It's not just a very busy week for markets and economic releases: it is also a busy week is on tap for policy events. Fed Chairman Powell will testify before Congress regarding monetary policy but is likely to face numerous questions on economic policy as well as financial regulation.

Also, as Stifel's Chief Washington Policy strategist Brian Gardner notes, financial regulators will speak publicly this week on digital assets. Elsewhere, the White House will release President Biden’s FY2024 budget on Thursday. Investors should discount headlines following the budget’s release. Presidents’ budgets are typically DOA and this one is likely to be no different. Lastly, President Biden indicated that he will sign legislation to block changes to Washington DC’s criminal code. This provides a clue regarding future prospects for action on China tariffs.

Below we look at these in sequence:

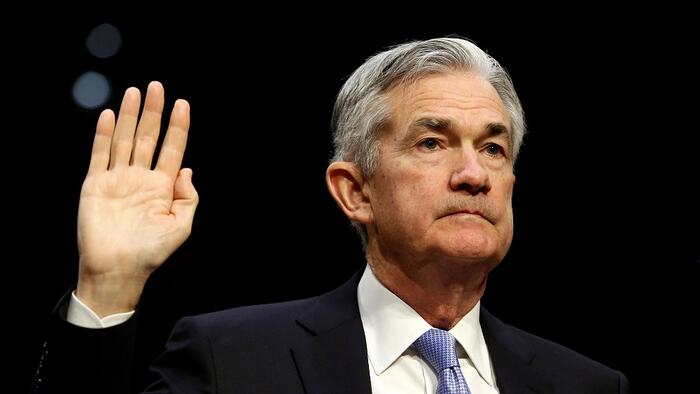

Powell on Capitol Hill

Federal Reserve Chairman Jerome Powell will testify before Congress twice this week. First, Powell will appear before the Senate Banking Committee on Tuesday and before the House Financial Services Committee on Wednesday. While the stated purpose of his appearances is to deliver the Fed’s semi-annual monetary policy report, numerous questions will be asked about bank regulatory issues.

In her preview, Bloomberg chief economist Anna Wong says she expects Powell to signal the Fed is ready to push rates higher than December’s dot plot indicated if inflation prints continue to exceed expectations, underscoring the FOMC’s resolve to get inflation under control. At the same time, he’ll acknowledge that the Fed’s dual mandate includes full employment, and that he retains hopes of achieving a soft landing for the economy.

Here is what else Bloomberg expects:

Stifel's Gardner adds several secondary things to keep an eye for:

Besides Powell's testimony, there will be several other political events to keep an eye on:

Crypto Events

In addition to Chairman Powell’s appearance on Capitol Hill, which will probably include Q&A on cryptocurrencies, several other regulators will speak in public this week on digital assets.

Biden Budget

On Thursday, the White House will release President Biden’s FY2024 budget. As a reminder to investors, budgets are loaded with policy proposals, most of which will never see the light of day. This budget will likely be no different.

The President’s State of the Union address previewed several tax proposals that are likely to be included in the budget including taxes on unrealized capital gains and an increase in the stock buyback tax. The proposal to tax unrealized capital gains will be DOA. Although an increasing number of Republicans have criticized the use to stock buybacks, GOP critics of buybacks are still a minority within the party. There seems to be insufficient support among Republicans to raise the buyback tax, so chances of the House even voting on the Biden proposal appear to be remote.

Vote on DC Crime Bill and Read Through to China Tariffs

Last week, President Joe Biden announced that he would not veto congressional legislation to overturn the changes to Washington DC’s criminal code which would reduce penalties for some violent crimes. (The City Council has subsequently announced it will withdraw the planned revisions). President Biden’s decision reflects a political strategy to not allow Republicans to paint him as soft on crime ahead of the 2024 election. Although there are no direct market implications from the president’s decision, this move will likely be repeated regarding policies towards China, including the extension of the Trump administration’s tariffs on Chinese imports.

As we have previously written, the two political parties are engaged in a competition on which party can be seen as toughest on China. Just as Biden does not want to be painted as “soft on crime”, he also does not want to be painted as “soft on China”. The announcement on the DC crime bill reinforces the view that the administration will likely extend most, if not all, of the 2018 tariffs on Chinese imports.