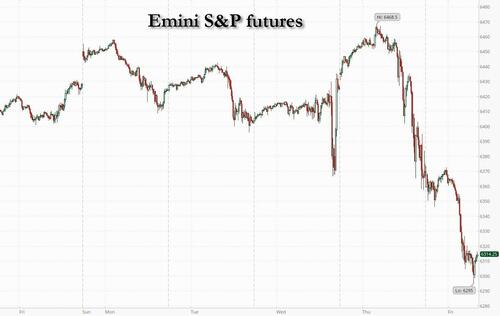

Global markets and US equity futures extended a selloff as Trump’s sweeping import tariffs sparked renewed fears about the outlook for economic growth amid traders. The MSCI All Country World Index fell for a sixth day, the longest streak since September 2023. As of 8:00am ET, S&P futures on the S&P 500 retreated more than 1%, suggesting the index will extend a three-day run of declines. In premarket trading, Amazon.com slumped as much as 8%

and weighed on Big Tech after projecting weaker-than-expected operating income, prompting questions about its huge AI spending; Elsewhere AAPL (+1.7%) rallied on iPhone sales growth including while other Mag 7 names are mostly lower NVDA (-.25%), GOOG/L (-2.2%) and META (-1.3%) as Consumer Discretionary and Healthcare underperform. In rates, 30y TSYs added 3.2bps. Commodities are mixed, with precious metals higher and base metals lower. Today's economic data slate includes July jobs report (8:30am), July final S&P Global US manufacturing PMI (9:45am), and July ISM manufacturing and July final University of Michigan sentiment (10am)

In premarket trading, Mag 7 stocks are mostly lower: Amazon.com slides 7% after projecting weaker-than-expected operating income and trailing the sales growth of its cloud rivals, leaving investors searching for signs that the company’s huge investments in artificial intelligence are paying off. Apple rises 1.8% after the company reported its fastest quarterly revenue growth in more than three years, easily topping Wall Street estimates, after demand picked up for the iPhone and products in China. Others are mostly in the red (Microsoft +0.5%, Meta -1%, Tesla -1.2%, Alphabet -1.8%, Nvidia -2%).

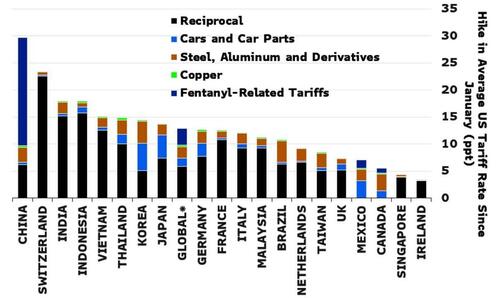

Late on Thursday, Trump announced a slew of new levies, including a 10% global minimum and 15% or higher duties for countries with trade surpluses with America, as he forged ahead with his turbulent effort to reshape international commerce. Questions about the impact on growth and inflation are starting to overshadow the AI-driven optimism that has buoyed megacap technology stocks.

“Next week marks a significant turning point for global trade with the introduction of Trump’s tariffs, creating uncertainty about how these new and historical barriers will affect markets in practice,” said Kim Heuacker, an associate consultant at Camarco. “Current high valuations, particularly among US stocks, are becoming increasingly difficult to justify.”

Trump’s baseline rates for many trading partners remain unchanged at 10% from the duties he imposed in April, easing the worst fears of investors after the president had previously said they could double. Yet, his move to raise tariffs on some Canadian goods to 35% threatens to inject fresh tensions into an already strained relationship.

Taken together, the average new tariff rate rises to 15.2% from 13.3% — up significantly from 2.3% in 2024, according to Bloomberg Economics. The biggest losers appear to be China and Switzerland, Bloomberg economist Maeva Cousin says.

Now that tariff news is in the bag, all eyes turn to today's jobs report: the US economy is expected to have created 104,000 jobs in July, down from 147,000 a month earlier. The “whisper” is for 120,000. According to JPMorgan, either would be good enough to take the S&P 500 higher (see our full preview here). Today's closely-watched jobs report may give fresh hope to doves looking to make the case for the Fed to cut interest rates. There are fewer company updates to distract from payrolls, but a slew of new tariffs is dampening the mood.

