What is the risk of investing in another country?

Given the rapid growth of emerging economies, and the opportunities this may present to investors, it raises the question: does investment exposure abroad come with risk, and how can that risk be analyzed?

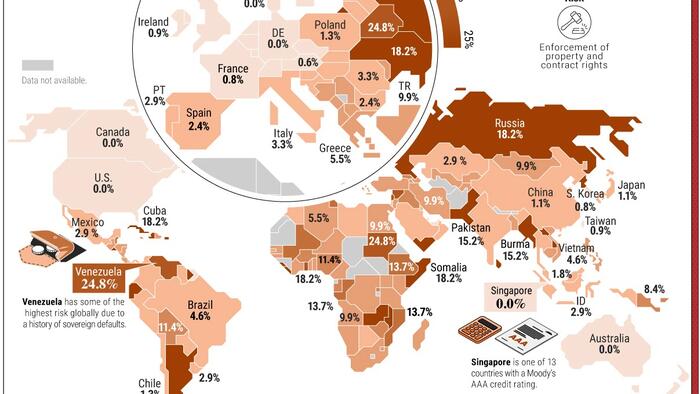

To help answer this question, Visual Capitalist's Dorothy Neufeld and Sam Parker created the following graphic to show country risk around the world, based on analysis from Aswath Damodaran at New York University’s Stern School of Business.

For many reasons, there are variations in risk across different countries. These can be influenced by geopolitical factors, such as political risk, whether they are in a stage of early growth, or have stable property rights.

To get a clearer picture of country risk, Damodaran analyzed the following broad factors:

In addition, a nation’s default risk was analyzed, which is a common measure used in financial markets. When a nation defaults on its debt, it often leads to market turbulence, and other negative effects that can last for many years.

Together, these factors, along with others, estimate a country risk premium, which is the extra risk in a given market. The U.S. served as baseline for measuring the extra risk of each country.

Below, we show country risk around the world, from highest to lowest risk as of July, 2023:

