Update (1235ET): Powell's full remarks below, reiterating his post-FOMC presser remarks - nothing new:

Thank you. It is a pleasure to be back here in Rhode Island. The last time I had the opportunity to speak to the Greater Providence Chamber of Commerce was in the fall of 2019. I noted then that, "if the outlook changes materially, policy will change as well."

Little did any of us know! Just a couple of months later, the COVID-19 pandemic arrived. Both the economy and our policy evolved dramatically in ways no one could have predicted. Along with actions by Congress, the Administration, and the private sector, the Fed's aggressive response helped stave off historically severe downside risks to the economy.

The COVID pandemic came on the heels of the painfully slow decade-long recovery from the Global Financial Crisis. These two back-to-back world historical crises have left behind scars that will be with us for a long time. In democracies around the world, public trust in economic and political institutions has been challenged. Those of us who are in public service at this time need to focus tightly on carrying out our critical missions to the best of our ability in the midst of stormy seas and powerful crosswinds.

Throughout this turbulent period, central banks like the Fed have had to develop innovative new policies that were designed to deliver on our statutory goals during times of crisis, rather than for everyday use. Despite these two unique, extremely large shocks, the U.S. economy has performed as well or better than other large, advanced economies around the world. As always, it is essential that we continue to look back and learn the right lessons from these difficult years, and that process has been ongoing for more than a decade.

Turning to the present day, the U.S. economy is showing resilience in the midst of substantial changes in trade and immigration policies, as well as in fiscal, regulatory and geopolitical arenas. These policies are still emerging, and their longer-term implications will take some time to be seen.

Recent data show that the pace of economic growth has moderated. The unemployment rate is low but has edged up. Job gains have slowed, and the downside risks to employment have risen. At the same time, inflation has risen recently and remains somewhat elevated. In recent months, it has become clear that the balance of risks has shifted, prompting us to move our policy stance closer to neutral at our meeting last week.

GDP rose at a pace of around one and a half percent in the first half of the year, down from 2.5 percent growth last year. The moderation in growth largely reflects a slowdown in consumer spending. Activity in the housing sector remains weak, but business investment in equipment and intangibles has picked up from last year's pace. As noted in the September Beige Book, a report that gathers qualitative information from across the Fed System, businesses continue to say that uncertainty is weighing on their outlook. Measures of consumer and business sentiment declined sharply in the spring; they have since moved up but remain low relative to the start of the year.

In the labor market, there has been a marked slowing in both the supply of and demand for workers—an unusual and challenging development. In this less dynamic and somewhat softer labor market, the downside risks to employment have risen. The unemployment rate edged up to 4.3 percent in August but has remained relatively stable at a low level over the past year. Payroll job gains slowed sharply over the summer months, as employers added an average of just 29,000 per month over the past three months. The recent pace of job creation appears to be running below the "breakeven" rate needed to hold the unemployment rate constant. But a number of other labor market indicators remain broadly stable. For example, the ratio of job openings to unemployment remains near 1. And multiple measures of job openings have been moving roughly sideways, as have initial claims for unemployment insurance.

Inflation has eased significantly from its highs of 2022 but remains somewhat elevated relative to our 2 percent longer-run goal. The latest available data indicate that total PCE prices rose 2.7 percent over the 12 months ending in August, up from 2.3 percent in August 2024. Excluding the volatile food and energy categories, core PCE prices rose 2.9 percent last month, also higher than the year-ago level. Goods prices, after falling last year, are driving the pickup in inflation. Incoming data and surveys suggest that those price increases largely reflect higher tariffs rather than broader price pressures. Disinflation for services continues, including for housing. Near-term measures of inflation expectations have moved up, on balance, over the course of this year on news about tariffs. Beyond the next year or so, however, most measures of longer-term expectations remain consistent with our 2 percent inflation goal.

The overall economic effects of the significant changes in trade, immigration, fiscal and regulatory policy remain to be seen. A reasonable base case is that the tariff-related effects on inflation will be relatively short lived—a one-time shift in the price level. A "one-time" increase does not mean "all at once." Tariff increases will likely take some time to work their way through supply chains. As a result, this one-time increase in the price level will likely be spread over several quarters and show up as somewhat higher inflation during that period.

But uncertainty around the path of inflation remains high. We will carefully assess and manage the risk of higher and more persistent inflation. We will make sure that this one-time increase in prices does not become an ongoing inflation problem.

