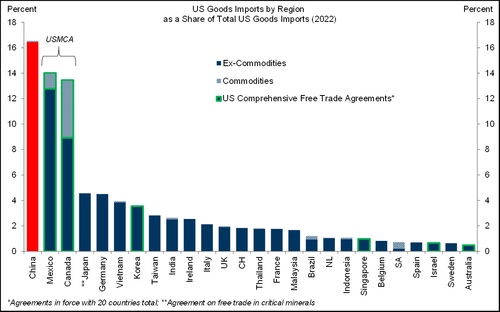

Some more details: 43% of US goods imports come from Mexico (15.4%), Canada (13.6%), and China (13.9%).

At the proposed tariff rates, this would generate slightly less than $300bn (or 1.0% of GDP) in tariff revenue annually, without accounting for dynamic effects, such as changes to import volumes and prices or taxable incomes, and boost the US effective tariff rate by 8.6% (Goldman's rule of thumb is that every 1% increase in the effective tariff rate would raise core PCE prices by 0.1%), while the proposed tariff increases would also boost core PCE prices by 0.9% if implemented.

In its commentary on the tariff announcement, Goldman political analyst Alex Phillips writes that while he had assumed tariffs on imports from China will rise early next year, it is more likely Mexico and Canada will avoid across-the-board tariffs. Phillips also notes that if implemented, these are about three times as large as the China and auto tariffs the bank assumes in its baseline economic forecasts but slightly smaller than a 10% universal tariff.

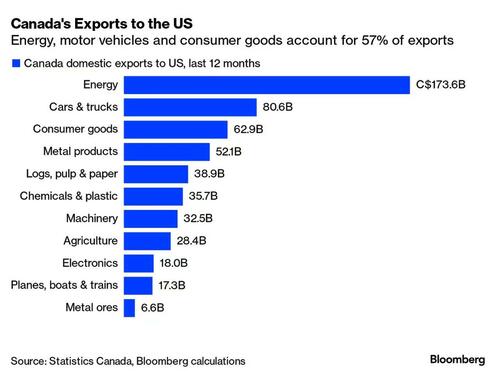

In a separate note from Goldman Delta One trader Rich Privorotsky (available here for pro subs), he writes that the bigger surprise in the Trump proposal is Canada. To this point, Goldman tried to calibrate the FX impact of tariffs by assessing the importance of US trade for different economies and the complexity of the products they produce: here the Loonie stands out too.

Privo also found it curious that China's HSI was actually up for most the session having now eventually back some its gains (now unch) and believes that "if tariffs on China went up only another 10% I think relative to expectations that have been built up this might be taken as a modest positive."

Privorotsky also suggests that Trump's announcement is another part of the wall of worry for Europe. Tariffs are known risk (unknown in magnitude) and "it's the waiting that is really the problem." So while it make sense for European stocks to be down in sympathy on the news (especially after some hopefulness that recent cabinet picks might mean a less hawkish approach), he would argue that a 25% tariff on Canada (biggest source of trade is the import of energy) is likely more of a negotiating tactic rather than a likely outcome.

Bottom line: while the CAD will lurch lower on this, it will likely find support.

Turning to China, Goldman's EM strategist Sun Lu focuses on the silver lining, i.e., "it's priced in", and lays out the following analysis (excerpted from her full note available to pro subs).

Dovish views:

FX response:

What trades does Lu like? Continue to like owning 1y USDCNH, USDTWD and USDSGD topside, funded by selling short-dated downside. The Goldman strategist prefers to be long USD ahead of actual tariff announcements rather than just headlines.

Finally, we go to Goldman EM vol trader trader Sanjiv Nanwani who writes that "the market remains in a holding pattern despite early AM tariff headlines – but as far as China is concerned, the tariffs seem to underwhelm what is already expected, and in any case, the authorities are clearly unwilling to let FX move as evidenced by the ~unchanged USDCNY fix today."

The vol market seems to suggest the same – don’t expect spot to do a whole lot before the inauguration. Nanwani found that a little surprising, "as we now have confirmation that Trump is already contemplating tariff policy and is prepared to announce them ahead of his formal inauguration, which the market will surely have to re-price in response to."

Nanwani likes owning some cheap 1mth USD calls here, notwithstanding the poor realized performance (suppressed by the fix) over the past 1-2 weeks. Further out, the market remains very keen on holding onto term premium, keeping calendars uber steep but creating a very high bar for the delivery of realized performance – there is a real risk that the premium decay on some option structures will more than offset expected gains from delta. He therefore likes vol-selling strategies in 3mth+ expiries, particularly via USD bull seagulls, to benefit from both the inverted forward curve and steep vol curve. ATM run: 1m 4.6 3m 6.1 6m 6.6 1y 6.9.

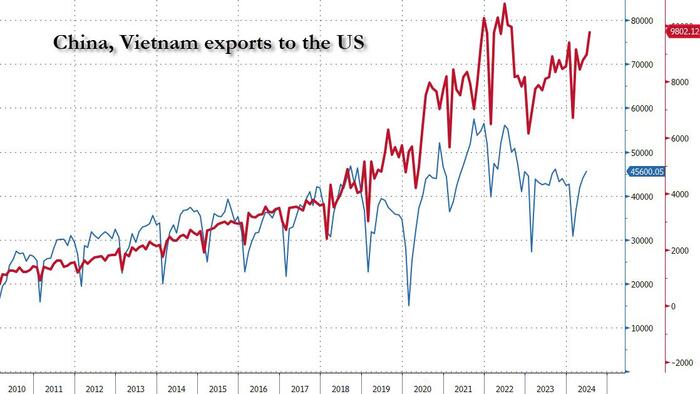

It's not just Goldman however: in a note to clients (available to pro subs), SouthBay Research this morning reminds us that while attention is focused on China, it really should be on Vietnam; here's why:

Here is the timeline to consider:

Next, and especially for all the inflation alarmists, it is worth noting that there was minimal inflationary impact in the last trade war:

In this context, the real question - according to Southbay - is why doesn't Trump also Tariff Vietnam?

Consider this: in 2023, registered Chinese investment in Vietnam was $8.3B. Thanks to offshoring production by Chinese manufacturers, Vietnam has become a player in the global supply chain.

This is a response to Trump initiated tariffs whereby OEMs like Apple want to de-risk their exposure to China. Despite proclamations of de-risking and 'internationalizing the supply chain', these moves don't really change the reality that products and components are still sourced from Chinese producers.

Given that it's obviously a shell-game, why isn't Trump lumping Vietnam into the anti-China trade tariffs? Here, geopolitics is the most likely reason.

There is a containment policy in place. While it's nice to talk about democracy, the major reason for US support of Taiwan is power projection: Taiwan sits at the underbelly of China. With South Korea and Japan to the East, and Taiwan and the Philippines to the South, the US and allies have China surrounded. In case war breaks out with China, a naval blockade would be very effective and complete.

Or almost complete, as Vietnam would seal the deal. Turning Vietnam into a friendly ally would plug a big hole in the shipping routes out of Hong Kong. Ships would have to thread a path between Vietnam, the Philippines and Taiwan.

In other words, it's not just negotiation, but more like foreplay... and at the moment there is a courtship underway. China is throwing billions of dollars at Vietnam. The US not so much. But Vietnam is wary of China and might want an American military presence.

Trump belligerence towards Vietnam would not create necessary goodwill. Which also means that as long as Trump plays softball with Vietnam, China will continue to bypass most if not all of the tariff threat.

More in the full note from Southbay available to pro subs.