By Peter Tchir of Academy Securities (full pdf available here)

Just last weekend, we discussed Confusion versus Uncertainty. We have a long list of potential market moving-events, many of which might be at pivotal moments.

I still like rates. Friday’s move could have pushed the Fed’s second cut out to next year, while, for me, the jobs data solidified the chance of a July cut, with 3 to 4 for the year. 10s back to 4.5% is a buying opportunity, though a range of 4.2% to 4.6% seems about right. A bit of a wide range, but the volatility around so many of the topics listed above, especially the bill, still needs to be considered.

Credit boring. Crypto exciting.

Credit, which I think I understand, should do okay here. So far the calendar hasn’t slowed much, but credit has held in very well. Across the globe, anyone looking for corporate credit risk needs to come to the U.S. as the market is the only place big enough to offer diversification across industries, ratings, and maturities. Also, the companies issuing corporate debt are often global in nature, so the exposure isn’t confined to the U.S.

On Crypto, I don’t understand the rush for governments to get involved, but it seems that is the trajectory we are on. So long as corporations can add crypto to their balance sheets and see their stock valuations rise more than the amount of crypto they bought, I can understand why they would do that. However, I cannot understand that relationship, which is driving the process. I do understand anxiety around FX globally and deficits globally, but I’m still not sure how that translates into owing crypto – but certainly I am more tempted to jump back on the bandwagon than fight it here.

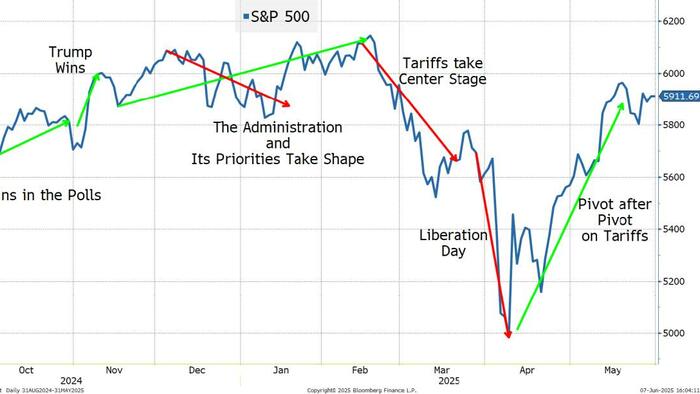

Equities. Maybe not “priced to perfection” but getting close. When we examine the list of risks, uncertainties, or even things to be confused about, the market seems positioned to the optimistic side. That could be proven correct, but the risk/reward has definitely shifted with the recent legs of this rally (China, chips, and deficit spending). The IPO market is wide open and that could be a big benefit not just to markets, but also for the economy as new and innovative companies are brought to the forefront of daily market headlines!

It has been great being on the road a lot (on the road again this week) and talking to so many of our clients, colleagues, and members of the Geopolitical Intelligence Group.

Today, I just wanted to conclude by thanking all of those who take time out of their hectic schedules to meet with, talk to, or even just respond to Academy Securities as it helps us grow and get better!

If we go back to today’s question “Where are We Now?” the answer is at some pivotal moments for some major drivers to kick into gear, or stumble, as they near the goal line.