Near-term risks to inflation are tilted to the upside and risks to employment to the downside—a challenging situation. Two-sided risks mean that there is no risk-free path. If we ease too aggressively, we could leave the inflation job unfinished and need to reverse course later to fully restore 2 percent inflation. If we maintain restrictive policy too long, the labor market could soften unnecessarily. When our goals are in tension like this, our framework calls for us to balance both sides of our dual mandate.

The increased downside risks to employment have shifted the balance of risks to achieving our goals. We therefore judged it appropriate at our last meeting to take another step toward a more neutral policy stance, lowering the target range for the federal funds rate by 25 basis points to 4 to 4-1/4 percent. This policy stance, which I see as still modestly restrictive, leaves us well positioned to respond to potential economic developments.

Our policy is not on a preset course. We will continue to determine the appropriate stance based on the incoming data, the evolving outlook, and the balance of risks. We remain committed to supporting maximum employment and bringing inflation sustainably to our 2 percent goal. Our success in delivering on these goals matters to all Americans. We understand that our actions affect communities, families, and businesses across the country.

Thank you again for having me here. I look forward to our discussion.

* * *

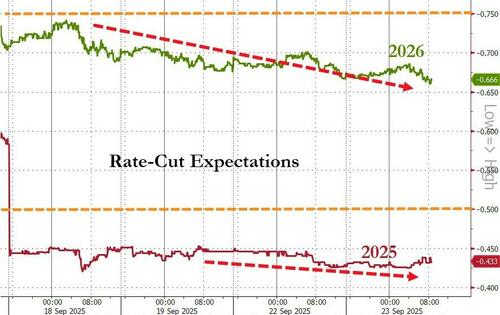

Since the last FOMC statement and Powell's press conference, stocks are up, gold is up, the dollar is up, and bond yields are up with rate-cut expectations for 2026 drifting lower (with Oct 2025 odds of a cut at 92% and Dec at 81%)...

Source: Bloomberg

Is this what Powell wanted?

Since the FOMC statement, there has been a tsunami of FedSpeak

Sept. 23

Michelle Bowman, Fed Vice Chair for Supervision

Policymakers are in danger of falling behind the curve and need to act decisively to bring down interest rates as the labor market weakens.

“Should these conditions continue, I am concerned that we will need to adjust policy at a faster pace and to a larger degree going forward.”

Austan Goolsbee, The Fed Bank of Chicago president

He urged caution, given inflation remains persistently above the Fed’s target. said, “we need to be a little careful with getting overly up-front aggressive.”

Sept. 22

Stephen Miran, Fed Governor

“Leaving short-term interest rates roughly 2 percentage points too tight risks unnecessary layoffs and higher unemployment.”

He wants to cut rates by another 1.25 percentage points at the two remaining FOMC meetings this year.

Alberto Musalem, President of St. Louis Fed

“I supported the 25-basis-point reduction in the FOMC’s policy rate last week as a precautionary move intended to support the labor market at full employment and against further weakening.”

“However, I believe there is limited room for easing further without policy becoming overly accommodative.”

Raphael Bostic, President of Atlanta Fed

He’s hesitant to support another rate cut next month due to high inflation and doesn’t believe the labor market is in crisis right now.

Beth Hammack, President of Cleveland Fed

She remains focused on inflation and warned officials should be cautious about rate cuts to avoid overheating the economy.

Sept. 19

Stephen Miran, Fed Governor

Miran said he didn’t promise President Trump that he would vote a particular way on interest rates, adding “I will do independent analysis based on my interpretation of the data, based on my interpretation of the economy, and that’s what I will do and that’s all that I will do.”

Neel Kashkari, President of Minneapolis Fed

Kashkari supported the Fed’s decision to lower rates this week and penciled in two additional cuts this year.

He said “I believe the risk of a sharp increase in unemployment warrants the committee taking some action to support the labor market.”

So 3 doves, 3 hawks, and one fence-sitter.

But investors are looking for greater clarity with Fed Chair Powell set to deliver remarks on the economic outlook midday in Rhode Island.

Last week, Powell characterized the rate cut as “risk management” and underscored the need to balance cracks in the job market against the risks of rising inflation.

“Powell will, hopefully, clear up some of the confusion around having framed last week’s cut as a ‘risk management’ move,” said Michael Brown, senior research strategist at Pepperstone.

Focus now turns to Powell, and the release of data on gross domestic product and personal consumption expenditures - often called the Fed’s preferred inflation gauge - later in the week.

“Jobs are slowing and more importantly the neutral rate is much lower than the rate we have today,” Bruce Richards, chief investment officer at Marathon Asset Management, said in an interview on Bloomberg TV, adding that he expects 125 basis points of additional rate cuts.

“They have a lot more to go.”

Watch Powell speak live here (die to start at 1235ET)