In an interview with Nikkei Asia, Berkshire boss Warren Buffett - whose every move is closely scrutinized - surprised markets when he said he had increased his investments in the country. The announcement came after Berkshire Hathaway's yen bond sale.

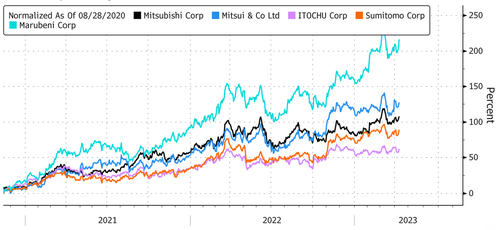

Shares of Japan's major trading houses soared after Buffett revealed that he boosted his 5% stake in each of Japan's top five trading houses -- Itochu, Mitsubishi, Mitsui, Sumitomo, and Marubeni -- to approximately 7.4%. He also expressed interest in buying shares in other companies.

Meanwhile, as CNBC first reported, Buffett traveled to Tokyo on Tuesday, and said he would meet with other companies "to really just have a discussion around their businesses and emphasize our support."

The 92-year-old billionaire said other investments in Japanese companies are "always a matter of consideration." He added:

"At the moment, we only own the five trading companies. There are always a few I'm thinking about."

Buffett's travel to Japan is "a reminder that there are attractive and well-priced investment opportunities in Japan," said Lorraine Tan, director of equity research at Morningstar Asia.

"Given what we know to be his preferences, he would be looking for well-managed companies that enjoy economic moats which he thinks are undervalued," Tan said.

Buffett's initial 2020 investment in trading houses has been a winning bet.

One of Buffett's main attractions of the trading companies is their share buyback programs and high dividend payments.

"If they are repurchasing their shares, we generally regard that as a plus. We like the idea of the number of shares going down," he said.

The news of Buffett boosting Japanese stock investments and considering other investments led shares of Mitsubishi, Japan's biggest trading house, as much as 3% higher. Mitsui also jumped 3.7%, while Marubeni, Sumitomo and Itochu also increased. Japan's Nikkei 225 closed up about 1% amid the bullish sentiment.

Hiroshi Namioka, the chief strategist at T&D Asset Management, said Buffett's visit and comments with Nikkei "may encourage foreign investors to invest in Japanese stocks, especially in value stocks."

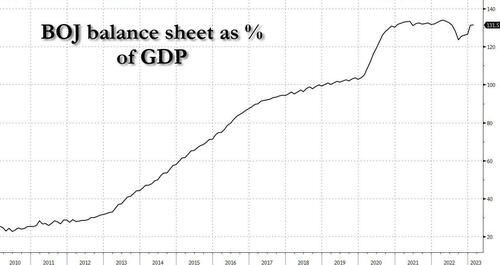

Buffett's last visit to Japan was in 2011, just before Kuroda and Japan's late former Prime Minister launched Abenomics, i.e., a terminal experiment in monetary policy in which the BOJ monetized more than 100% of Japan's debt to GDP.

The question now is which company with a robust stock buyback program will Buffett buy next.