The elusive unicorn is no longer a myth in the U.S. startup world, with over a thousand private startups reaching a $1 billion valuation in the last 25 years.

While some of these startups eventually go public and go on to become household names, it’s also common for founders to exit through mergers and acquisitions (M&A), by selling their startup to another organization. In fact, over half of the 1,110 unicorns in the U.S. have made some sort of an exit—either through an IPO, a direct listing, a SPAC or an acquisition—since 1997.

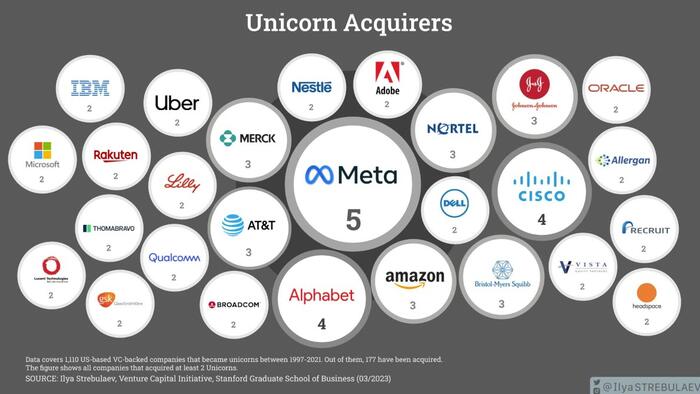

Ilya Strebulaev, professor of finance and private equity at the Stanford Graduate School of Business, brings us this visualization featuring the companies that acquired the most unicorns over the last 25 years.

Strebulaev’s database lists 137 private and public companies along with PE firms who’ve acquired at least one unicorn since 1997, totaling 177 acquisitions.

In total, 27 companies have acquired two or more unicorns, accounting for nearly 38% of all acquisitions. 110 companies have acquired just one unicorn.

Meta, the parent company of Facebook, leads the pack with the most unicorn acquisitions in the U.S., purchasing five unicorns since its founding in 2008, including: Kustomer, WhatsApp, Instagram, CTRL-Labs, and Oculus VR.

Notably, WhatsApp—which closed at a purchase price of $19 billion—was Meta’s most expensive acquisition yet, over nine times their next most expensive purchase, Oculus VR.

Meanwhile, Alphabet (now the parent company of Google) and Cisco are tied in second place with four U.S. unicorn acquisitions each.

Unlike its Big Tech peers, Apple has only made the one U.S. unicorn acquisition: navigation company HopStop that helped bring public transit features to Apple Maps.

Meanwhile, 56% of acquirers received venture capital funding of their own when they were private companies. This includes pack leaders like Meta, Cisco, Alphabet, and Amazon.

Unicorn acquisitions are driven by two factors: the rate at which new unicorns are minted, and the climate for M&A transactions more broadly.

To begin with, the minting of new unicorns is largely influenced by the venture funding environment. Funding opportunities increase when interest rates go down, which makes riskier, venture-scale ideas more enticing. During the last decade of persistently low interest rates up until 2022, unicorns flourished more than ever.

Meanwhile, as tech companies like Apple, Microsoft, Alphabet, and Meta began seeing outsized profits in the 2010s, venture investors and their LPs looked to get in on the ground floor of tech startups that could emulate their success, often paying premium valuations for the chance. Simultaneously, big tech looked to acquire unicorns themselves, both to augment their business lines and to squash potential competitors.

However, the era of “easy money” may have come to an end, and privately-held startups have seen valuations drop in recent years. This means that for the next little while—at least until monetary policy stops tightening—unicorns could become a rarer sight.

Unicorn acquisitions may also see a similar fate. Persistent inflation and the government anti-trust push are just some of the other factors that have led to VC-backed startup acquisitions falling to their lowest quarterly levels in a decade. The more expensive the valuation, the harder to find a buyer, which means that some unicorns may even lose their $1 billion tag even when they do get acquired.