“Given all the uncertainties, it makes a lot of sense for traders, for dealers to take some money off the table going into nonfarm payrolls today,” said Gareth Nicholson, CIO of Nomura International Wealth Management.

The Euro Stoxx 600 falls 1.2% to around a one-month low, tracking declines in Asia with pharmaceutical stocks including Novo Nordisk A/S, GSK Plc and AstraZeneca Plc leading declines after Trump demanded drug companies lower US prices. Travel, industrial and technology shares are also leading declines. The tariffs are “really bad for Europe,” said Ludovic Subran, chief investment officer at Allianz SE. “The cost for companies will be huge, as the US is the biggest market by far.” These are the biggest movers Friday:

Earlier in the session, Asian stocks were set to record their biggest weekly decline since April as Washington’s tariffs damped the outlook for the export-dependent region. The MSCI Asia Pacific Index dropped as much as 1% on Friday, with South Korean equities leading declines after authorities unveiled plans to raise taxes on corporations and investors. Tech shares weighed on the regional gauge as Tokyo Electron dropped the most in nearly a year following a move by the chip tool maker to lower its full-year earnings outlook. The retreat in the Asian index marks a reversal of the back-to-back weekly gains that helped propel it to the highest level since March 2021. Investors are watching the parameters and impact of trade deals, as well as factors such as central bank policy direction to plot their next move.

In FX, the Bloomberg Dollar Spot Index rises 0.2%, trading at the highest in two months after Trump fired his latest salvo at the Federal Reserve, saying in a social-media post the institution’s board should “assume control” if Chair Jerome Powell doesn’t lower interest rates. Traders are also bracing for key US jobs data later Friday. The Swiss franc is among the weakest G-10 currencies, falling 0.5% against the greenback after Switzerland was hit with a 39% levy by Trump. The yen outperforms, rising 0.2% after some modest jawboning from the Japanese Finance Minister.

In rates, treasuries are mixed, with outperformance at the short-end pushing 2-year yields down 2 bps. Gilts lead a selloff in European government bonds, with UK 10-year yields rising 5 bps.

In commodities, WTI crude futures fall 0.7% to $68.80 a barrel. Gold rises $5. Bitcoin falls 1%. Bitcoin is on the backfoot, and trades back below the USD 115k mark - downside which is in-fitting with the broader risk tone.

Looking at today's US economic data calendar we get the July jobs report (8:30am), July final S&P Global US manufacturing PMI (9:45am), and July ISM manufacturing and July final University of Michigan sentiment (10am). Fed speaker slate includes Hammack (9:10am) and Bostic (10:30am)

Market Snapshot

Top Overnight News

Earnings

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly subdued following the weak handover from US peers and as participants digested the latest Trump tariff adjustments ahead of the deadline and with the key US Non-Farm Payrolls report on the horizon. ASX 200 was pressured with underperformance in tech, healthcare and financials leading the declines in most sectors as sentiment is dampened amid trade uncertainty. Nikkei 225 slumped at the open but was well off today's worst levels with a rebound facilitated by recent currency weakness. Hang Seng and Shanghai Comp were lacklustre mood following the latest S&P Global China General Manufacturing PMI (formerly sponsored by Caixin) which missed forecasts and surprisingly returned to contractionary territory. US equity futures lacked demand after declining on Thursday and with little impact seen following the mixed fortunes in the likes of Apple and Amazon post-earnings.

Top Asian News

European bourses (STOXX 600 -1.3%) opened entirely in the red, and has continued to trundle lower as the August 1st tariff deadline passed. US President Trump announced new rates on 92 countries, which brought the average US tariff rate to 15.2% (prev. 13.3%, prev. 2.3% pre-Trump). European sectors are entirely in the red, in-fitting with the risk tone. Media is found right at the bottom of the sectoral list, pressured by post-earning losses in UMG (-6.3%); the Co. lowered its earnings forecast and highlighted rising content costs. Tech is also on the backfoot, as the sector cools from recent upside and as the risk-tone weighs.

