During the Memorial Day holiday break, food inflation was certainly on the minds of those who had to purchase beef patties and other BBQ-related items for outdoor parties. The Biden administration has deflected rampant food inflation on 'greedy' corporations, but more likely due to supply constraints. Beef and egg prices are climbing, and staples like orange juice, cocoa beans, and coffee are skyrocketing. Now, the latest soft commodity that is pushing higher is wheat.

Bad weather across the world's top growing regions, including the driest May in Ukrainian records, lack of rainfall in Western Australia, and unseasonably cold weather in Russia, has sent wheat futures in Chicago to a nine-month high.

Here are the top growing regions experiencing adverse weather conditions (courtesy of Bloomberg):

Wheat futures jumped 3.3% in early Asian trading but have since trended lower in Europe and the US. Prices are up about 2% around 0730 ET.

Bumper Black Sea harvests have capped prices in the last 1.5 years, but supply concerns are mounting as top growing regions, as noted above, are hit with adverse weather conditions, denting harvest forecasts. This led analysts to survey ahead of the US government's wheat forecast to project the smallest global stockpiles in nearly a decade.

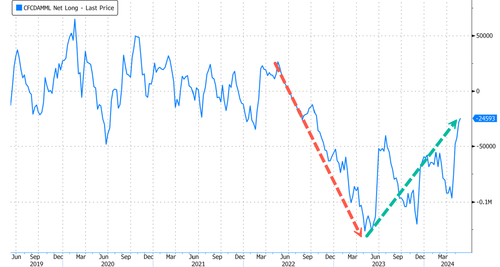

The dismal projection comes as hedge funds have been cutting back net bearish bets in Chicago.

Ole Houe, chief executive officer at broker and adviser IKON Commodities, told Bloomberg that the rally has been fueled by farmers holding onto stockpiles for higher prices: "Growers have all the power, and they are wielding it mercilessly."

Looking at broader food indexes, especially the UN World Food Index, prices have increased marginally in recent months.

Meanwhile, spot commodity prices tracked by Bloomberg recently surged to levels not seen in 1.5 years.

Rising commodity prices have sparked a sense of nervousness in the Biden team ahead of the presidential elections.