| Country | Country Risk Premium |

|---|

| ???????? Belarus | 24.8% |

| ???????? Lebanon | 24.8% |

| ???????? Venezuela | 24.8% |

| ???????? Sudan | 24.8% |

| ???????? Syria | 24.8% |

| ???????? Argentina | 18.2% |

| ???????? Cuba | 18.2% |

| ???????? Ghana | 18.2% |

| ???????? Russia | 18.2% |

| ???????? Sri Lanka | 18.2% |

| ???????? Ukraine | 18.2% |

| ???????? Zambia | 18.2% |

| ???????? Haiti | 18.2% |

| ???????? North Korea | 18.2% |

| ???????? Malawi | 18.2% |

| ???????? Sierra Leone | 18.2% |

| ???????? Somalia | 18.2% |

| ???????? Ecuador | 15.2% |

| ???????? El Salvador | 15.2% |

| ???????? Laos | 15.2% |

| ???????? Pakistan | 15.2% |

| ???????? Suriname | 15.2% |

| ???????? Liberia | 15.2% |

| ???????? Myanmar | 15.2% |

| ???????? Yemen | 15.2% |

| ???????? Belize | 13.7% |

| ???????? Congo (Republic of) | 13.7% |

| ???????? Ethiopia | 13.7% |

| ???????? Mali | 13.7% |

| ???????? Mozambique | 13.7% |

| ???????? Tunisia | 13.7% |

| ???????? Guinea | 13.7% |

| ???????? Barbados | 11.4% |

| ???????? Bolivia | 11.4% |

| ???????? Burkina Faso | 11.4% |

| ???????? Gabon | 11.4% |

| ???????? Iraq | 11.4% |

| ???????? Maldives | 11.4% |

| ???????? Nigeria | 11.4% |

| ???????? Solomon Islands | 11.4% |

| ???????? Zimbabwe | 11.4% |

| ???????? Angola | 9.9% |

| ???????? Bosnia and Herzegovina | 9.9% |

| ???????? Cape Verde | 9.9% |

| ???????? Congo (Democratic Republic of) | 9.9% |

| ???????? Egypt | 9.9% |

| ???????? Kenya | 9.9% |

| ???????? Kyrgyzstan | 9.9% |

| ???????? Moldova | 9.9% |

| ???????? Mongolia | 9.9% |

| ???????? Nicaragua | 9.9% |

| ???????? Niger | 9.9% |

| ???????? St. Vincent & the Grenadines | 9.9% |

| ???????? Swaziland | 9.9% |

| ???????? Tajikistan | 9.9% |

| ???????? Togo | 9.9% |

| ???????? Turkey | 9.9% |

| ???????? Iran | 9.9% |

| ???????? Madagascar | 9.9% |

| ???????? Bahrain | 8.4% |

| ???????? Cambodia | 8.4% |

| ???????? Cameroon | 8.4% |

| ???????? Cook Islands | 8.4% |

| ???????? Costa Rica | 8.4% |

| ???????? Jamaica | 8.4% |

| ???????? Papua New Guinea | 8.4% |

| ???????? Rwanda | 8.4% |

| ???????? Tanzania | 8.4% |

| ???????? Uganda | 8.4% |

| ???????? Gambia | 8.4% |

| ???????? Guinea-Bissau | 8.4% |

| ???????? Albania | 6.8% |

| ???????? Bahamas | 6.8% |

| ???????? Bangladesh | 6.8% |

| ???????? Benin | 6.8% |

| ???????? Fiji | 6.8% |

| ???????? Honduras | 6.8% |

| ???????? Jordan | 6.8% |

| ???????? Montenegro | 6.8% |

| ???????? Namibia | 6.8% |

| ???????? Armenia | 5.5% |

| ???????? Côte d'Ivoire | 5.5% |

| ???????? Dominican Republic | 5.5% |

| ???????? Greece | 5.5% |

| ???????? Macedonia | 5.5% |

| ???????? Senegal | 5.5% |

| ???????? Uzbekistan | 5.5% |

| ???????? Algeria | 5.5% |

| ???????? Brazil | 4.6% |

| ???????? Georgia | 4.6% |

| ???????? Oman | 4.6% |

| ???????? Serbia | 4.6% |

| ???????? South Africa | 4.6% |

| ???????? St. Maarten | 4.6% |

| ???????? Trinidad and Tobago | 4.6% |

| ???????? Vietnam | 4.6% |

| ???????? Azerbaijan | 3.8% |

| ???????? Cyprus | 3.8% |

| ???????? Guatemala | 3.8% |

| ???????? Morocco | 3.8% |

| ???????? Paraguay | 3.8% |

| ???????? Sharjah | 3.8% |

| ???????? India | 3.3% |

| ???????? Italy | 3.3% |

| ???????? Mauritius | 3.3% |

| ???????? Montserrat | 3.3% |

| ???????? Romania | 3.3% |

| ???????? Andorra | 2.9% |

| ???????? Aruba | 2.9% |

| ???????? Colombia | 2.9% |

| ???????? Croatia | 2.9% |

| ???????? Curacao | 2.9% |

| ???????? Hungary | 2.9% |

| ???????? Indonesia | 2.9% |

| ???????? Kazakhstan | 2.9% |

| ???????? Mexico | 2.9% |

| ???????? Panama | 2.9% |

| ???????? Philippines | 2.9% |

| ???????? Portugal | 2.9% |

| ???????? Uruguay | 2.9% |

| ???????? Libya | 2.9% |

| ???????? Bulgaria | 2.4% |

| ???????? Peru | 2.4% |

| ???????? Spain | 2.4% |

| ???????? Thailand | 2.4% |

| ???????? Turks and Caicos | 2.4% |

| ???????? Guyana | 2.4% |

| ???????? Botswana | 1.8% |

| ???????? Latvia | 1.8% |

| ???????? Malaysia | 1.8% |

| ???????? Slovenia | 1.8% |

| ???????? Bermuda | 1.3% |

| ???????? Chile | 1.3% |

| ???????? Iceland | 1.3% |

| ???????? Lithuania | 1.3% |

| ???????? Malta | 1.3% |

| ???????? Poland | 1.3% |

| ???????? Slovakia | 1.3% |

| ???????? China | 1.1% |

| ???????? Estonia | 1.1% |

| ???????? Israel | 1.1% |

| ???????? Japan | 1.1% |

| ???????? Kuwait | 1.1% |

| ???????? Saudi Arabia | 1.1% |

| ???????? Belgium | 0.9% |

| ???????? Cayman Islands | 0.9% |

| ???????? Czech Republic | 0.9% |

| ???????? Hong Kong | 0.9% |

| ???????? Ireland | 0.9% |

| ???????? Isle of Man | 0.9% |

| ???????? Jersey | 0.9% |

| ???????? Macao | 0.9% |

| ???????? Qatar | 0.9% |

| ???????? Taiwan | 0.9% |

| ???????? UK | 0.9% |

| ???????? Brunei | 0.9% |

| ???????? Abu Dhabi | 0.8% |

| ???????? France | 0.8% |

| ???????? Guernsey | 0.8% |

| ???????? Korea | 0.8% |

| ???????? U.A.E. | 0.8% |

| ???????? Austria | 0.6% |

| ???????? Finland | 0.6% |

| ???????? Australia | 0.0% |

| ???????? Canada | 0.0% |

| ???????? Denmark | 0.0% |

| ???????? Germany | 0.0% |

| ???????? Liechtenstein | 0.0% |

| ???????? Luxembourg | 0.0% |

| ???????? Netherlands | 0.0% |

| ???????? New Zealand | 0.0% |

| ???????? Norway | 0.0% |

| ???????? Singapore | 0.0% |

| ???????? Sweden | 0.0% |

| ???????? Switzerland | 0.0% |

| ???????? U.S. | 0.0% |

| | |

As the table above shows, five countries share the highest risk: Belarus, Lebanon, Venezuela, Sudan, and Syria. In Belarus, Russian military forces continue to operate. Venezuela has faced hyperinflation and endemic corruption for many years.

On the other hand, 13 countries had the lowest risk, including several European nations, Singapore, and New Zealand. This is due to factors such as their AAA-rated government bonds, low corruption, and strong property right protections.

The growth of emerging economies presents opportunities for investors, shaped by demographic influences, rising GDP, and technological advancements seen globally.

Adding to this, diversification across sectors, assets, and geographies may stand to benefit investors more generally.

With this in mind, investments in other countries are exposed to country risks that go beyond, but ultimately influence the long-term performance of stocks, bonds, and other financial assets. Considering these factors, the reward of investing in international companies may come with macroeconomic and country-specific risks.