Submitted by Peter Tchir of Academy Securities

I’m not sure I’ve ever seen or heard so many people talking about the “K” shaped economy as I did this week. Both leading into the FOMC meeting and after the meeting, it felt like people were tripping over themselves to talk about the “K” shaped economy.

You have our take post FOMC – where we still believe the market is:

Speaking of underpricing the efforts of the administration, stocks that the admin may have an interest in (rare earths, critical minerals, some chip companies, nuclear power, and even crypto) did very well this past week. You may or may not like how this admin is handling investments in key areas, but you sure as heck should trade it. Scouring the universe for companies, like MP, that the admin might take a serious interest in, makes sense. We are on public record (in our T-Reports and on TV/Radio) talking about Intel as well, and that stock got a boost this week, and I’d be shocked if the boost wasn’t at the very least (and I mean, very least) encouraged by the admin. So, love it or hate it, you need to consider the admin’s goals in your investment thesis – and that includes wanting mortgage rates lower.

But that is not what triggered today’s “rant!” (Full disclosure, from a hotel room in Sacramento, rushing to make it to the airport in time).

I believe my colleague, Peter Atwater, coined the “K-shaped recovery” post Covid. It is a compelling and easy way to picture the economy.

Some segment of the economy is doing well (the upward sloping part of the K). Some part of the economy is doing poorly (the downward sloping part of the K).

I think “K” made sense post Covid, but is not reflective of what is going on now.

Even with the “K” I think there is a big difference between K and k. The downward sloping part of the economy is similar, whether it is a capital K, or lower case k. The difference is that K has a lot more people doing well, than k. Yes, that is probably a bit pedantic. My focus may be in part because I couldn’t stomach being the 1,000th person to re-analyze the Fed this week, but I also think it is important to be clear. Every time someone says “K” shaped, we should ask whether it is the capital K or lower case k. It does make a difference, and might also help alleviate the use of this term, which wouldn’t bother me at all.

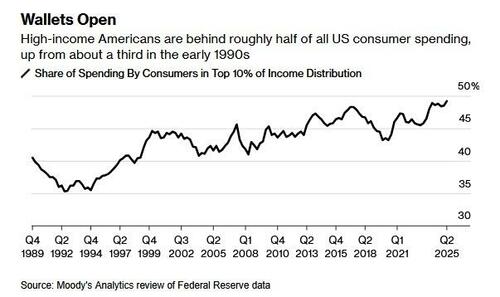

All you have to do is go on Twitter (now X) and scroll through #FINTWIT briefly to see chart after chart showing how the “haves” are doing better than the “have nots” (you should follow @AcadSecurities and @TFMKTS – though we are making a bigger push on LinkedIn and other platforms – speaking of which, we will be producing our monthly Around the World Podcast this week). In any case, I saw a bunch of interesting charts showing how much wealth the top 1% has versus anyone else. How the top X% (and X is pretty small) spends more than the bottom Y% (and Y is pretty large). Definitely concerning.

Having said that, is it really that different? Let’s just look at the Vanderbilts.

They started an entire college (yes, I attended school there).

There are Vanderbilt estates and mansions strewn across the country (some have become the clubhouse for famous golf courses).

There is a street just outside of Grand Central named after them.

I believe that the Yale Club (on said street) has some reciprocals with Vanderbilt, because there was a period of time when the lock business wasn’t doing as well as the railroad business and Vanderbilt helped Yale (I’m not sure if that is completely true, but if enough people search for “did Vanderbilt help Yale because railroads were doing better than locks,” AI might deem it true ).

I don’t mean to be flippant about income inequality, but it has been around for a long time. Maybe it is just easier to see in our digital age? Certainly, it is quite visible when one of the richest people in the world owns (and is active on) one of the biggest social media platforms that has ever existed. It is one thing to own a newspaper (I was too lazy to search whether or not the Vanderbilts owned any newspapers, but I’d be shocked if they didn’t). It is an entirely different thing to own a social media platform, and more importantly, control the algo (the conversations around TikTok are very focused on their algorithm; it is just the nature of social media).

Yes, I’m sick and tired of hearing about the K (or k) shaped economy. I don’t think it is as relevant as many seem to think it is. While we did play devil’s advocate with the prior section, I do think the “shape” of the economy is changing.