Top European News

FX

Fixed Income

Commodities

Geopolitics

d

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Welcome to August, which begins with the deadline now having been passed for tariff deals to be concluded with the United States. Much of the rhetoric and the negotiation are now behind us and we'll now see how the rubber hits the road. The US tariff rate has risen to about 15% from a little over 2% at the start of the year. That’s their highest level since the 1930s but that has not prevented US equities from being near their all-time highs and other markets being much stronger this year.

With just a few hours to go before the August 1 deadline, last night President Trump signed an executive order outlining a new set of tariffs, including a 10% global minimum and duties of 15% or higher for countries with trade surpluses with the US. Some of the higher rates that had not previously been confirmed included 39% on Switzerland and 20% on Taiwan. The tariffs are due to take effect after August 7 which, while being a delay for technical implementation, could leave open the possibility of more countries agreeing deals in the next week. Trump also announced that tariffs on Canadian goods would rise from 25% to 35% immediately (though goods compliant with the United States-Mexico-Canada Agreement would remain exempt which reduces the impact). So, Canada is being singled out to a degree.

Earlier in the day, following a meeting with Mexican President Claudia Sheinbaum, President Trump announced a 90-day extension in trade negotiations between the US and Mexico. During this period, Mexico will continue to pay a 25% tariff on non-USMCA compliant goods and cars as well as 50% on steel and aluminium. In exchange, Mexico has agreed to immediately eliminate its non-tariff trade barriers.

Meanwhile, the US Court of Appeals began hearing arguments yesterday regarding Trump’s use of tariffs, with a ruling expected “within weeks,” according to Bloomberg. The first hearing yesterday saw some sharp questions from judges on the administration’s use of International Emergency Economic Powers Act to set broad tariffs. Ahead of the hearing, Trump posted on Truth Social, warning that if the US cannot defend itself using “tariffs against tariffs,” the country would be “dead, with no chance of survival or success.”

Equity markets have seen contrasting themes over the last 24 hours as a resurgence of US “tech-ceptionalism” was offset by a broader loss of momentum.” The Mag-7 gained +1.39% to a new record high, buoyed by impressive earnings from Microsoft (+3.95%) and Meta (+11.25%), whose valuations continued to climb. Microsoft posted its largest daily gain since early May and briefly surpassed a $4 trillion market capitalisation, placing it just behind Nvidia as the world’s second-largest company.

However, the broader equity mood turned more cautious as the US session went on, with the S&P 500 retreating from its early peak of +1.01% just after the open to close -0.37% lower. And the small-cap Russell 2000 fell by -0.93%, moving back into the red YTD. While month-end effects may have played a role in this softening, there were also specific headwinds. Healthcare stocks (-2.79%) were the laggards in the S&P after Trump sent letters to 17 of the largest pharma companies, demanding they charge the US the same as other countries for new medicines and giving the companies 60 days to voluntarily comply. The Philadelphia Semiconductor index slid -3.10% after underwhelming results from Qualcomm (-7.73%) and ARM Holdings (-13.44%).

After the US close, we saw mixed results from Apple and Amazon. Apple’s shares gained around 2% after-hours following a strong revenue beat ($94bn vs $89.3bn est.) amid the strongest sales growth in more than three years which CEO Tim Cook ascribed to an acceleration across many markets including China. On the other hand, Amazon lost ground as it projected weaker-than-expected Q3 operating profits ($15.5-$20.5bn vs 19.4bs est.) and saw weaker cloud growth than rivals. Against this background, US futures are indicating a negative start with those on the S&P 500 (-0.15%) and NASDAQ 100 (-0.20%) edging lower.

On the data front, June’s US core PCE—the Fed’s preferred inflation gauge—rose by +0.3% month-on-month, in line with expectations. However, the year-on-year rate came in a tenth above forecast, which was hinted at by revisions in Wednesday’s GDP report. This will not go unnoticed by the Fed, especially as it exceeds the level targeted by Governor Waller, one of the two dissenters arguing for a cut at the FOMC this week. Initial jobless claims leaned hawkish, coming in at 218k versus 224k, while continuing claims were -7k below forecast at 1946k. The Employment Cost Index (ECI) for Q2 also surprised to the upside at +0.9%, a tenth above expectations. These figures are likely to draw more attention from the Fed than the personal spending data, which came in a tenth below expectations at +0.3% for June. The generally solid data saw pricing of Fed cuts by year-end decline by another -3.4bps to only 33bps. 2yr Treasury yields rose +1.5bps, while 10yr yields (+0.4bps) were steady.

