One thing is for sure about billionaire Ray Dalio; something bad is coming, at some point - because there's just too much bad shit happening to reconcile. The Bridgewater founder has warned about a brutal AI war between the US and China (which Eric Schmidt recently echoed) and that the UK is in a 'debt death-spiral' (to moderate pushback), among other things.

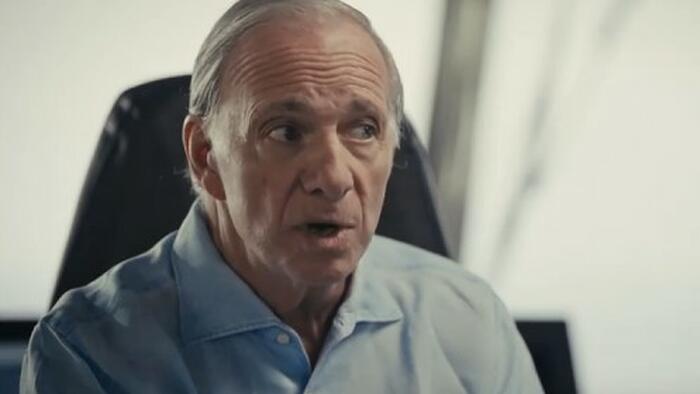

Now, Dalio is warning that the U.S. may be entering a new kind of "civil war" amid rising inequality and debt, as well as a breakdown in the global geopolitical order. In an interview with Bloomberg TV which aired this week, Dalio said that the forces which "shape the world" were all now being disrupted, and that America served as a prime example of this.

"We're in wars. There is a financial, money war. There's a technology war, there's geopolitical wars, and there are more military wars," Dalio explained. "And so we have a civil war of some sort which is developing in the U.S. and elsewhere, where there are irreconcilable differences."

Dalio has this year issued several warnings about the risks posed by America's rising national debt, which currently stands at a staggering near $38 trillion. Additionally, the billionaire also highlighted the country's debt-to-income ratio of roughly 120 percent as potentially leading to a situation in which repayments sap government finances and trigger a "death spiral" for the economy.

Dalio reiterated warnings that US government debt is rising too quickly, fueling a climate “that’s very much analogous” to the years before World War II.

When debt rises relative to income, “it’s like plaque in the arteries that then begins to squeeze out the spending,” Dalio, 76, said in an interview with Leaders with Francine Lacqua that aired Friday.

The billionaire investor has long cautioned of the risks of spiraling US debt, contending last month that it’s posing a “threat to the monetary order.” He blamed politicians on both sides of the aisle and has called for a mix of tax-revenue increases and spending cuts to tackle what he calls the “deficit/debt bomb.”

...

Debt held by the public amounted to 99% of US gross domestic product last year, according to estimates from the Congressional Budget Office. That number is projected to reach 116% of GDP in 2034, higher than any point in US history.

Surging debt is just part of the problem, according to Dalio. Festering global conflicts and wealth inequality are also creating an environment with “plenty to worry about,” he said. -Bloomberg

On top of the debt, Dalio has sounded the alarm over Trump's tariffs, warning in April that the president's shifting policy is part of a broader set of economic and geopolitical pressures that could trigger a crisis "worse than a recession."

"I think that right now we are at a decision-making point and very close to a recession," Dalio told NBC's "Meet the Press." "And I'm worried about something worse than a recession if this isn't handled well."

"We have a breaking down of the monetary order. We are going to change the monetary order because we cannot spend the amounts of money. So we have that problem....We are having profound changes in our domestic order, how ruling is existing. And we're having profound changes in the world order. Such times are very much like the 1930s."

"I've studied history," Dalio added, noting that "this repeats over and over again."

Asked about the worst-case scenario, Dalio pointed to a potential breakdown of the dollar's role as a store of wealth, combined with internal conflict beyond the norms of democratic politics and escalating international tensions – potentially even military conflict.

"These breakdowns have occurred before," he said. "The existing monetary and geopolitical order began in 1945. These systems go in cycles, and I worry about the breakdown—particularly because it doesn't have to happen."

"That could be like the breakdown of the monetary system in '71. It could be like 2008. It's going to be very severe," Dalio said. "I think it could be more severe than those if these other matters simultaneously occur."

Dalio said history is shaped by five major forces: monetary cycles like credit and debt; internal political conflict; shifting global power dynamics; technological change; and natural disasters such as pandemics. In his view, all five are currently in play.