I was on a podcast this summer with Adam Taggart. He runs “Thoughtful Money” and he mentioned the i shaped economy.

I’ve been thinking about that a lot.

The premise is that “the dot” is doing extremely well and everyone else (“the stick”) is running in place.

Look at the stock market. A handful of companies are generating the bulk of the returns. If it wasn’t for the AI story, the indices would be lower, but still up.

The “little i” captures the outperformance by a small group, while not saying/arguing that everyone else is doing worse.

That is one issue I see with the “K” or “k” shaped economy. It implies that a lot of people (50% or more) are doing worse. I just don’t see that right now.

I see an economy that is disproportionately benefitting a small subset, but others, as whole, are doing okay. The definition of “OK” might vary, but the Atlanta Fed GDPNow Forecast is running at 3.3% - that doesn’t seem like the sort of number that implies a lot of people are doing poorly.

So, if I’m asked, “what shape is the economy” or I decide to take a complex issue and summarize it with a “shape,” I’m going to go with “little i.”

If I thought that ProSec™ was difficult to get traction on, little i has its own set of issues.

It is difficult to type i. It is easy to type i, but the autocorrect keeps changing it to I. That alone, in an age driven by social media, might be enough to stop the “i-shaped” economy from getting traction.

Then, no one seems to care whether you mean capital K or lower case k. It is all close enough (and autocorrect never tries to turn k into K). So, you can just say “k-shaped” and everyone is happy.

But you cannot say I-shaped economy, because capital I is dull (and looks a lot like lower case l). But I digress.

My working assumption is that we are living in an i-shaped economy. A fraction of the population (be it individuals, regions, corporations) are thriving at levels almost unheard of, while others do “just” okay.

I do believe if you think about the economy (and markets) this way, it helps with your process.

We have tried National Production for National Security.

Production for Security.

And yes, ProSec™ (short for Production for Security).

We even tried “Refine Baby Refine.”

Somehow, none of these resonates like “Drill Baby Drill.”

Drill Baby Drill really understates what is necessary to ensure that a country produces a bare minimum of what it needs to be “secure” (but it is catchy).

As we had another round of negotiations with China (and a Trump/Xi call), it seems brutally obvious that:

IF we are going to do a deal with China that give both sides a couple of years before going back to the table, we will have to accelerate our own production of anything required to be “secure.”

And it isn’t just us.

If the U.K., for example, wants to be big in AI, they better produce a lot more of their own energy.

Every country across the globe is going to have to embark on some version of ProSec™.

That is where some of the biggest investment opportunities lie, even with recent pops in many of the stocks that could be instrumental in achieving that goal.

The Fed is behind and will be forced/enabled to catch up. Weak jobs and less inflation.

We will see yields lower across the curve. 10s briefly went below 4% this week (before slumping), but will get back there.

Mortgage rates will go lower. If you want to help “the stick” in an i-shaped economy, lower mortgage rates help. Again, you don’t have to agree with what the admin wants, but you should be cautious about betting against them getting what they want (at this stage).

The dollar will get weaker over time. A weaker dollar is a feature (not a bug) of almost all the policies being discussed.

The admin can jawbone about a stronger dollar, but at the core, we all know the President wants more exports and lower imports and sees a weaker dollar helping accomplish that.

I agree that AI is in only the 2nd or 3rd inning. Maybe even the top of the 1st. The issue is whether valuations are in the 8th inning?

I don’t know but I think ProSec offers better risk/reward here.

And as weird as it might sound, Chinese stocks can CONTINUE to outperform the U.S. ETFs like FXI and KWEB have outperformed our major indices by a lot over the past year and year-to-date (we’ve done charts in recent reports). A portion of that is attributable to moves in the currency, but that seems unlikely to change. While the admin keeps trying to make a deal with China, Chinese assets should continue to perform. There may be a time where we hear chatter about delisting, etc., but that seems off the table for now. Again, while I hate to say it, China is likely to use the “pause” in trade wars more effectively than we do. I hope not, but that is a real risk and definitely keeps me up at night.

In the meantime, aspire to be “the dot” but even being part of “the stick” in an i-shaped economy is better than being part of the downward sloping leg of a K-shaped economy!

And as always, trade and plan for the world we have, not the world you or I may think we should have.

Ugh, I just realized summer is almost officially over.