Staying with data, today brings the latest US payrolls number. Our US economists expect headline payrolls to slow to +75k in July (from +147K in June) amid payback from a likely seasonal June spike in education employment, and private payrolls to gain +100k (previously +74K in June), with the unemployment rate edging up to 4.2%. You can sign up for their post-employment call to discuss the data and the impact on the Fed outlook here.

While the data supported Chair Powell’s cautious stance, Trump launched one of his most pointed attacks yet on the Fed Chair, accusing him of “costing our country trillions of dollars” and being “too political to have the job.” Treasury Secretary Scott Bessent made some more softly critical remarks on CNBC, suggesting it would be “highly unusual” for Powell to remain on the Fed Board after his term ends next May. He added that the White House would begin interviewing candidates for the Fed, with a nomination announcement expected “by year-end.”

In the euro area, 10-year yields fell by 1-2bps across the board, while 2-year yields edged up slightly. Inflation data from France, Italy, and Germany was mixed. Italy’s CPI surprised slightly to the upside at +1.7% year-on-year (vs. +1.6% expected), driven by a rise in food inflation (3.9% vs. 3.3%). Germany’s July CPI, however, came in slightly below expectations at +1.8% (vs. +1.9%). Following the country releases, our European economists see this morning’s euro area headline inflation release tracking for a low +2.0% reading (consensus +1.9%) with core HICP set to hold steady at +2.3%.

European equities were more subdued ahead of the US tariff hike. The STOXX 600 fell by -0.75%, with wine and spirits companies particularly affected due to the anticipated 15% tariff on those products. A European Commission spokesperson confirmed that the EU is still negotiating for an exemption on alcoholic beverages. The CAC 40 dropped -1.14%, the DAX -0.81%, while the FTSE 100 outperformed slightly, down just -0.05%, supported by strong earnings from Rolls Royce (+8.50%).

Asian equity markets, along with US futures, are experiencing a decline this morning following the imposition of new tariffs by the US on numerous trading partners. The KOSPI (-3.23%) stands out as the largest underperformer, trading sharply lower in response to the new Finance Ministry’s proposal to increase capital gains tax (more details below). Meanwhile, Chinese stocks are relatively stable, with the Hang Seng (-0.18%), the CSI (-0.16%), and the Shanghai Composite (-0.12%) all registering minor losses after experiencing significant declines in the previous session. Additionally, the Nikkei (-0.38%) and the S&P/ASX 200 (-0.75%) are also declining in unison with their regional counterparts.

Returning to South Korea, the new government has announced an increase in the corporate tax rate from 24% to 25%, with all corporate tax brackets rising by one percentage point. Furthermore, the stock transaction tax will be raised from 0.15% to 2%. The threshold for capital gains tax on stock holdings will be reduced to 1 billion won from the current 5 billion won. These measures are intended to recover public revenue lost during two years of slowing growth and tax reductions implemented by the previous administration. As you can imagine the proposals are not proving popular amongst market participants.

Early morning data revealed that China’s manufacturing sector unexpectedly contracted in July, as a decline in export orders and weak domestic demand took their toll. The S&P Global China Manufacturing PMI dropped to 49.5 in July (compared to +50.2 expected), down from 50.4 in June. In other news, Japan’s jobless rate remained unchanged in June at 2.5%, while the jobs-to-applicants ratio fell to 1.22 (versus +1.25 expected) from 1.24 in May.

Looking ahead, today’s US data releases include the July jobs report, the ISM index, total vehicle sales, and June construction spending. We’ll also see Italy’s July manufacturing PMI, the Eurozone’s July PMI, and Canada’s July manufacturing PMI. On the earnings front, reports are expected from Exxon Mobil, Chevron, Moderna, Nintendo, and AXA.