Authored by Lawrence Wilson via The Epoch Times (emphasis ours),

Prescription drugs provide relief from pain, fight infection, stabilize moods, reduce inflammation, combat dread diseases, and extend lives.

These medications have become a fact of life for many—perhaps most—Americans. On average, half of them took at least one prescription drug in a given month, according to a recent CDC survey. More than 13 percent took five or more.

And the rate is growing.

In 2020 Americans filled 6.4 billion prescriptions, about 19 per person.

By 2023, Americans were consuming more than 210 billion daily doses of medication annually. That’s more than 600 pills, shots, drops, IVs, creams, mists, or suppositories for every person in the country.

A child born in 2019 in the United States can expect to spend roughly half of his or her life taking prescription medications, according to Jessica Y. Ho, a researcher at Pennsylvania State University.

The United States consumes more prescription drugs than any country in the world and spends nearly twice as much for them as all other nations combined.

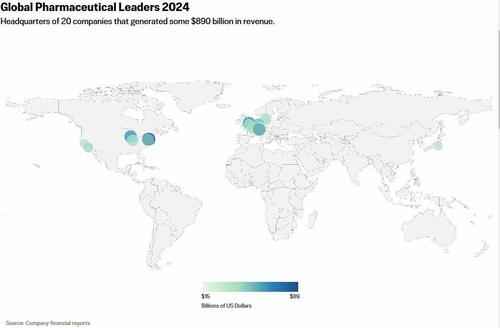

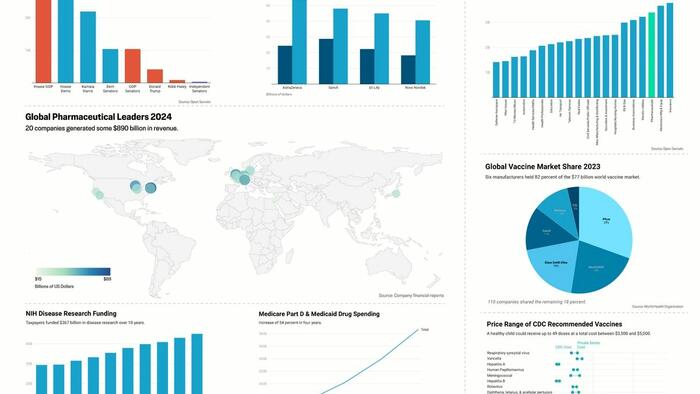

Global pharmaceutical sales were estimated at $1.6 trillion in 2023, according to Statista. That’s roughly equal to the gross domestic product of Spain and nearly double that of Switzerland.

The ten largest pharmaceutical companies in the United States alone have a combined worth of more than $2.1 trillion.

Recent growth in the industry has been driven by the creation of new types of medications including biologics and peptides. These medications can be highly effective but also very expensive.

Biologics are drugs derived from living sources rather than chemicals. Medicare paid nearly $66,000 per patient for prescriptions of Humira in 2023. That’s a biologic medication to treat rheumatoid arthritis, plaque psoriasis, and other diseases.

Development of biologics has more than tripled over the last decade. The Food and Drug Administration (FDA) approved 17 biologics in 2023, up from an average of 4 per year between 1999 and 2013.

Americans consumed 72 percent of the top 50 biologic drugs sold in the world in 2022, according to the Department of Health and Human Services.

Peptides are drugs that mimic the function of certain substances within the human body.

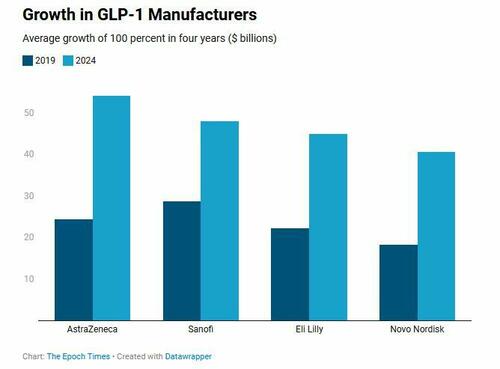

A particular type of peptide called GLP-1 helps regulate blood sugar and appetite. Ozempic, Weygovy, and Trulicity are GLP-1 medications.

