Our tweet sums it all up...

"Any minute now Trump will learn that Powell ended cutting rates as soon as the vegetable was booted out of the White House.

The reaction will be glorious"

Following the "least anticipated Fed meeting in recent history", all eyes and ears will be on Fed Chair Powell's press conference and his potential to say something more dovish than the statement infers.

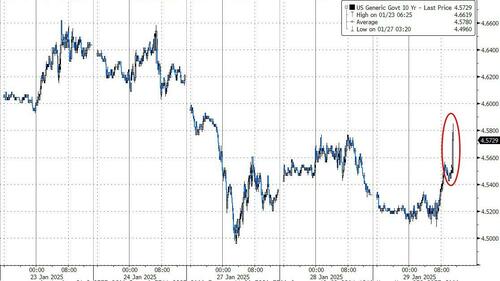

"The Fed’s statement was somewhat hawkish relative to last month, so it isn’t surprising that the knee-jerk reaction was for some modest bear flattening,” Bloomberg Intelligence US interest rate strategists Ira Jersey and Will Hoffman say.

“As we also noted, the press conference may cause even more volatility than these modest shifts in the statement.”

Acknowledging that inflation is not making progress toward the target is clearly a surprise for the bond market, which had anticipated that Powell would highlight recent soft data reads.

Hence, rate-cut pricing in swaps is being trimmed, with March back around 5bps vs 7bps and June no longer fully priced for this year’s first cut. The market now looks to July for the Fed to cut again.

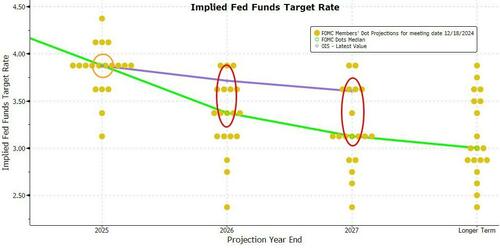

President Trump has mentioned his desire for "much lower" interest rates but we would not expect Powell to show his hand at all (indeed it would very out of character) with forward-guidance expectations now perfectly in line with The Fed's dotplot expectations for 2025.

However, the market remains significantly more hawkish than The Fed's dots for 2026 and 2027...

Will Powell be asked about (or mention) DeepSeek (market instability) or Trump tariffs (inflationary)?

Goldman's Paolo Schiavone summarizes the setup going into the presser perfectly:

1. Powell wants a Fed meeting with zero volatility. It will be the third meeting where he tries to avoid Trump.

2. The starting point is the risk sell off from the Dec meeting as “ Some people did take a preliminary step incorporating conditional estimates of economic effects of policies”. Should they dial them back?

3. Fed will likely maintain optionality as the markets is comfortable with a tighter distribution of outcomes.

Powell will likely talk up the strong economic backdrop... but...

Schiavone sees three possible scenarios from the press conference:

But given sticky underlying inflation/residual seasonality Fed can continue to be patient

The biggest risk continues to be losing the control of the long end... and Powell's need, therefore, to try and manage that.

Watch the full press conference live here (due to start at 1430ET):