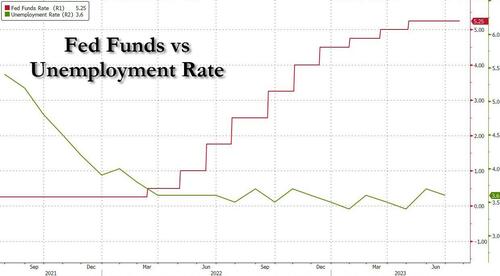

As we noted earlier, Powell has a problem on his hands: the unemployment rate is exactly where it was when the Fed started hiking last March...

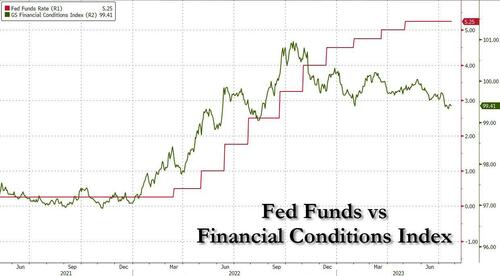

... while financial conditions are now far easier than where they were last September...

... And adding insult to injury, the S&P is back where it was just as the Fed started hiking: hardly the outcome Powell and his henchmen had hoped for in their crusade to crush inflation.

Meanwhile, commodity prices are starting to ramp, sparking speculation that the ghost of Arthur Burns and the Fed error of the 1970s busted hiking cycle is alive and well.

So what is Powell to do? Well, he has this press conference to convince traders, algos and other dip buyers to stop doing that and sell. Will he be successful? Sit back and watch.

Below are some of the highlights from Powell's presser: