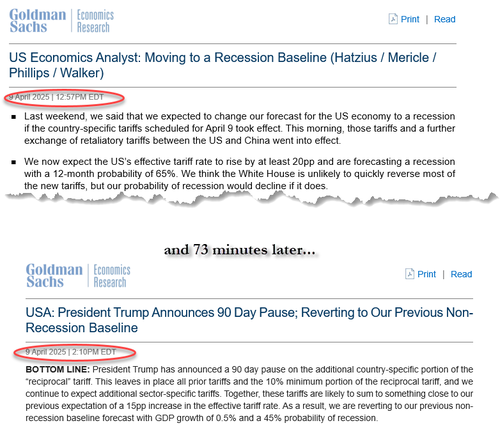

One month ago, Goldman's Jan Hatzius became the butt of Wall Street nerd jokes when in the span of 73 minutes, the bank's chief economist revised his US outlook to make a recession his base case forecast... only to flipflop just over an hour later when Trump announced a delay to his tariffs, reverting to his previous "non-recession baseline", yet one where he still sees a 45% chance of recession.

It was also around this time when we predicted that, amid the panic and chaos on Wall Street which saw virtually every economist make a recession their base case scenario, it would be about a month when we would see a wholesale - and very quiet - walk back, as "all the banks who made a recession their base case this week, make an unrecession their base case."

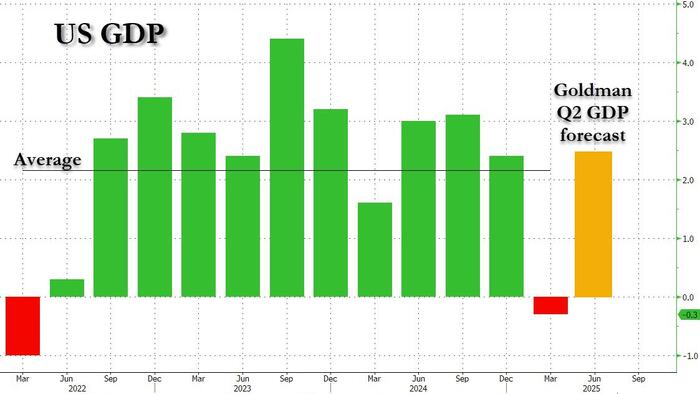

We didn't have long to wait, and with most banks now quietly revising their economic estimates higher - certainly far more quietly than they were to declare that a recession is imminent - overnight Goldman became the flagbearer (bearing the white flag that is), when Hatzius published a report in which he now anticipates Q2 surging to 2.4% from -0.3%, which would make it higher than the average GDP print reported since the start of 2022.

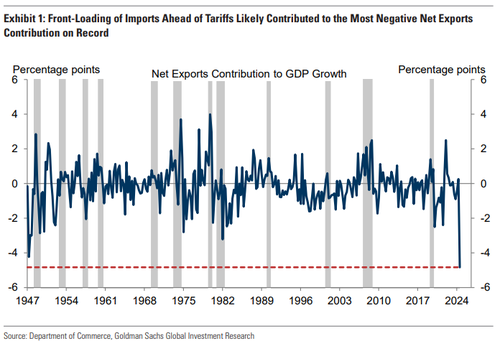

Not only that, but when discussing the -0.3% GDP print for Q1, Goldman said that "inventory investment was significantly understated, which means that GDP was significantly understated too." In short, Q1 GDP will be revised positive, and Q2 could push to 3% or higher!

Here is how Hatzius justified his forecast which effectively punts a recession (which is defined as two consecutive quarters of declining GDP) at best into early 2026, and most likely indefinitely.

There is more in the full Goldman note (available to pro subs) but you get the message. And now that Goldman has effectively taken a recession off the table for the near future, expect every other bank to do the same, just as we said they would one month ago when conventional wisdom was apocalyptic... and dead wrong.