Medicare Part D alone paid more than $22 billion to provide GLP-1 medications in 2023, an increase of nearly 130 percent in two years.

Currently, the GLP-1 market is dominated by Novo Nordisk, Eli Lilly, AstraZeneca, and Sanofi, though others are working to develop similar medications.

U.S. drug prices were more than double those in other countries as of 2022, and more than 4 times as much for brand-name drugs, according to global consulting firm RAND.

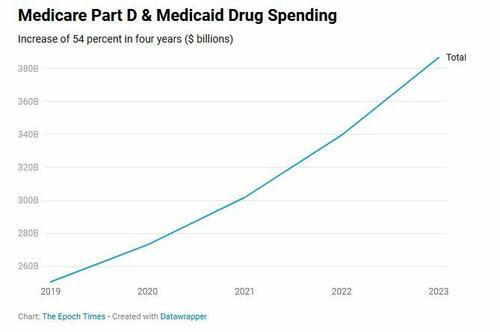

Pharmaceutical companies do considerable business with the federal government, deriving $387 billion in payments from Medicare Part D and Medicaid in 2023 alone.

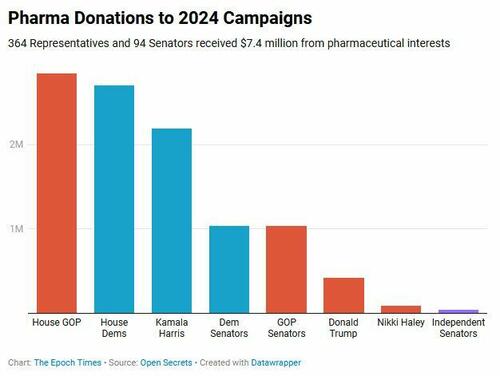

Pharmaceutical companies and some 100 allied political action committees spent more than $15 million in campaign contributions during each of the last two presidential elections, and nearly as much during the mid-terms.

Those amounts are overshadowed by the pharmaceutical industry’s annual lobbying expenditures. The industry spent more than $150 million to influence federal and state legislatures in 2024. Of its more than 700 lobbyists, nearly two thirds were former government employees.

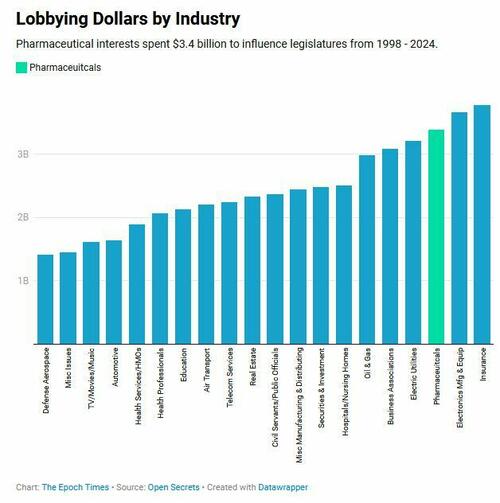

The pharmaceutical lobby spent more money over the past quarter century than did electric utilities, oil and gas companies, hospitals and nursing homes—more than the automotive and defense aerospace industries combined.

Developing new medications is expensive. The average cost of bringing a new drug market can range up to $2 billion, according to data cited by the Congressional Budget Office.

Congress aided companies investing in research via the One Big Beautiful Bill Act, which includes a provision for makers of drugs that treat rare diseases. The law widens the definition of a rare disease drug and further delays Medicare price negotiations on drugs that treat them.

That allows the makers of those drugs to continue charging Medicare full price for the medications, in order to fund future research.

Normally, a drug that has been marketed for at least 9 years and receives $200 million per year in Medicare payments would be eligible for price negotiation.

Read the rest here...