By Peter Tchir of Academy Securities

As the 10-year Treasury trades near the low end of our current range of 4.3% to 4.5% and we digest jobs data and prepare for the Fed, it seems like a good time to revisit and restate our outlook for rates.

Before going further, it makes sense to take a look at the likely political reaction to the first Fed cut. Why? Because, I for one, believe that it will influence the timing of their cuts this year.

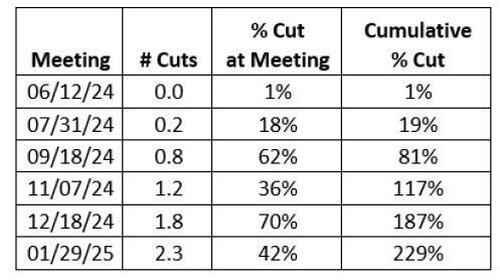

Using the WIRP function in Bloomberg, we can examine what the market is pricing in, as of Tuesday June 2nd.

The market clearly disagrees with me, as the market has September as the largest probability of a cut before December. Cumulatively the market is pricing in an 80% chance of a cut before the election.

I believe the Fed wants to cut once, as it would be a confirmation that their policies have worked. That they tightened appropriately, and slowed inflation down to the point that they can start going the other direction. They did all of that without tipping the economy into recession.

Given the long lag effects and the desire to demonstrate their successful policies, the Fed will give us a cut this year, almost regardless of what the data signals. If the data is too strong, they might not cut, but it has been equivocal at best.

So, I like a cut at the July meeting. 25 bps is my base case, with a possibility of 50 bps if the data is weak enough (which I suspect it will be on the jobs front).

I lean towards July rather than September because, while the Fed will see the same political discourse about their cut, it will be far enough away from the election to mitigate the political noise, and it is peak holiday season, making it less likely that the noise will be heard.

From there I expect another 1 to 2 cuts this year, presumably November and December.

I am basically in the 75 bps camp for this year (with either 2 or 3 cuts), starting sooner than is currently priced in.

We will get an updated Summary of Economic Projections at the June meeting.

On the dot plot front, I am looking for the median to move to 2 cuts, and to be in line with the mean that dropped in the prior release. So, I’m likely going to be fighting the dots.

Look for Powell to put July firmly on the table, which would also be fighting the dots (but he often does that).

Look for 2026 and the “longer run” (presumably the terminal rate) to inch higher. There has been enough discussion about R* in recent weeks for the Fed not to question what the appropriate level of longer-term yields should be. Similarly, there is enough debate about whether current yields are restrictive at all (not just restrictive enough) that there is likely to be an incremental move to Normal for Longer.

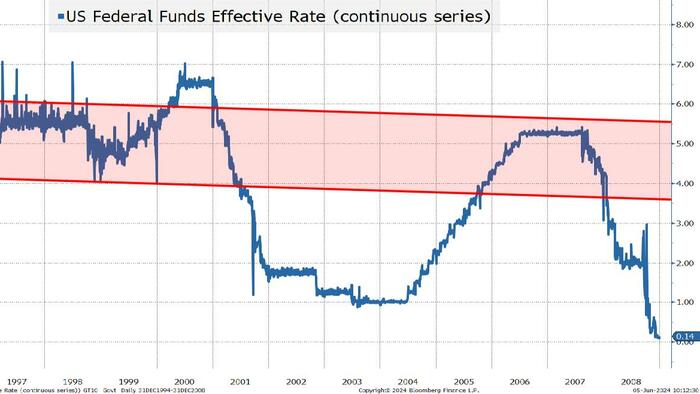

While we have lurched from financial crisis to financial crisis in the past 15 years, maybe we have lost sight of what used to be “normal”? Maybe something well above 3% is “normal”? Will the AI productivity boom not allow for growth with higher rates?

It is probably a touch early to be fixated on the terminal rate, but I think that will become a more captivating topic once the Fed makes the first cut.

I suspect as that happens, that terminal rate projections will increase AND we may finally see some “normalization” of the yield curve.

There will be pressure on yields from many sources, and in many directions. This will include data and policy that influence yields, the shape of the curve, etc. The list is huge, and probably includes things I haven’t even thought of, let alone discussed, but let’s take a stab at highlighting what seem to be the most likely influences.

Good for yields, to some degree, means “bad” for the economy.

Jobs. I have two working assumptions on the jobs data that I think point to a weaker employment situation than the market (and even the Fed) is pricing in.

The insatiable consumer. Most “perplexing” of all is how incredibly resilient the consumer has been. Is that finally changing?

There are some pretty powerful forces supporting bonds, which should help on yields.

What could push yields higher?

I believe that the negatives outweigh the positives for yields going forward.

For the coming days, up to and including the Fed meeting, my base case is that we could see lower yields. I expect the number of cuts to bump to 3 by the end of January 2025, and the timing of cuts to be pulled forward (July for the first). The 10-year could drift as low as 4.2%, but that would be a stretch and I would be preparing for higher yields as we break through 4.3%.

With one caveat, that sometime between now and year-end, the 10-year will break 5% again.

Investors should be taking advantage of the recent rally in bonds, while issuers should be issuing whatever they need as Treasury yields and credit spreads are favorable, and that outlook gets murkier the closer we get to the middle of the summer!